In recent months, tariffs have gained prominence as a factor shaping the broader economic landscape. Many are reassessing how tariffs impact insurance — ranging from personal and specialty coverages to more complex, customized policies for businesses of all sizes. As global trade policies shift, the implications for insurance are multifaceted, ranging from changes in material costs to impacts on premiums and disaster recovery efforts. “Overall, we will see lower economic growth and increased inflation, both in the U.S. and globally,” explains Michael Menhart, Chief Economist of Munich Re Group.

These changes are happening day by day, and the broader industry is still attempting to understand the impact tariffs will have in real time. Now is the time to explore the relationship between tariffs and insurance, drawing on expert insights, historical data, and current industry trends to provide a comprehensive understanding of how these economic measures shape the sector for insurers and their policyholders.

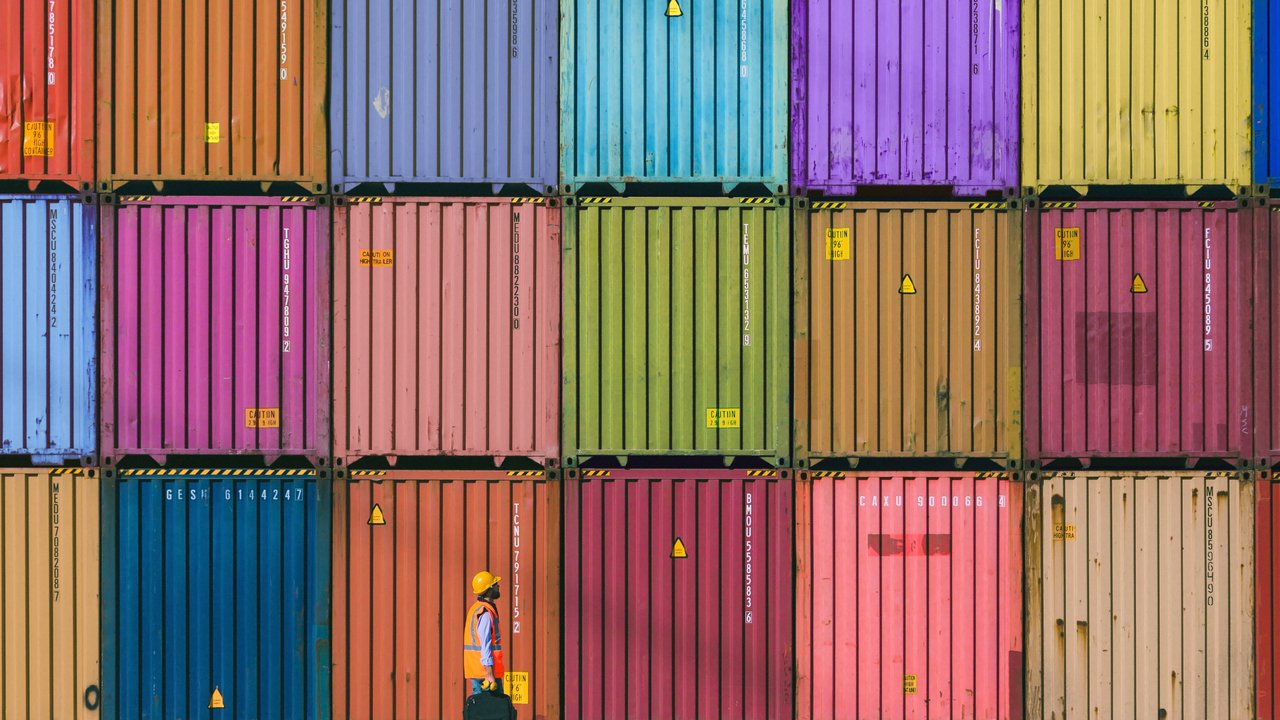

First, and inescapably, policyholders should expect rising costs, not just in the U.S. but globally, especially for property damage and complex claims. Several factors, including supply chain disruptions and regulatory hurdles, will likely mean higher prices for materials like aluminum, wood, and steel. In a recent article in Risk and Insurance magazine1, James Sanzone, AVP Ocean Marine Underwriter for Munich Re Specialty, stated, “Rising tariffs increase the declared value of imported goods, as duties, taxes, and fees contribute to the total landed cost. This increase in value requires corresponding adjustments to insurance coverage. Without updated coverage limits, businesses risk significant financial exposure in the event of loss or damage.”

In addition, there is concern that this will directly impact claims costs and could eventually lead to higher premiums, especially as climate change and other natural disasters increase, complicating the picture. “2024 was a record year,” said Farah Zafar, SVP, Legal, Compliance & Claims for Munich Re Canada. “It was the largest national catastrophe losses we've ever had in Canada,” said Zafar. The picture was largely the same further south, with the Palisades fires in Southern California. In both cases, Munich Re Specialty and its subsidiaries worked tirelessly to meet the moment, ensuring that policyholders got clear answers and the support they needed to get back on their feet. These tariffs not only impact future loss events but past ones as well. As recovery continues from these recent catastrophic events, the cost to replace and rebuild for these claims will be impacted by the increased costs of materials due to the rising tariffs on building materials and extended timeframes from supply chain disruptions.

Accurately assessing underwriting risk and addressing rising costs in an environment influenced by tariffs can be a challenge. So how can the insurance industry respond? For one, by recognizing that change is constant, and that these changes, while perhaps occurring at an accelerated rate, are what our industry, and Munich Re Specialty in particular, are built for. “We’re always responding to things that are happening in the marketplace from a claims perspective,” said Eric Hunziker, Chief Claims Officer at American Modern Insurance Group, a part of Munich Re Specialty. “Whether it is changing weather patterns, severity of events, or economic influences to labor and material prices,” the ability and experience to adapt to changing market conditions is something every policyholder and insurer should look for, and for which Munich Re Specialty is well known.

While there are still plenty of unknowns, we can prepare by leveraging global expertise, analyzing existing trends and data (including climate data), and building relationships with specialized vendors and contractors. This final point is especially important as global supply chains slow. Speaking about third-party claims, which are also impacted by rising prices, Peter Macdonald, Chief Claims Officer at Munich Re Specialty – North America, cites the importance of employing negotiation expertise in managing complex claims. “There are more factors, really, than just rising costs when you get down to third-party claims. You have a lot more to work with,” he said, adding that employing people with the expertise to negotiate favorable solutions is key, even in the face of rising costs.

Ultimately, proactive prevention is the best defense when it comes to challenges like regulatory hurdles and supply chain disruptions. When asked to recall recent events that have presented similar challenges, Hunziker recalls the obstacles American Modern faced during 2020, with both the COVID-19 pandemic and a very active hurricane season causing significant supply chain disruptions, subsequent inflation, and dramatic changes to interaction methods. Despite the global disruption, they demonstrated resilience by continuing to handle claims, making sure their teams were supported, and having a physical “boots-on-the-ground” presence. “This isn’t the first time we’ve had to respond to changing dynamics,” said Hunziker.

In closing, the insurance landscape is being significantly impacted by tariffs right now, with rising costs of materials and threat of higher premiums, coupled with the increasing frequency and severity of natural disasters, already creating new challenges. While there is some uncertainty surrounding the long-term impacts on insurers and policyholders alike, proactive portfolio management, continuous communication, and adaptation will be essential. Insurers have a unique opportunity to guide their clients through these challenges by providing innovative solutions and options.

Employing the right expertise in strategic risk management and claims excellence will ensure insurers are well-positioned to play a key role in helping clients navigate tariff risks and prepare for volatility in an increasingly complex global economy. With over 140 years of experience, the Munich Re family of companies have the history, the expertise, and the global perspective to help you address these changes.

Contact us

- Email pmacdonald@munichre.com

- vCard Download

Newsletter

properties.trackTitle

properties.trackSubtitle