To date there have been very few heart attack claims in Canada that have not fulfilled the medical criteria required under the policyholder’s Critical Illness (CI) policy. However, as medical testing has advanced in recent years, Heart Attack as a covered CI condition has faced some challenges.

The question some insurers have encountered is: Should we pay a claim if the medical criteria in the policy definition are not met but the diagnosis of a heart attack has been confirmed by current standards of medical practice or by criteria that did not exist when the policy was issued?

How did this conundrum arise?

Individual CI insurance was introduced in Canada in the late 1990s on a fully guaranteed, non-cancellable basis. This provided consumers with the security of well–defined coverage along with fixed premiums set at the time of policy issue. CI policies contain carefully-worded definitions for each covered condition and pay a benefit when the policy definitions and requirements are met. However, challenges arise when policy requirements, fixed when the policy was purchased, fall out of step with changing medical diagnostic criteria and practice. As the field of medicine moves forward, the differences between static policy requirements and new medical diagnostic criteria create challenges for certain covered critical illness conditions. This is the case for Heart Attack.

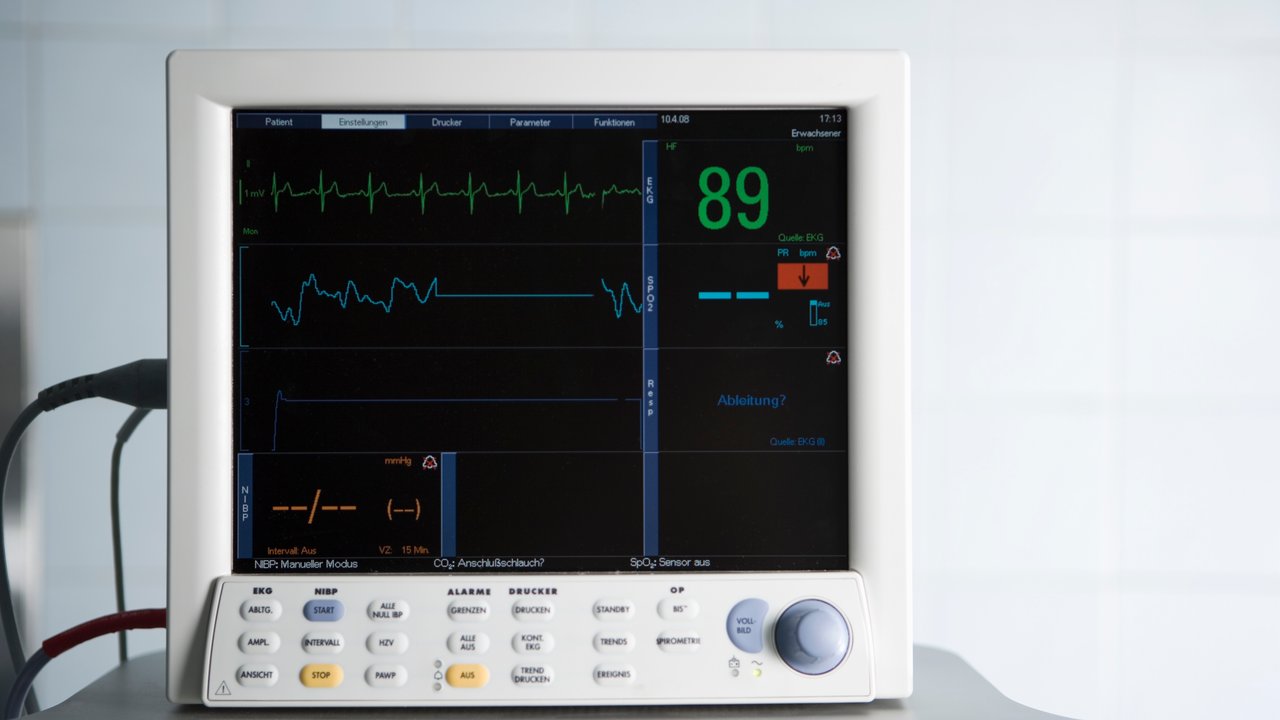

The modern treatment of heart attack may see patients undergo cardiac catheterization before serial troponin levels have been measured. In this instance the treating team will make a diagnosis of heart attack based on a combination of medical history (the presence of typical chest pain), serial ECGs and coronary angiography. A claim denial based on the non-availability of serial troponin levels may, in such situations, be inappropriate.

A second problem has been created by the recent arrival of the “highly-sensitive” troponin blood test. This test allows very small elevations of troponin to be detected and thus permits very small heart attacks to be diagnosed. However, these highly-sensitive troponin elevations may also be caused by a variety of other medical problems and indeed, by vigorous exercise! Thus a label of “Heart Attack’ may, on occasion, be inappropriately assigned to an individual complaining of chest pain in a hospital emergency room. In this instance the insurer is faced with the dilemma of a claim for Heart Attack when alternative conditions can readily explain both the clinical situation and the elevated troponin. In these situations the diagnosis of Heart Attack is far from ‘definite’, as the CI definition requires.

What should insurers do when CI definitions and modern medicine are no longer aligned?

It is Munich Re’s stance that for a claim to be payable the CI definition, as written in the policy, should be satisfied. This stance is also supported by Canadian case law.

That said, in some cases it becomes clear that the diagnosis of a covered condition, such as Heart Attack, has been established with a high degree of certainty, yet the policy definition has not been satisfied. In such cases, if there is clear, convincing evidence that the condition has indeed been diagnosed, Munich Re, in keeping with the intent of the insurance contract, will accept such claim payments. We believe that is one way in which the industry can sustain and protect the value of Critical Illness insurance.

In the case of Heart Attack, this acceptance is contingent on an in-depth analysis of all available medical information, including notes from referring hospitals, emergency rooms, in-hospital notes, discharge summaries and reports of consulting doctors. This process allows the consideration and eventual ruling-out of other diagnostic possibilities.

The critical illness definitions in the policy should continue to be the first determinant of payable claims. However, as clinical practices continue to change, honoring a CI policy’s intent--with appropriate medical evidence supporting the validity of the claim--is the best way forward for our clients and our industry.

Contact the authors

/Tim%20Meagher%202019.jpg/_jcr_content/renditions/crop-1x1-400.jpg./crop-1x1-400.jpg)

properties.trackTitle

properties.trackSubtitle