Inflation impacts on the property (re)insurance market

Nothing Assumed Podcast with Marcus Winter

properties.trackTitle

properties.trackSubtitle

About this episode

Understanding the impacts of inflation within the property (re)insurance market and how insures can be proactive in managing inflation costs. Deep dive into other concerns for property including: catastrophes, climate change and risk mitigation.

About the guest

Mike Quigley is Executive Vice President and Head of Property Underwriting & Multiline Risk Quantification, Munich Re US. Mike leads a team of over forty professionals, including property underwriters, actuaries and cat modelers and is responsible for the underwriting performance and strategy for the MRUS property treaty portfolio and for the treaty pricing of all lines of business.

Episode transcript

Marcus Winter (00:01):

Hello, and welcome to Nothing Assumed, a quick talk on topics that keep the reinsurance industry up at night. My name is Marcus Winter. And today it is my pleasure to welcome my colleague, Michael Quigley as my guest. Mike is the head of property here at Munich Re US, and he's also responsible for all pricing topics. And together we will dive into the topic of inflation. Mike, welcome, and thanks for joining me.

Michael Quigley (00:27):

Thanks Marcus. Happy to be here.

Marcus Winter (00:28):

It's no secret that the economy inflation is at a record high. Many argue that it has not reached its peak yet. And given the relevance of the inflation for our pricing and modeling, and given the uncertainty of the future trends, is this the end for our actuarial approach? Do we need to completely redo the way, how do we, we do, we, we price the business? And, uh, what does the future look like when it comes to the quantification of risk?

Michael Quigley (00:58):

Uh, it's, it's true that the current inflationary environment is highly unpredictable and unprecedented, but by no means is at the end of the traditional actuarial approach, uh, to our business. Uh, it's, it's quite the opposite actually. Uh, the, the insurance industry has made its living quantifying risk and uncertainty, and more than ever, we need technical experts like actuaries closer to the front lines. And while the inflation poses significant challenges to us, a problem like most problems is more digestible when we break it down into its component parts.

Marcus Winter (01:37):

That sounds great. So let's look at the various components.

Michael Quigley (01:40):

Well, uh, with the most recent quarterly earnings reports, we continue to see that economic inflation is pressuring carrier results and driving the need for further premium increases, particularly in personal lines and commercial property. The pandemic has really resulted in two components that are fueling these increases. First, there's the shortage of skilled labor. Per the US Chamber of Commerce through, with data through the end of last year, 91% of contractors had find, reported having difficulty finding skilled workers. The combination of the high demand for their work and the shortage of skilled labor has led to wage inflation, and we continue to see upward pressure through the first quarter on those, uh, wage numbers. And I expect that this labor shortage will continue to pressure us in the industry through 2023.

(02:39):

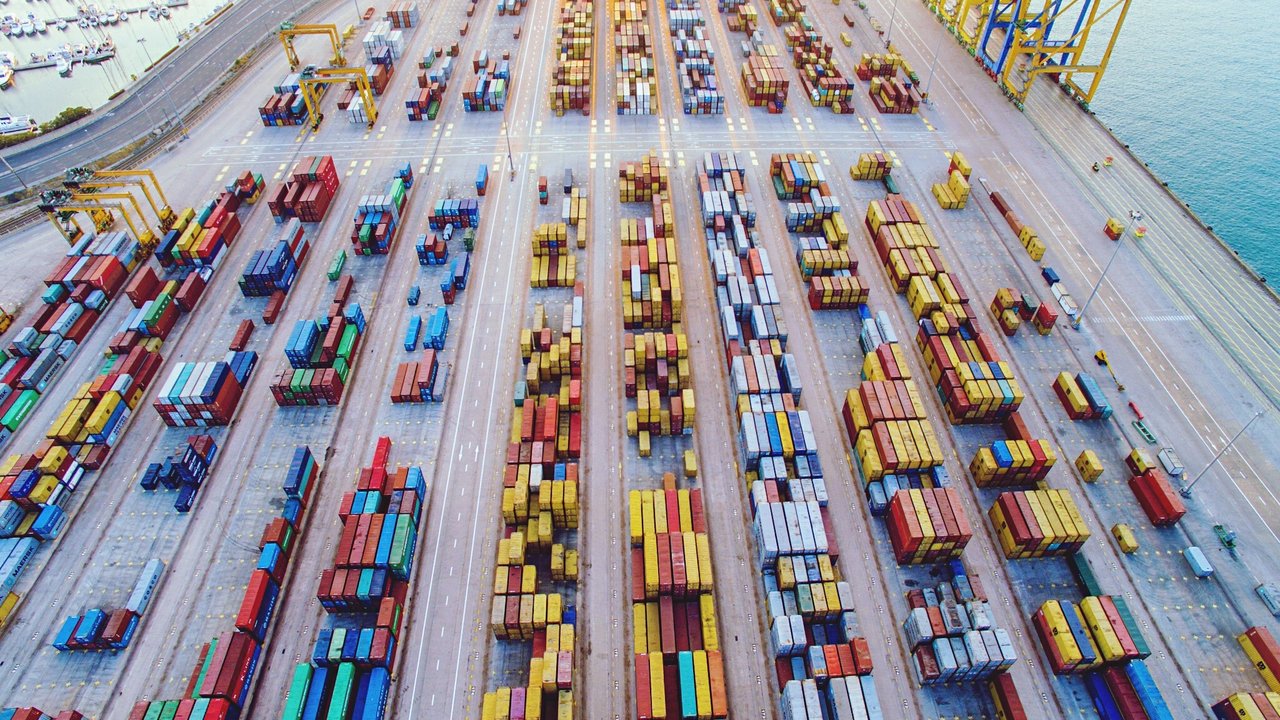

The second component driving, uh, pre-construction cost is really the cost of materials. And this is one, I think a lot of people are probably aware of, but we've seen the significant spike, actually starting mid year, last year in lumber. And then we started seeing, other, uh, materials such as metals and metal related products increasing significantly towards the latter half and into the beginning part of this year. Supply chains have, supply chains have been significantly impacted by the pandemic, and our key driver of the trends we observe here on the material side. Freight rates reach the 10 year high due to congestion in key ports. We've seen staffing issues with shipping crews, quarantine restrictions and oil prices have all put pressures on supply chain.

(03:27):

By the end of last year, 95% of contractors face the shortage of at least one material. This has exacerbated, you know, projects, lengthened them, so leading to upper cost pressures as well. I fully expect that phenomenon to last into 2023 as well. So when we break the problem down into these pieces and examine the underlying drivers of inflation, we can better understand the problem, but then we can also put these pieces back together and get a clear picture of what's happening in aggregate. Overall, when you combine the impacts of the cost of materials and the shortage of skilled labor, we're experiencing an increase in the residential and commercial property reconstruction, reconstruction costs in the high single digits to [inaudible 00:04:12]. And these are trends that are, uh, in line with, or similar with what we saw last year. So when you come, you look at the cumulative impact of these trends on the underlying cost of property insurance and reinsurance products, it's significant.

Marcus Winter (04:29):

Mike, you are the head of property for Munich Re US. So you see the whole market. Um, what are your biggest concerns when it comes to inflation in property lines specifically on the insurance side?

Michael Quigley (04:40):

Well, the biggest concern is obviously whether insurers are fully estimating the impacts of the potential longevity and, and the high levels of inflation that we're experiencing, and that they're experiencing in their portfolios, and whether or not they're taking appropriate actions to react to those. In addition, I'm concerned, uh, about the potential of another bad year of natural catastrophes coinciding with this high inflation environment, that could lead to substantial demand surge impacts and even greater pressure on insurance carriers, portfolios, and, and just the market in general.

Marcus Winter (05:14):

That sounds that the insurance companies can do more than just adjust the rates upwards to reflect the inflation. Um, what, what are, what is the, what is the tool set for the insurance companies? What are some of the, uh, common practices that they can use?

Michael Quigley (05:30):

Yeah. Good questions. Um, it starts really with the proper evaluation, and projection of property values. Uh, property insurance premiums are all based on the property values. So if you get that wrong at the outset, the premium charged, uh, and the true exposure could be woefully inadequate. Um, we have seen this play out actually recently in some, some large claims, property claims, where the values were significantly inadequate. I would recommend that all insurers conduct a thorough review of their valuation process. If they haven't done so already, uh, you know, this is, this is step one. Um, it's important to review the adequate, uh, adequacy of those current values and if necessary recalibrate. Additionally, carriers should make sure that, that the process they not only review, but, but if they need to tweak that and put something in place, for the future that it's robust and it will allow for the updating of values for, in fu- with future changes of inflation.

(06:35):

That's really where we've seen, um, in recent months where some of the processes, existing processes, had fallen short. They were, they were made fine for a low inflationary environment that we all became comfortable with over the past, uh, years. But with the sharp change that we've seen last year and into this year, a lot of, uh, those processes, uh, have been slow to adapt and, and react. And I think it's really important for, for companies to think, to future proof their, their process that way from inflation. Beyond, um, beyond property values and a review of rate adequacy, carriers should look at their policy forms and the offered coverages, uh, to make sure, for example, that the percentage deductibles, uh, in place or, or the use of margin clauses in commercial property, which we've seen is, is been coming more popular and more frequent in this environment.

(07:28):

Carriers need to make sure that those coverage elements, uh, are well managed across their portfolio, and that, uh, these terms, because these terms can truly help hedge against the increasing inflation that we're seeing. Um, and then finally, uh, it's important to review the overall makeup of your portfolio. Uh, you know, relative to certain occupancies, uh, the, the, the exposure could be greater to the supply chain issues and the, uh, the inflationary environment pressures. Um, so that review should, and could lead to a review of risk appetites and appetite for new business in certain areas. So I think it's important to look at all facets of, uh, of a carrier's portfolio when addressing inflation.

Marcus Winter (08:14):

And at the same time, I would assume that it's not only the inflation that keeps the insurance up at night. So what would be the other topics that you see on the property side right now?

Michael Quigley (08:22):

Yeah. It's, it's amazing. I still have hair after the last several years (laughs), uh, with, with weather. Um, the biggest, biggest issue outside of inflation is clearly weather. Uh, if you look back at, at last year, the US experienced 20 separate billion dollar weather in climate disasters. Just put the year, second place just behind, uh, 2020, which had 22 separate billion dollar plus, uh, events. Uh, so we have a significant challenge when it comes to these, uh, weather related disasters. And we are facing a changing risk environment, not just on the inflation side, but on the weather and climate side. That makes the quantification of the impacts of potential weather events, extremely difficult for property underwriters. What we're seeing is an increased frequency of large losses from a variety of natural hazards. For example, we've had extreme drought conditions that have, we're seeing lead to more wildfires across more parts of the United States.

(09:21):

We've had increased rates of rainfall, especially, you know, intense daily rainfall, uh, resulting in flooding in places that never flooded before. Um, and this is really related to warmer atmospheres holding, retaining more moisture that then drop in the form of rain and floods. We've also seen the impacts of winter freeze in the deep south with the Texas, uh, events last February. Uh, you know, February of 2021, uh, leading to significant, uh, impacts on homes and businesses and, and the insurance industry as a whole. And then finally, if you live in the Gulf over the last year, uh, you know, the, the impact of land falling hurricanes and related severe convective storms have been significant, and all those (laughs) are, individually, they are challenging. When you put them all together and what we've experienced over the last, uh, four to five years, uh, and then you combine that with inflation, it clearly is, is a challenge. And you add to that some of the demographic shifts we've seen recently with more people moving to coastal regions, to CAT prone areas, uh, such as Florida and the Gulf states that just exacerbates this issue even further. So those are the challenges, these, these things keep me up at night.

Marcus Winter (10:35):

Thank you very much for sharing your insights there. Um, here's my last question. And, um, it's a magic want question, which I'll ask all my guests. Are you ready?

Michael Quigley (10:45):

Okay, sure. Fire away.

Marcus Winter (10:47):

If, if you had a magic want, what would you change about the property insurance and reinsurance market?

Michael Quigley (10:52):

Hmm. Uh, very good question. Let's, let's think about this. Uh, I could take this one in several directions. Um, but I think I'll go with the aspirational change. Uh, I would, personally would love to see the property insurance and reinsurance market lead the way in promoting risk mitigation and climate resiliency. Uh, so that we can bend down the cost curve and ensure that we can continue to provide, uh, affordable and sustainable products to policy holders. There's great work being done in this space, uh, but not enough in my opinion. And, uh, we know that this works, uh, we've seen homes built to the IBHS fortified standard, for example, withstand major damage from hurricanes. And we just don't have enough, uh, of the building stock fortified, and, and, and, uh, we haven't focused enough on that end of the equation. And if we can help policy holders avoid a claim in the first place and minimize damage to the application of proper building codes and enforcement of those codes, then we can counteract some of these effects of high inflation and climate change.

Marcus Winter (12:02):

Thank you, Mike. So, um, that means you say the actuarial science is not, um, outdated? We still need it? We can fight inflation, even though it's very high? I hope you-

Michael Quigley (12:17):

Not there yet (laughs).

Marcus Winter (12:17):

I, I hope you've, you're correct on that. Um, I think it's a very good approach that you have there to really dissect the problem into the various components and, um, the insights that you shared on the wages, and, and, uh, the cost of material, and the other factors that certainly is a, is a topic. And then to add the weather challenges that we have, um, certainly will keep in the whole, you and the whole team and the whole market busy for the, for the next few years. So thank you very much for joining.

Michael Quigley (12:43):

Thank you very much for having me.

Marcus Winter (12:44):

Um, next time I will be talking to Annamaria Landaverde. She's our lead cyber expert here at Munich Re US. Uh, bye for now.