properties.trackTitle

properties.trackSubtitle

Health insurance executives need accurate data to make the right decisions for their business

The business challenges you face

SMAART is the solution you need

With SMAART, you can make effective and timely decisions with accurate information, available at the beginning of each month, rather than the middle.

The actionable insights you seek are the glue between your company’s strategic goals and an effective decision-making process. This is the power of SMAART.

Get SMAART about the decisions you make

SMAART is a Claims Reserving, Portfolio Monitoring and Pricing System for the health insurance business. It provides you with a 360-degree view of your business performance, allowing you to monitor your portfolio profitability from a product and policy perspective, use past claims experience and factors like seasonality and medical trends to make projections for incurred claims, ultimate claims, and eventually price, and steer your portfolio towards desired targets. With a user-friendly experience, it provides you with the tools you need to:

- Manage your health business reserves

- Monitor policy performance and handle renewals

- Monitor product performance and decide pricing

Conceived by Munich Re actuaries, SMAART is a robust yet simple-to-use system that you can count on.

Who would benefit from SMAART?

SMAART provides the insights insurers need to effectively monitor their health portfolio, ensure profitability and stay ahead of the competition.

SMAART can also be beneficial to other professionals in the health insurance business, such as actuarial firms, brokers and consultancy firms.

- Insurance companies

- Actuarial firms

- Brokers

- Consultancy firms

- Health line manager

- Product pricing

- Claims handling

- Risk management

- Underwriting

- Actuarial

Multi-Organization Mode

SMAART’s Multi-Organization mode empowers health insurers and holding groups to seamlessly analyze data across multiple organizations or TPAs within a single interface. By consolidating key metrics such as loss ratios and premium volumes into a unified “Company Performance” dashboard, users gain actionable insights for financial and actuarial benchmarking.

The platform supports flexible currency display, allowing users to toggle between local currencies and USD, enabling consistent, cross-border comparisons for strategic decision-making and global reporting. This capability not only enhances portfolio management by ensuring alignment with target profitability—focusing on setting the right portfolio pricing beyond just individual policy pricing—but also enables proactive portfolio monitoring.

With clear visibility of the Target Loss Ratio (TLR) versus the Ultimate Loss Ratio (ULR), insurers can identify trends early and take timely, effective action to optimize results.

Watch our exclusive webinar on-demand

How you benefit from SMAART

SMAART ensures that you have access to the data you need, when you need it, so you can make intelligent decisions about your entire health portfolio. Specifically, SMAART provides you with:

- Single version of truth for your business

- Increased risk management capabilities via sophisticated reserves handling

- Improved operational efficiency for reserving, claims analysis and renewals

- Advanced pricing capabilities for policy renewals

- Superior portfolio monitoring on a policy and product level

- Enhanced compliance through automation and minimization of human errors

Key tools & capabilities to manage your business

Reserving Tool

Portfolio Tool

Group Tool

Individual Tool

Product Tool

General Features

Expertise and technology behind the solution

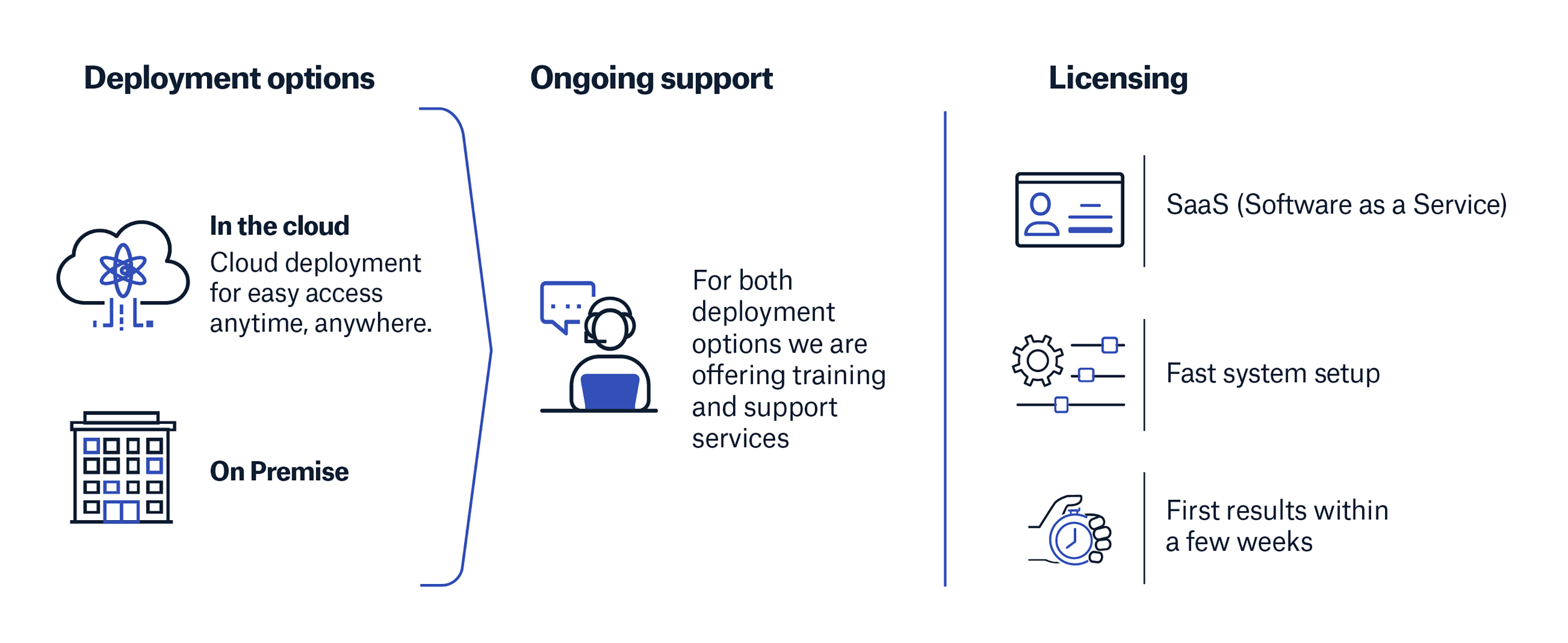

Deployment and licensing options that work best for your business

Get a custom demo using your own data

Step 1

Step 2

Step 3

Send you a template to fill with past data

Import your data once you return the template

Demonstrate the various tools and KPIs based on your own data and scenarios

.jpg/_jcr_content/renditions/original./iStock-1280956095%20(Static).jpg)