What is legal system abuse?

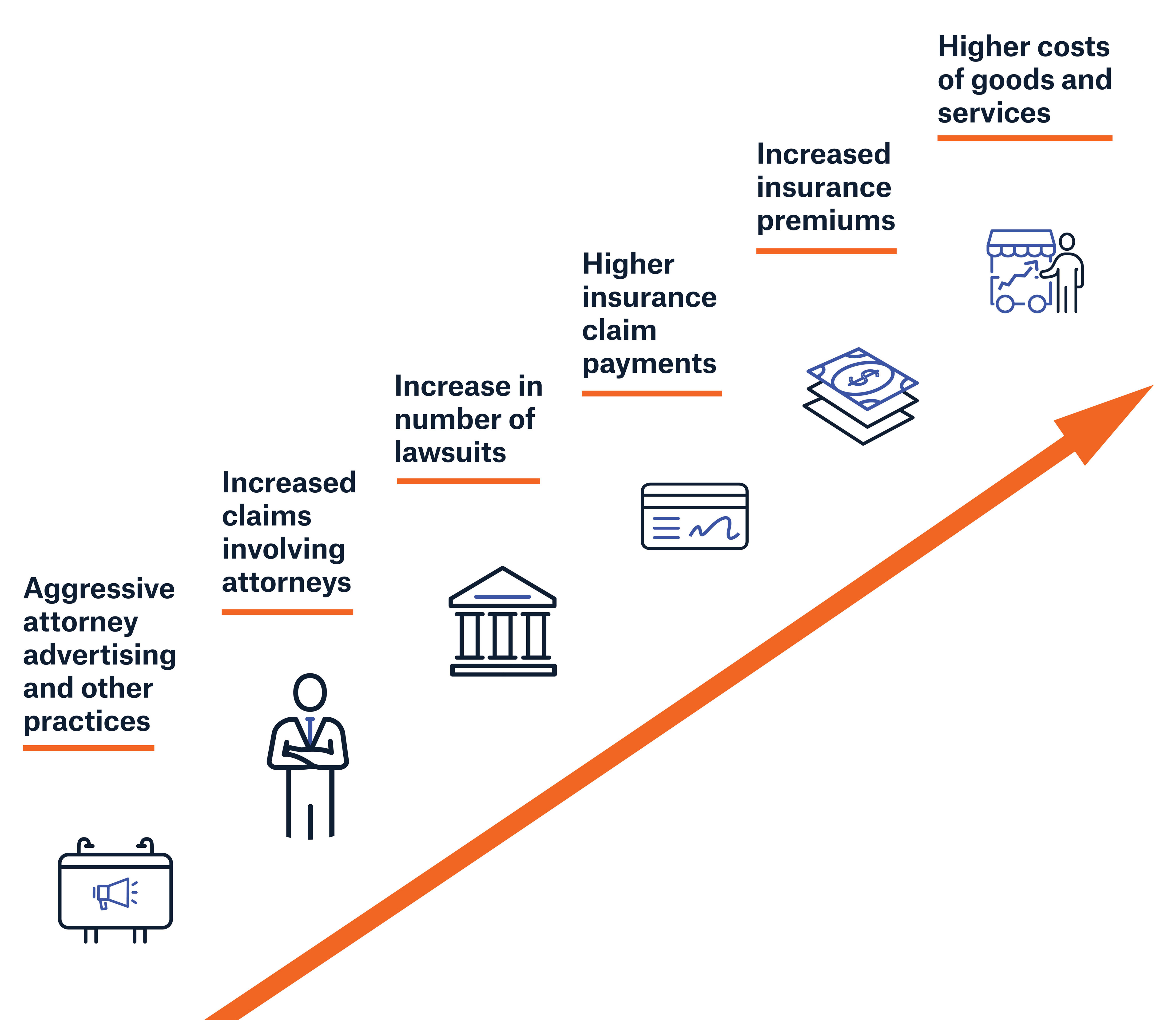

How does legal system abuse impact consumers?

Four common tactics of legal system abuse

- Aggressive attorney advertising

Attorneys use TV, radio, billboards, social media, and more to encourage plaintiffs to file lawsuits. Attorneys are promising large and rapid payouts to entice clients, file more lawsuits, and desensitize the public to large jury awards. - Jury anchoring

Once a case goes to trial, plaintiff attorneys intentionally mention an extremely high award amount as a starting point for the jury to consider — even well beyond what juries typically award in similar cases or even a judge may deem fair. This starting point often serves as an “anchor,” significantly elevating the final award. - Phantom damages

Plaintiff attorneys sue for damages calculated using the dollar amount a patient was billed for a medical service provided, instead of the amount the patient, their insurer, Medicare, Medicaid, or workers’ compensation paid for treatment. Essentially, it’s the portion of the bill that’s never actually paid and is therefore a fictional or “phantom” cost. - Third-party litigation financing (TPLF)

TPLF enables hedge funds and other financiers to invest in litigation, in exchange for a percentage of any settlement or judgment and provides high enough rates of return to attract billions of dollars of new deal commitments each year. There is growing concern about foreign adversaries using TPLF to undermine the interests of the US. The involvement of these external funders is usually not disclosed, and often contributes to more lawsuits, longer times to resolve cases, and ultimately less money for the injured parties.

Dollars fueling legal system abuse in 2024

How much does legal system abuse cost?

Impact on consumers and business owners

Raising awareness and educating people about the negative impacts of legal system abuse is critical. If left unchecked, it will continue to increase costs for all.

While consumers and business owners believe they’re receiving large settlements, in reality, injured parties can be left with less money — in some cases substantially less — than if they had settled their claim and had their injuries paid for directly without attorneys or funders involved.

How can you help combat legal system abuse?

Downloads

Resources

Insurance Information Institute (Triple-I)

Munich Re US

Munich Reinsurance America, Inc.

Munich Reinsurance America, Inc. (“Munich Re US”) is one of the largest reinsurers in the United States. We provide reinsurance coverages, specialty reinsurance, and risk management solutions to commercial and personal lines insurance carriers, agents and brokers, program administrators, and managing general agents. Learn more about Munich Re US at munichreamerica.com.

Insurance Information Institute

Known throughout the insurance industry as Triple-I, it is the trusted voice of risk and insurance, providing unique, data-driven insights to educate, elevate, and connect consumers, industry professionals, public policymakers, and media. For more than 60 years, Triple-I has provided definitive insurance information. Learn more about Triple-I at iii.org.

Disclaimer:

The information provided in this document is for general informational purposes only and does not constitute legal, financial, underwriting, or other professional advice. The recipient should consult with its own counsel or other advisors accordingly to verify the accuracy and completeness of any information used and as determined by the recipient’s particular circumstances. Examples given are for illustrative purposes only. The information presented here should not be construed to create either expressly or by implication any certification or guarantee of any kind that the use of these principles will necessarily produce your desired result. Munich Reinsurance America, Inc., its affiliates and the Insurance Information Institute (Triple-I), disclaim any and all liability whatsoever resulting from use of or reliance upon this material.

properties.trackTitle

properties.trackSubtitle