Engineering

Enable complex industry projects and new technologies

properties.trackTitle

properties.trackSubtitle

Engineers play a key role in successful underwriting and claims management

Customised claims management

When it comes to assessing potential risks for major projects, there is no way around our engineers at Munich Re. What makes them so special? They all have at least five years of professional practical experience and can provide significant added value for us as well as for our clients through their technical expertise and risk awareness. In this spirit, it may happen that a Munich Re team of engineers supports the construction of a bridge.

Munich Re employs engineers from a wide range of disciplines. With their technical know-how, they identify and assess existing and potential risks in highly complex construction and technology projects all over the world.

Risk management needs practical experience, openness & analytical thinking

Technical know-how & risk awareness

It takes deep engineering expertise and a solid understanding of risks, underwriting and the bottom line to keep sight of the big picture of large-scale projects. Engineers at Munich Re walk that borderline daily – at home in different worlds.

Apply now!

What we look for in engineers

Current topics in the field of construction and infrastructure

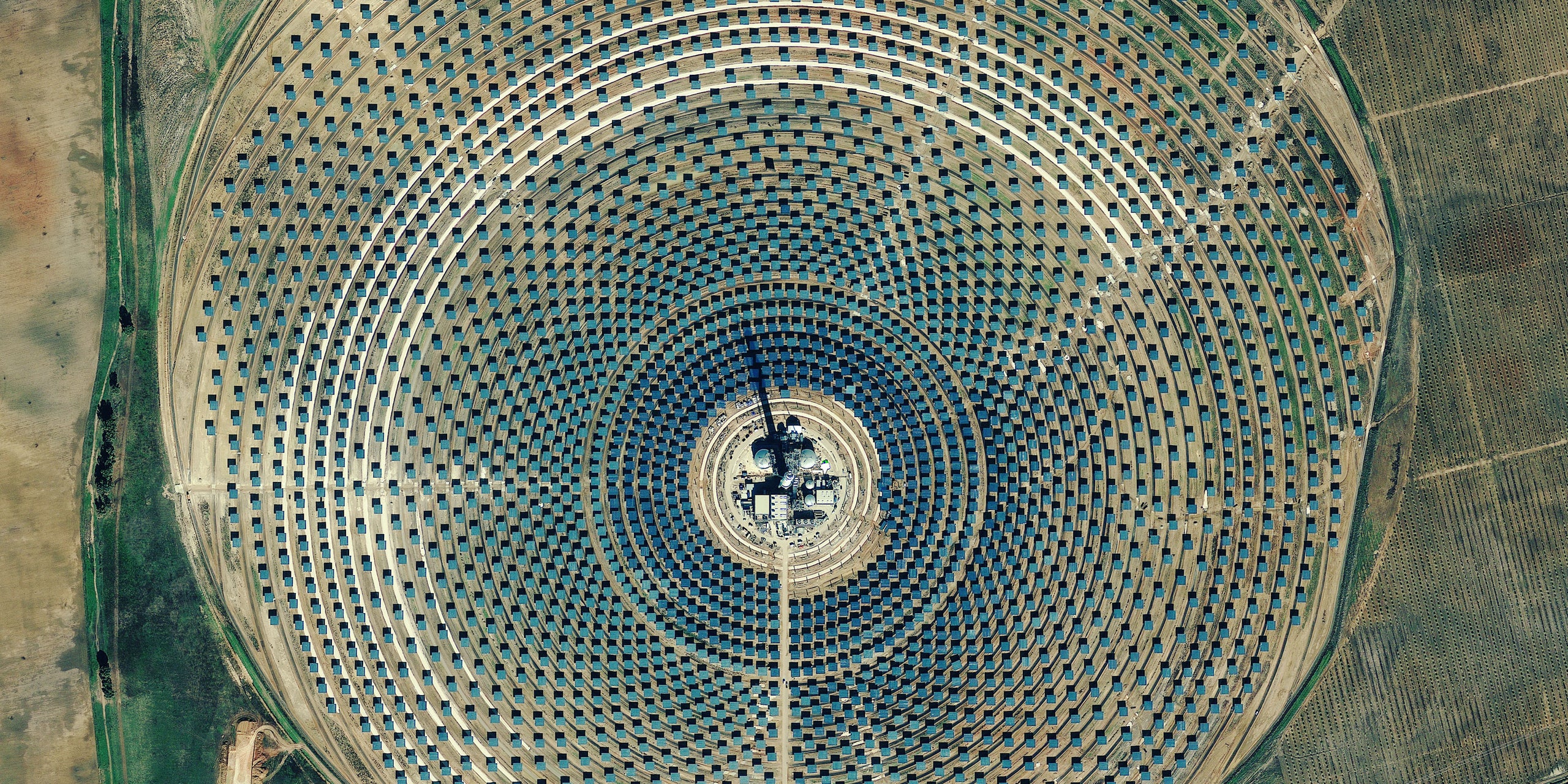

Green tech solutions offer great potential for companies at Munich Re

Insure energy efficiency

High-risk Dams

Meet engineers at Munich Re

I assess the risks and opportunities of future-oriented engineering projects and continuously have to change perspectives. I also find dealing with people from other cultures, industries and market regions inspiring.

Challenges in the field of engineering

Apply now!