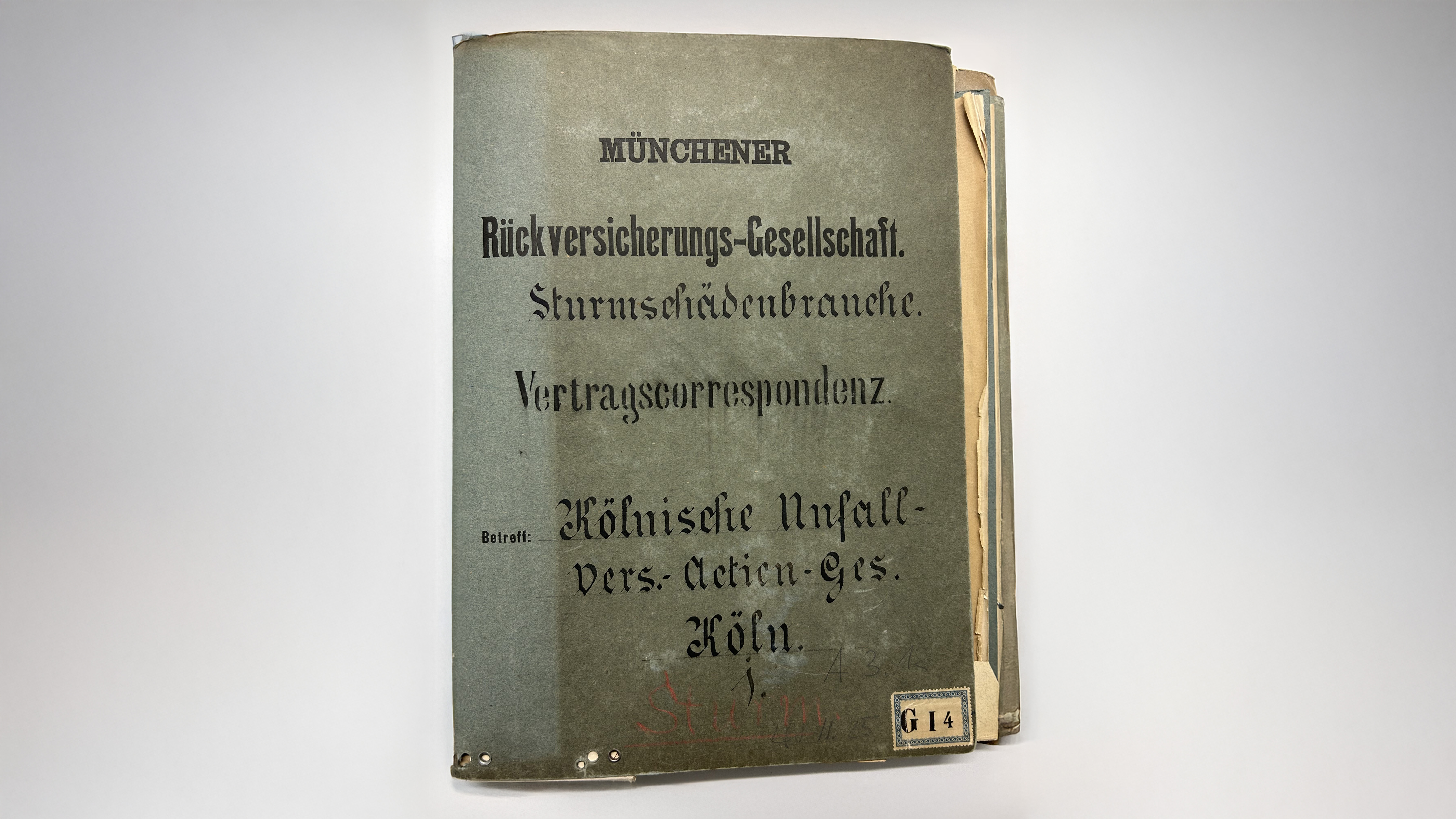

125 years of windstorm reinsurance at Munich Re

In 1900, Munich Re took the decision to begin reinsuring windstorm insurance – a seemingly uninsurable risk, but one that would more than pay off.

As we mark 125 years of insuring against this natural catastrophe risk, we wanted to take a brief look back to where the journey started.

At the end of the 19th century, the insurability of natural hazards was regarded with considerable scepticism. As the risks of windstorms, floods and earthquakes were considered incalculable, they were not covered by any insurance at that time.

On 7 August 1898, however, any initial scepticism gave way to necessity when a windstorm devastated an industrial suburb of Cologne – a turning point that highlighted the undeniable importance of insurance against storm damage.

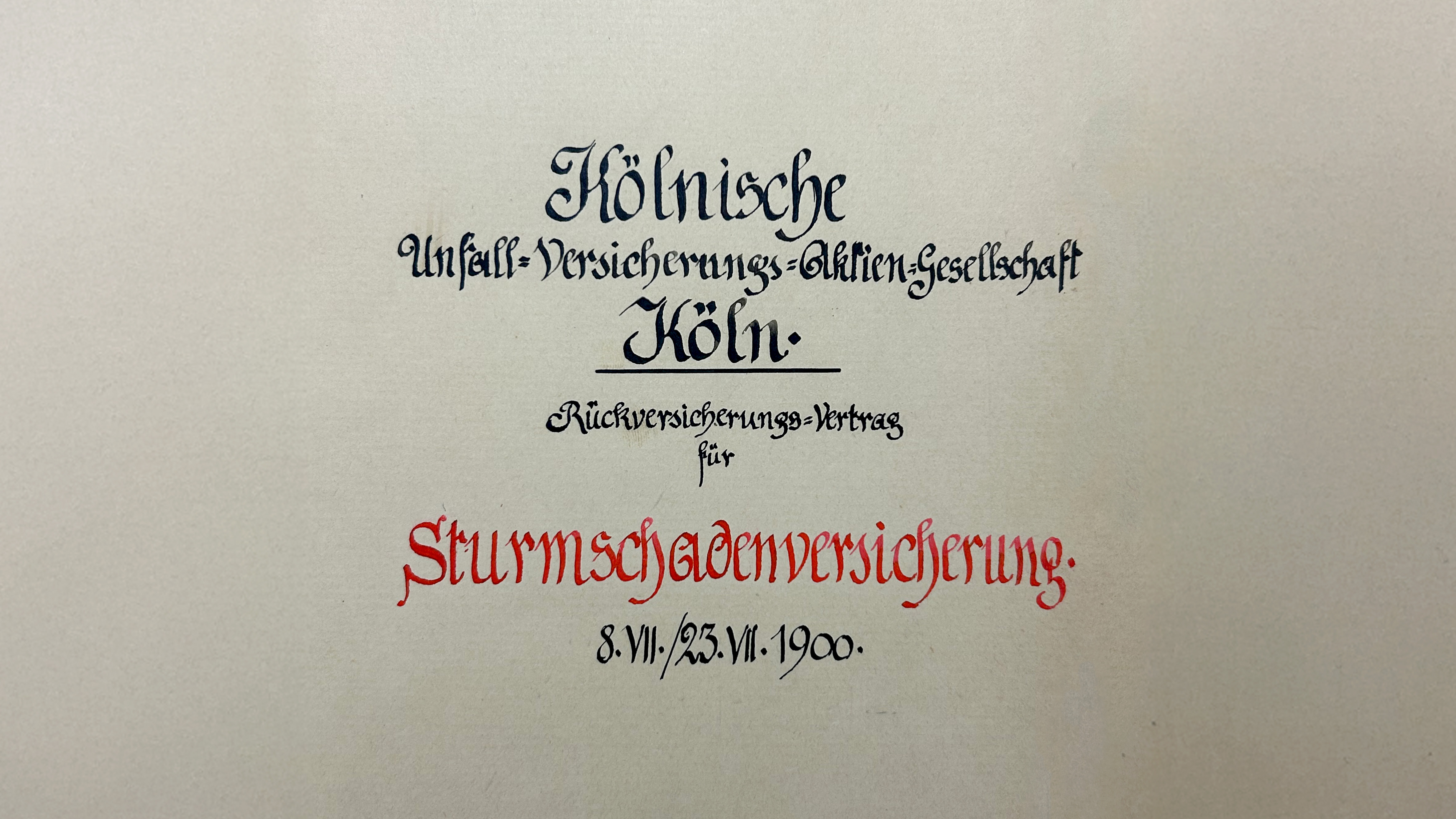

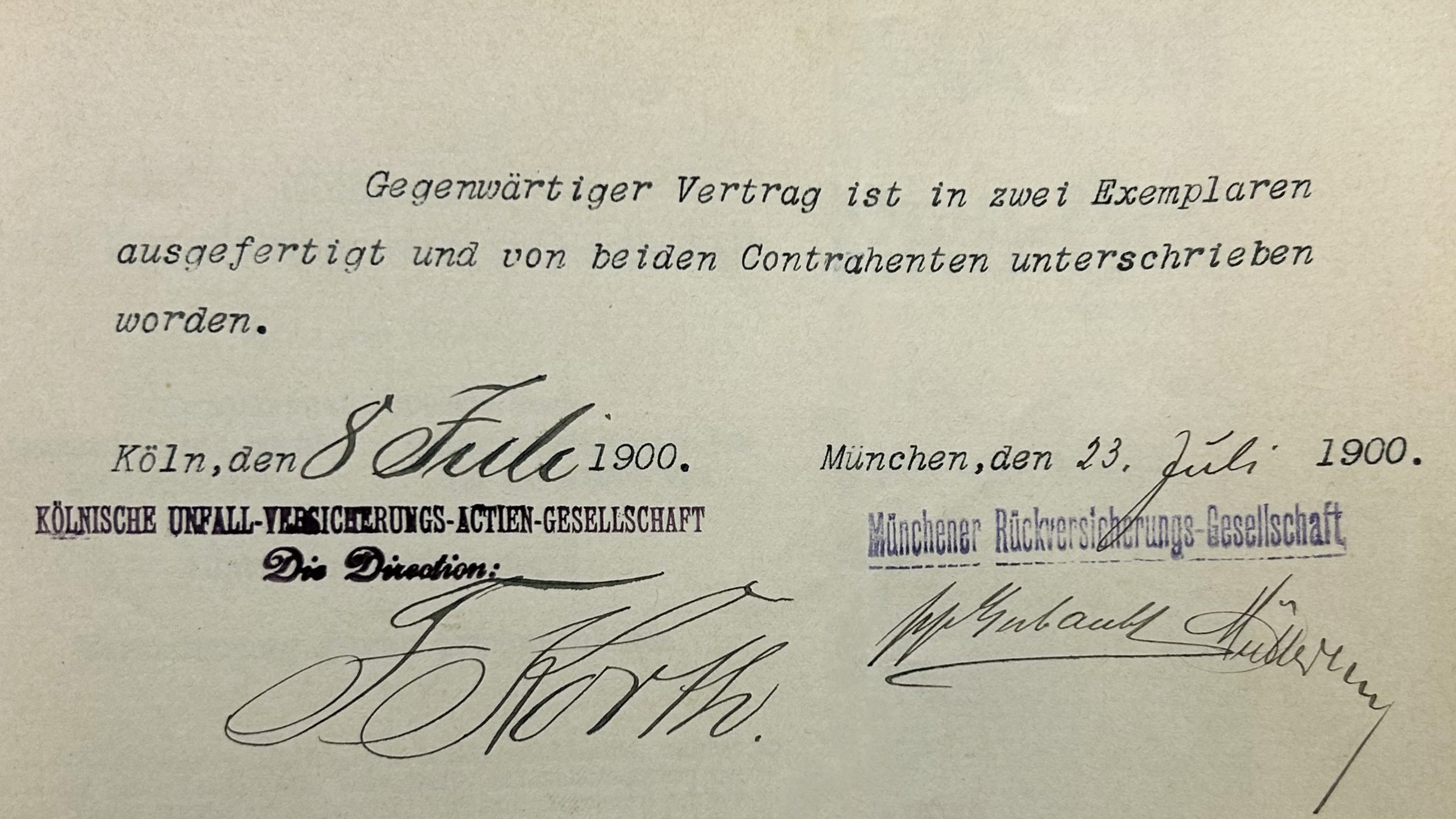

The event prompted the insurer then known as Kölnische Unfallversicherungsaktiengesellschaft to become the first company to start insuring storm damage in 1899. Today, the company trades as AXA Versicherung AG and is part of the AXA Group.

A short time later, Munich Re took the milestone decision, following discussions with Carl Thieme, one of the company’s co-founders and its first Chair, to reinsure a large portion of the Cologne-based insurer’s windstorm risk. Concluding this contract held such importance for Munich Re, then operating as Munich Reinsurance Company, that it pledged in return not to enter the windstorm insurance business itself or to provide such reinsurance to any other companies during the contract term.

The move to start reinsuring natural catastrophes quickly proved successful, laying the foundation for one of Munich Re’s largest lines of business, which now generates premium income in the billions. Natural hazard insurance is high-risk business but it also offers significant earnings potential.

Munich Re employs dozens of scientists to gain a precise understanding of natural catastrophe risks and their influencing factors. Some of the largest losses that Munich Re has ever incurred were caused by natural disasters, including Hurricane Katrina in 2005 and the devastating tsunami triggered by the 2011 earthquake in Japan. Given the company’s extensive risk expertise, however, covering natural catastrophe risks is, on average, very profitable.

Munich Re’s costliest natural disaster relative to its size to date was the 1906 San Francisco earthquake and subsequent fire. The loss ratio for this event stood at 7% of total annual gross premium – a figure that has not been matched since.

Over the last 125 years, the risk landscape has changed dramatically. Natural hazards have long since become a key event covered by insurers, alleviating the burden on society. For decades now climate change has been exacerbating the risk situation.

/strametz_claudia_sou.jpg/_jcr_content/renditions/crop-1x1-768.jpg./crop-1x1-768.jpg)

Our founders’ decision back then reflects what Munich Re continues to stand for today. We harness our expertise to develop concepts that enable risk transfer – even for hard-to-insure exposures. This way, insurance can help alleviate some of the financial losses for individuals or companies affected by natural catastrophes.

Munich Re has grown to become a global expert in natural hazards and regularly publishes in-depth reports and analyses on current developments and trends in natural hazard insurance, as well as reviewing recent disasters. In 2024, for example, natural disasters caused global losses totalling US$ 320bn.

The challenges facing the world today only underscore the need for natural hazard insurance. Munich Re systematically investigates natural disasters in the context of climate change, analysing their causes, frequency and intensity using extensive loss data. Interdisciplinary teams of experts made up of climate, geo and data scientists collaborate closely with research institutions and international organisations to gain fact-based insights.

By working at the interface of insurance and ongoing research in this way, Munich Re demonstrates that mastering today’s challenges and shaping the future is possible. If it weren’t for the pioneering spirit shown by Kölnische Unfallversicherungsaktiengesellschaft and Munich Re 125 years ago, this situation would look very different.

Related Topics

Newsletter

properties.trackTitle

properties.trackSubtitle