The new feature in SMAART: Covid-19 Adjustment Factors

11/11/2020

properties.trackTitle

properties.trackSubtitle

During the last few months, the world has faced a completely new situation due to the coronavirus pandemic (COVID-19). Entire countries were forced to lockdown several types of industries and services affecting all aspects of everyday life. Health insurance providers were also affected by this process as insured members could not visit doctors or hospitals for standard scheduled procedures.

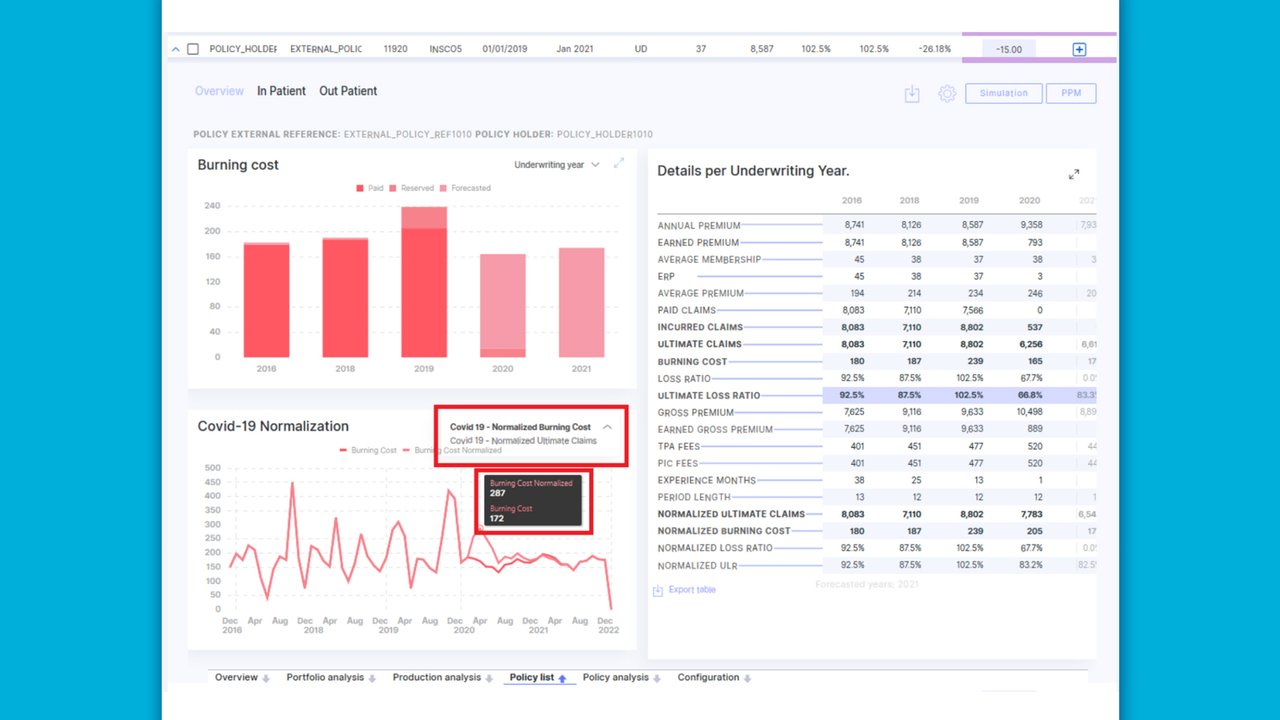

The impact on the processed and incurred claims of this period has been significant, and actuaries across the world are called upon to consider the drop of claims and assess the impact on the future reserves. The last few months’ lower claims also present a challenge for underwriters who need to assess expiring policies and give viable premium adjustments to renew them. Assessing a policy upon renewal based on the pandemic-lower claims can be problematic, as we may underestimate future claims.

We need to monitor and forecast the impact Covid-19 had and will have on our healthcare insurance business. To avoid unrealistically claim forecasts, there is a need to normalize the past experience.

A new mechanism that incorporates the coronavirus impact into the claims of the policies being reviewed has been created to address this situation. The new mechanism introduced into SMAART allows the Underwriter or Actuary to normalize the incurred claims of the past few months and the future forecasted claims to include the impact of the coronavirus better and avoid underestimating policy performance.

Learn more about how SMAART can help your health insurance business include the Covid-19 impact when forecasting future claims or assessing a policy upon renewal, by sending us an email at smaart@mrhealthtech.com or by requesting a demo here.