For life insurers, a major source of mortality risk mitigation is prudent underwriting at the time of application, which should ultimately reduce future claim costs. One way to refine the underwriting process is through measuring the impact of underwriting using insurance claims experience. Hypotheses are tested with the data and then improvements are made to the underwriting process. This process is best described using a control cycle as illustrated here.

Munich Re Life US recently performed a deep dive into death claims stemming from its significant block of fully underwritten life insurance policies. Our focus was to better understand the drivers of mortality related to various causes of death.

(Table 1). Screening tools in the underwriting process are not very effective at identifying potential cancer mortality risk. It should be noted that the focus of our research was on cancer mortality risk and not the incidence of cancer.

Dataset

Key findings

Early durations

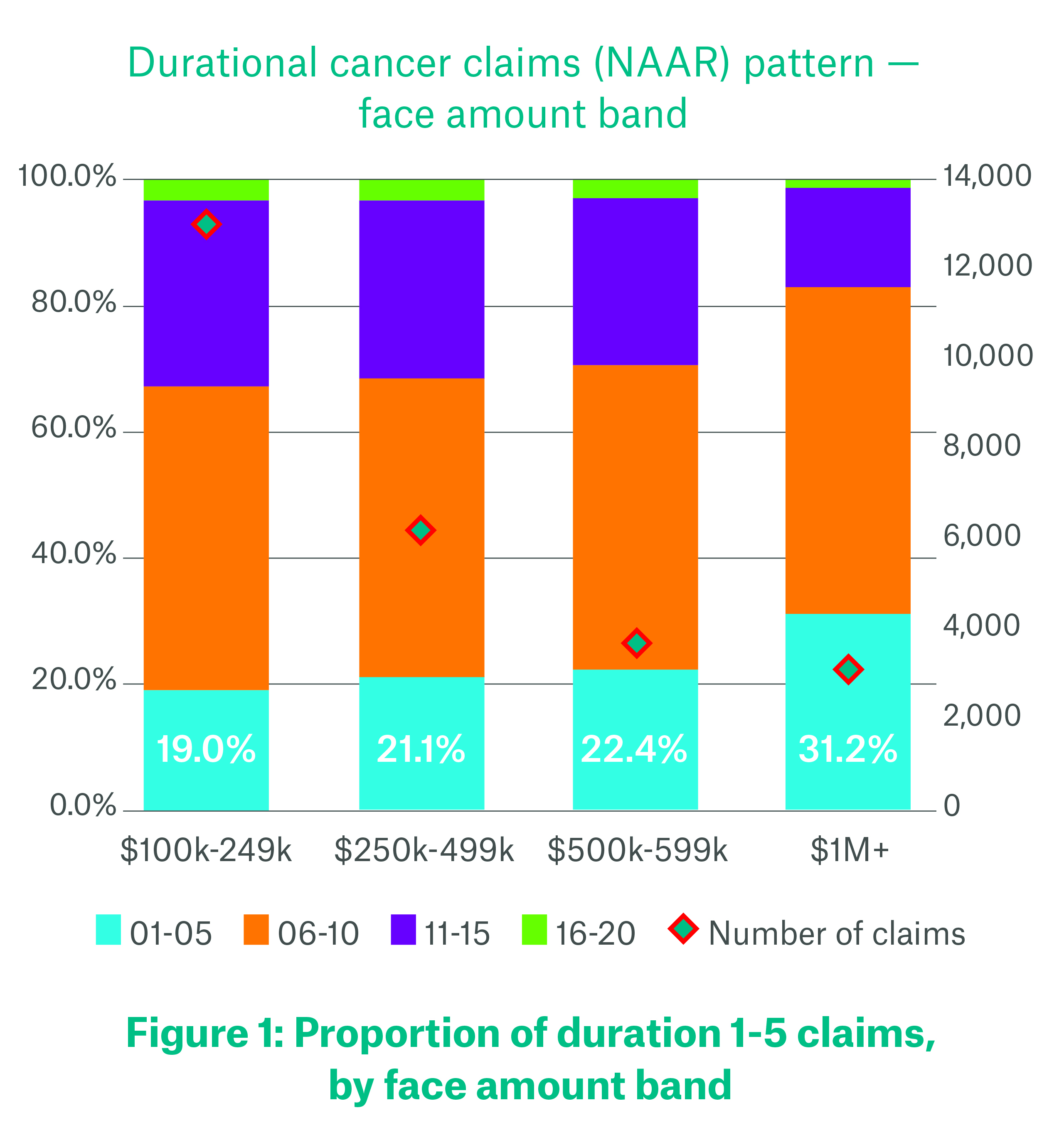

The proportion of cancer claims occurring in durations one to five increases across all face amount bands $100,000-$249,000, $250,000-$499,000, $500,000-$999,000 and over $1 million (Figure 1). This may be partially driven by anti-selection at higher face amounts.

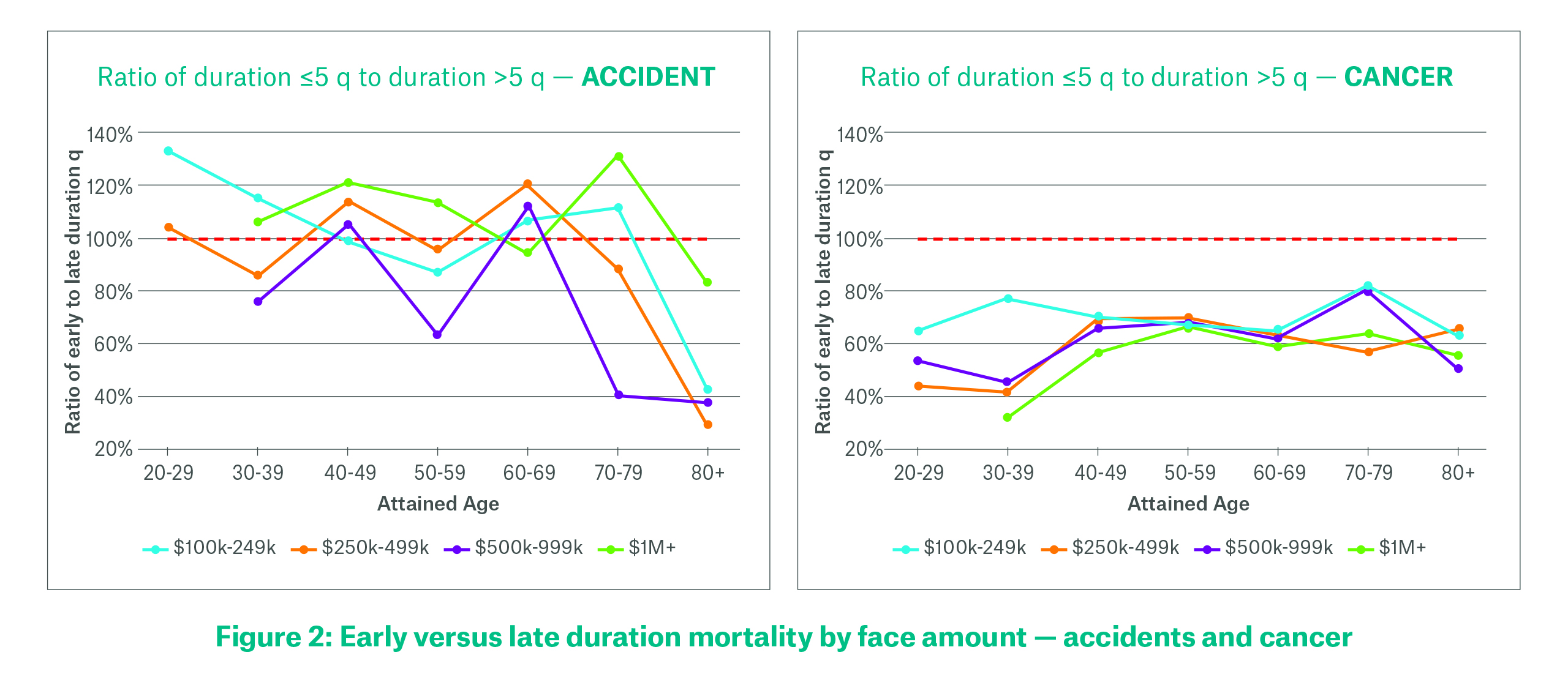

The majority of cancer claims (47%) occur in durations six to 10 while less than a fifth occur in the first five policy years. This trend is also seen for circulatory claims. Accidental and suicide claims tend to occur earlier, with 32% and 25% respectively in durations one to five. Figure 2 compares early duration to late duration mortality for accidents and cancer across face amount bands.

Cancer subtypes and face amounts

In the Munich Re block, cancer subtypes with the highest claims2 are lung (15.7%), colon (8.4%), breast (7.5%), eye/brain/central nervous system (7.1%), pancreas (7.8%), leukemia (6.9%) and genital organs (7.0%). Of these, eye/brain/central nervous system cancer is the one subtype that does not appear in the top seven for the U.S. general population.

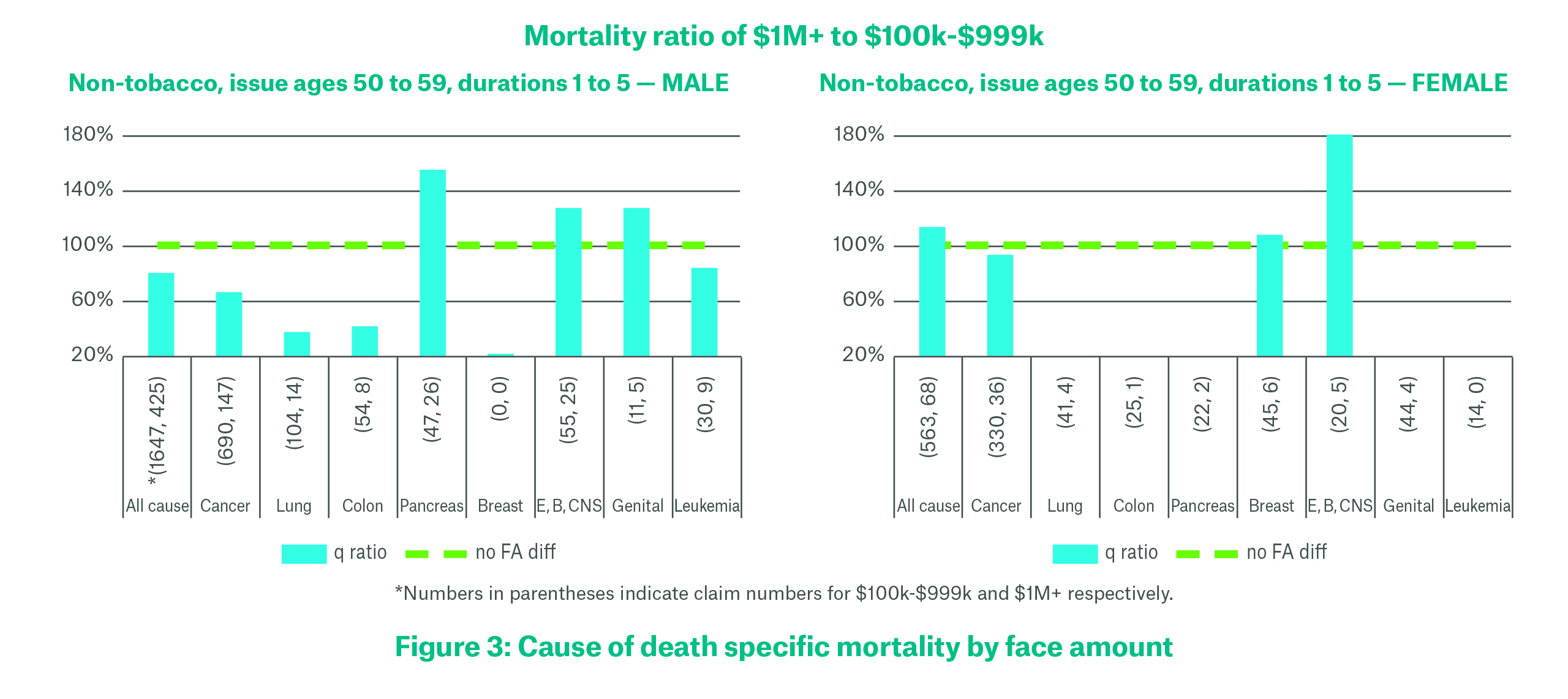

Cancer mortality for face amounts over $1 million is better than for face amounts $100,000-$999,000, likely reflecting the positive impact of underwriting and socio-economic factors. However, there are exceptions to this finding, notably for pancreatic and eye/brain/central nervous system (CNS) cancers (Figure 3).

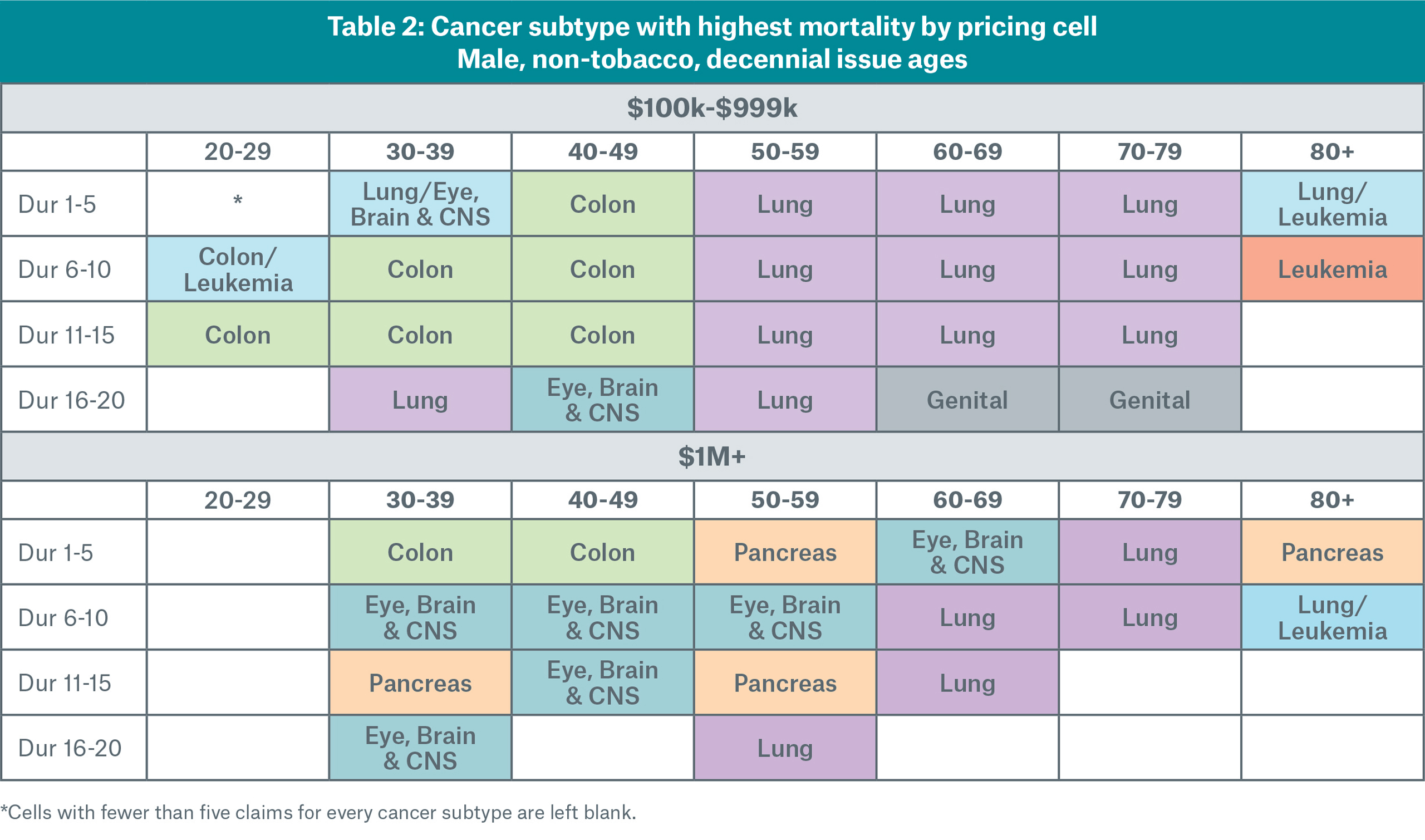

Among male non-tobacco users, for face amounts $100,000-$999,000, lung and colon cancer have the highest subtype mortality in several issue age/duration cells.

The occurrence of lung cancer claims points to possible smoking history misrepresentation or a consequence of smoker definitions prevalent in the industry. For the same group, pancreatic and eye/brain/CNS cancers show some evidence of elevated mortality for face amounts over $1 million (Table 2).

Excess mortality risk for smokers

Smoking or tobacco use increases cancer risk, particularly for lung cancer (Figure 4).

Implications for underwriters and the way forward

Smoking status

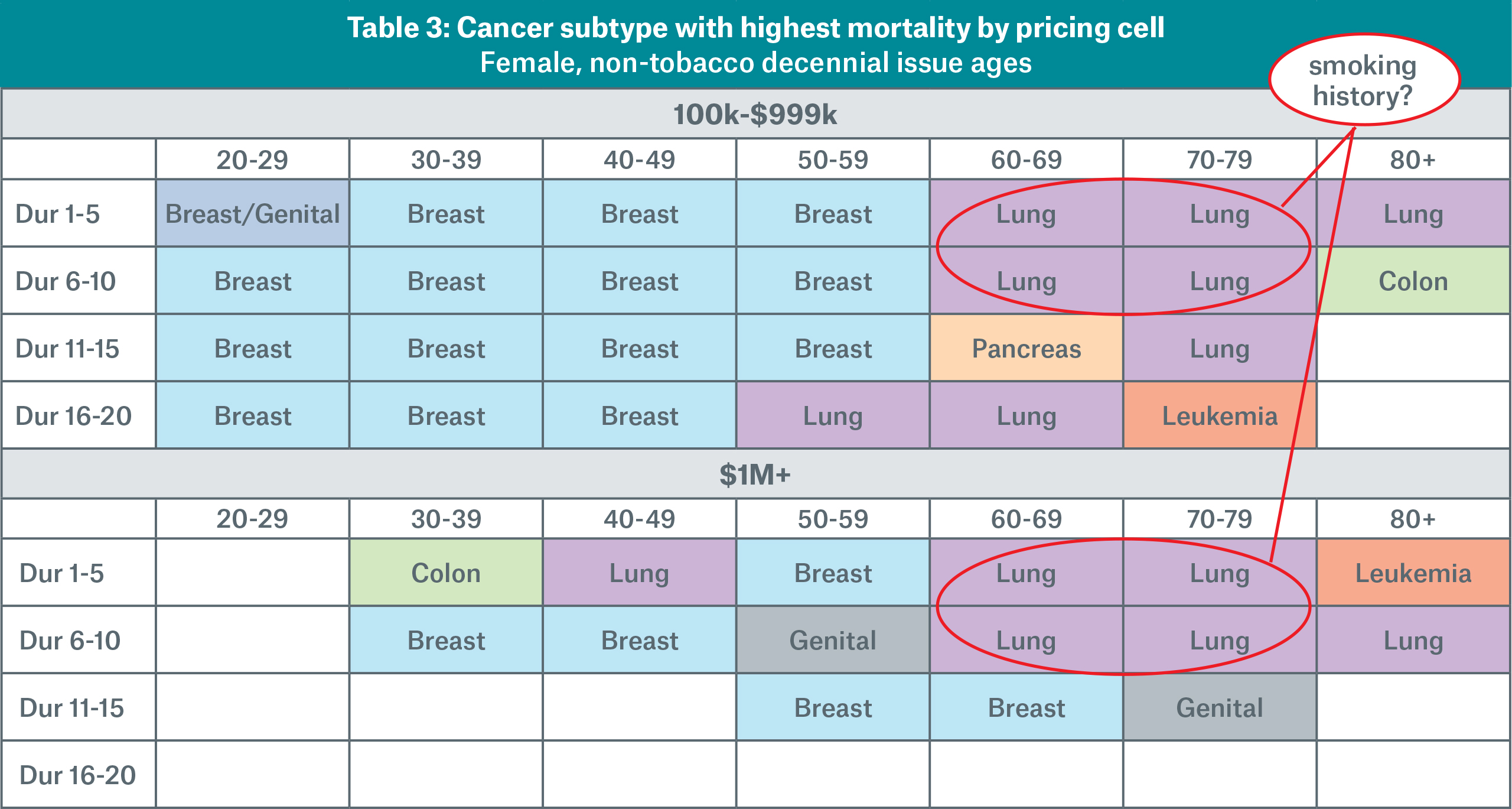

Our research demonstrates that smoking or tobacco use worsens mortality risk for all cancer subtypes. Verifying tobacco use is critical for accurate risk classification. Introduction of an accurate smoker prediction tool will be vital to combating anti-selection in the absence of a fluid-based nicotine screen.

Smoker definitions in a multi-class preferred, non-tobacco structure should be assessed for appropriateness. Adverse mortality impact of smoking may linger years after quitting smoking (Table 2, 3).

Value of other underwriting tools

In an accelerated underwriting environment, without the benefit of fluid testing like urine nicotine screen or blood, a well-constructed tele-app with drilldown questions to tease out smoking history and personal cancer history is a valuable underwriting tool.

Underwriters need to effectively use prescription drug databases, which are a valuable source of medication history, dosage, and physician specialty, to classify risk. Electronic health record (EHR) usage — now in a nascent stage — will become increasingly important in the absence of attending physician statements (APS).

Foreign nationals

Foreign nationals are becoming a bigger piece of a few insurers’ books of business. Early review of cause of death information has revealed cancer to be a sizable proportion of death claims in certain markets. Underwriters need to develop expertise in reviewing these cases based on information available from home countries, where medical records may not be as extensive as in the U.S.

Conclusions

With the trend towards automation, post-issue underwriting will be a cost-effective way for insurers to study the effectiveness of underwriting in the new paradigm. Pilot studies could be performed on samples to compare the effectiveness of new and traditional underwriting risk evaluation tools in screening for cancer risk. Business analytics should continuously monitor mortality trends in the automated underwriting space for differences with traditional underwriting.

Insurers should closely track their cancer claims experience by subtype, face amount band, and duration, to protect against the possibility of getting selected against, especially at the higher face amounts.

Cancer is an age-related disease and the aging population all but guarantees that we will see more applications from individuals who are adult cancer survivors and those who are at increasing risk for cancer because of aging itself. The use of markers such as PSA and CEA (carcinoembryonic antigen) in tandem with other underwriting tools will become important in the mature age population.

With regard to adult cancers, advances in immuno-therapy continue to show progress — for example, in advanced melanoma, non-small cell lung cancers, etc. — that will likely expand to other tumor types. These advances bring optimism that people may live longer (quality of life preserved) and that cancer will be treated as a chronic disease rather than a terminal one.

Contact the Author:

Newsletter

properties.trackTitle

properties.trackSubtitle