Tech Trend Radar 2020 – stay prepared amidst uncertainties

properties.trackTitle

properties.trackSubtitle

Stepping into a new decade, what awaits us in the 2020s? The technology world is constantly adapting to uncertainties across the globe. The Tech Trend Radar 2020 sheds lights on how you can prepare your business by making the best use of the emerging technology trends.

Continuous development of advanced technology is changing the way we live and work. The establishment of digital ecosystems enables organisations to push forward the digital transformation, while virtual assistants allow users to focus on high-impact work.

In 2020, the coronavirus pandemic has shifted our demand for technology application overnight. Technology such as location-based services is in place to obtain an accurate picture of the effectiveness of distancing measure. How will the pandemic push the development of emerging trends such as digital identity and white biotech even further?

Now more than ever, technology is not only a competitive advantage but also an actual necessity to keep businesses running. The awareness for digitalisation is on the rise on a large scale. This is precisely where the Tech Trend Radar 2020 comes into play. The sixth edition aims to provide information about the technology-driven trends in 2020 that are particularly relevant to the global insurance sector. A collaborative initiative by Munich Re and ERGO, the annual Tech Trend Radar aims to sharpen awareness of key trends and evoke a conversation about their relevance along the insurance value chain.

The structure of the trend report

As you explore our online interactive radar, you will find that we have categorised emerging technology trends into four fields:

- User Centricity

- Connected World

- Artificial Intelligence

- Enabling Technologies

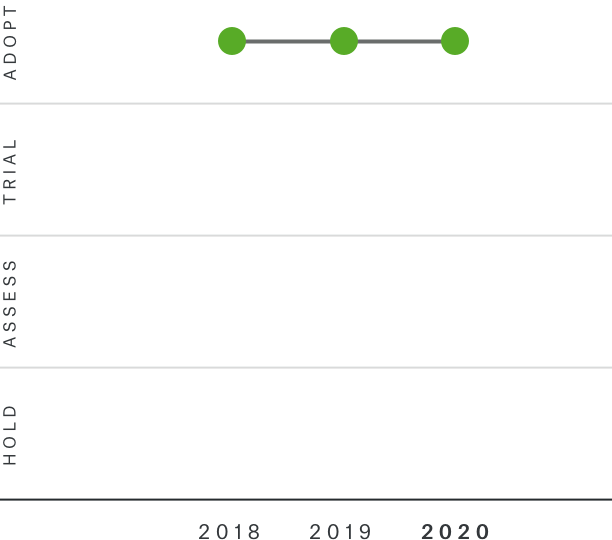

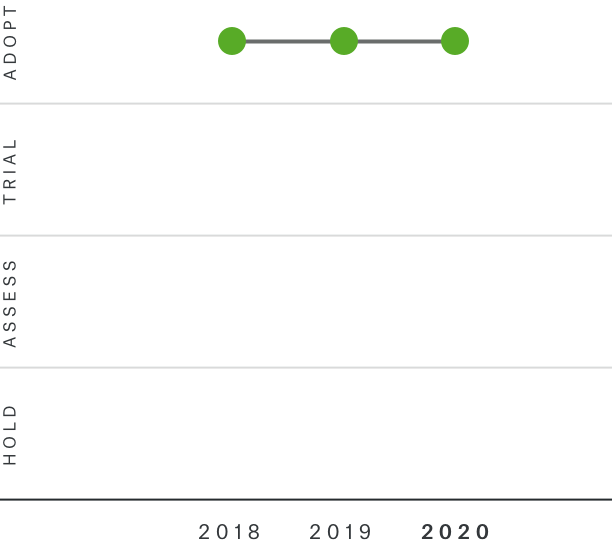

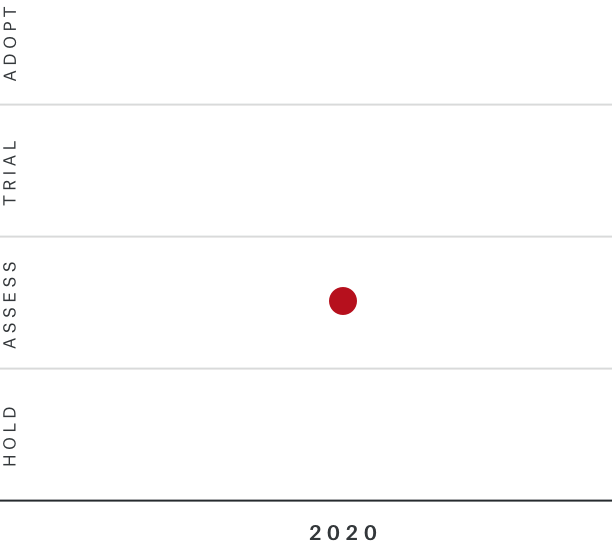

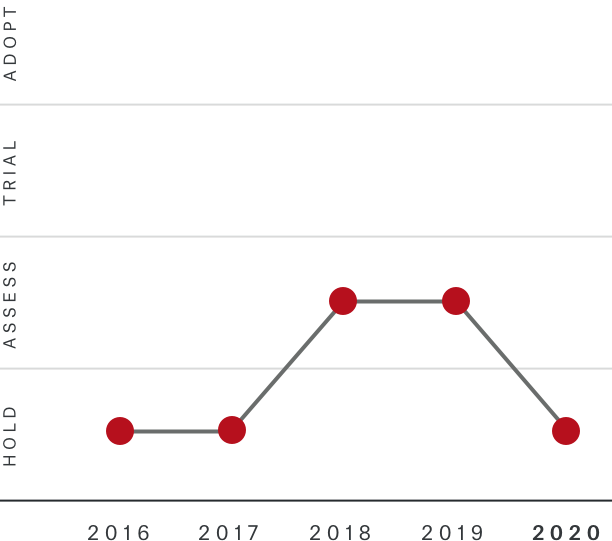

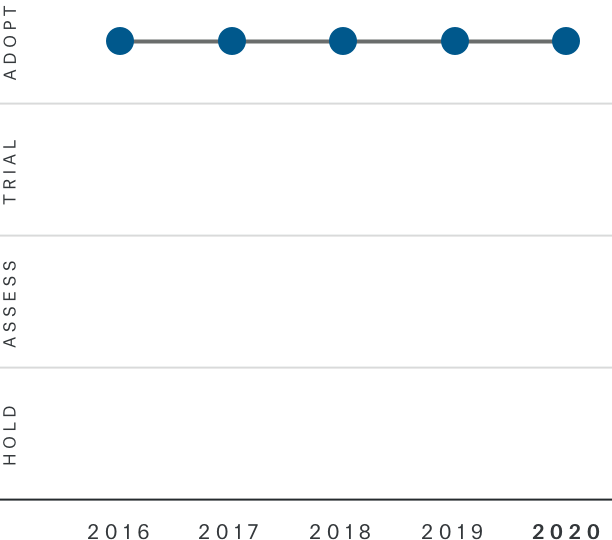

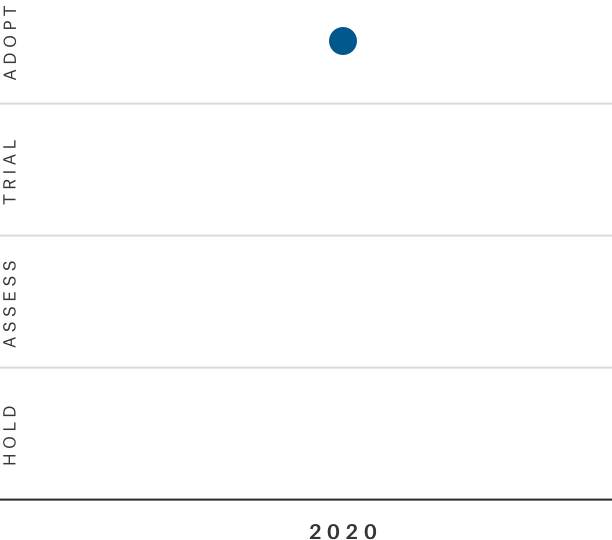

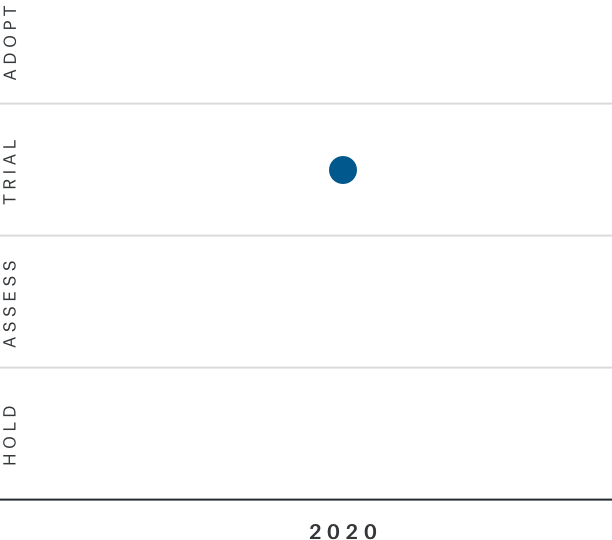

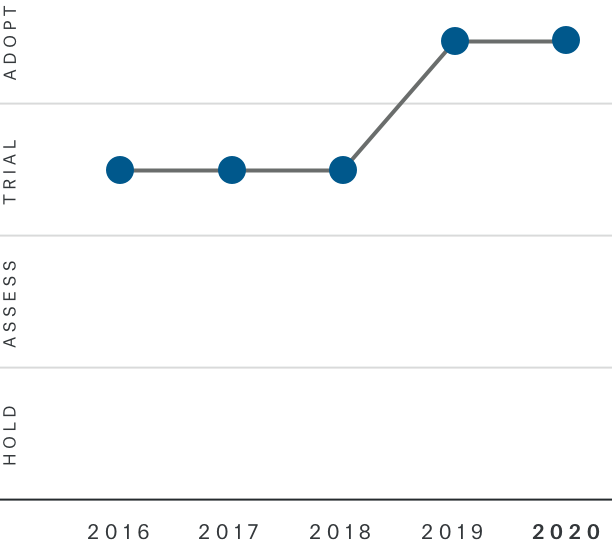

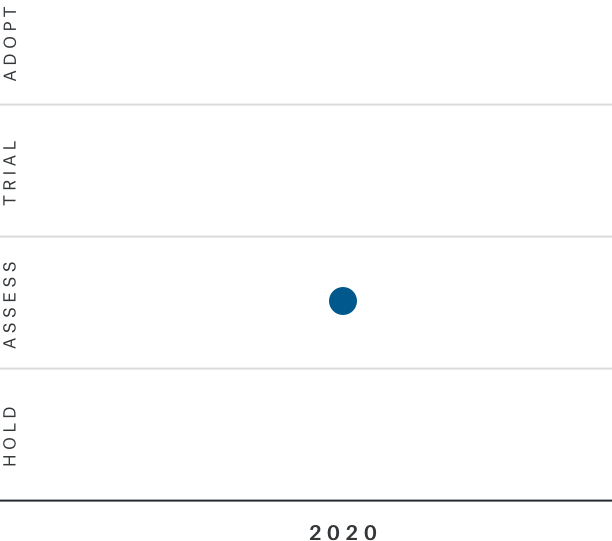

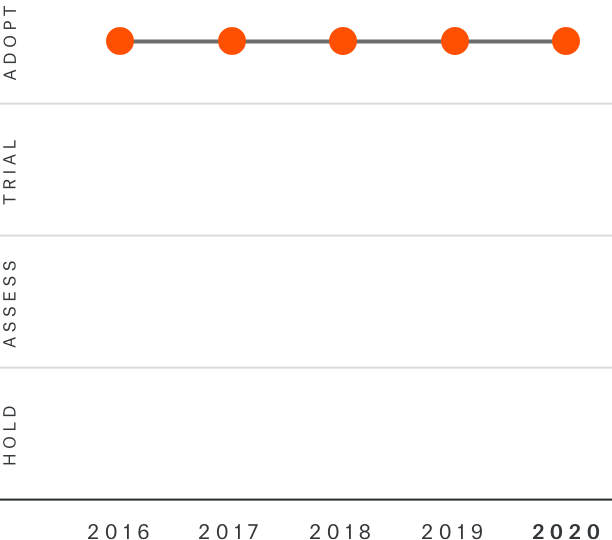

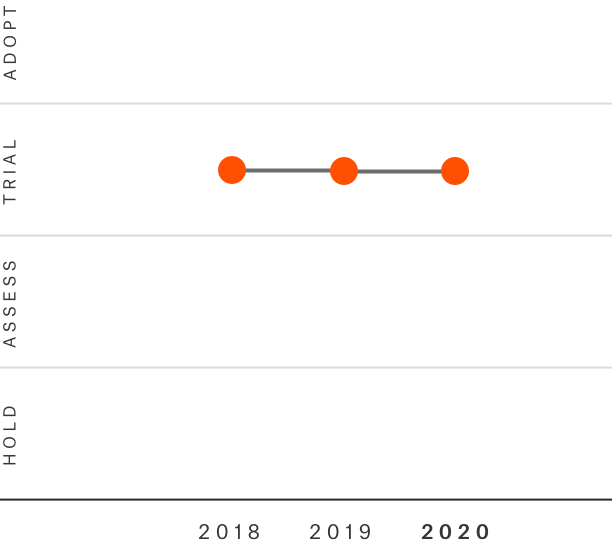

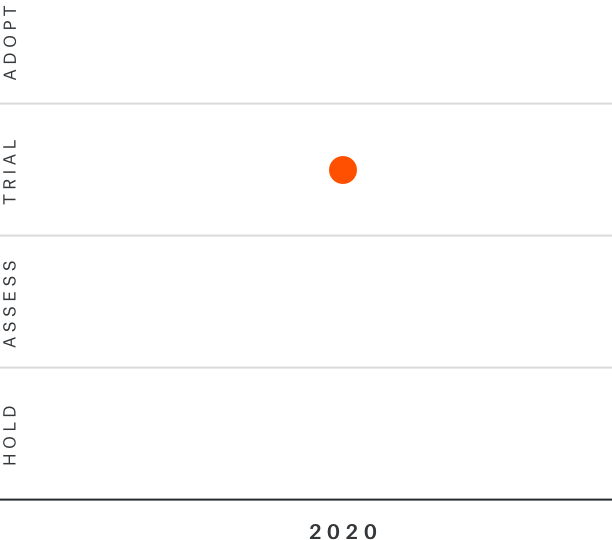

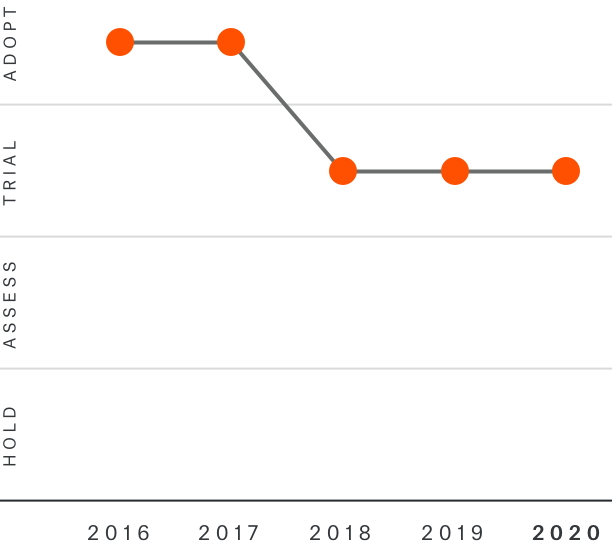

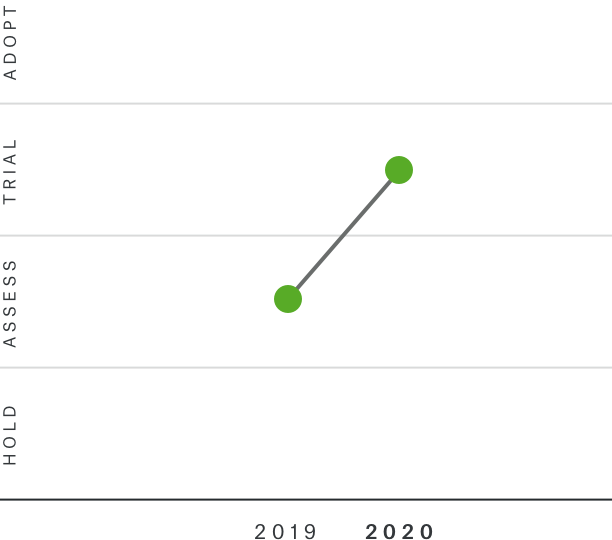

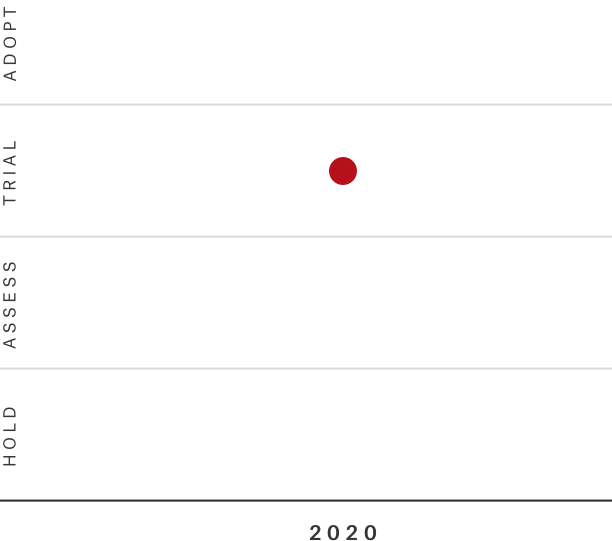

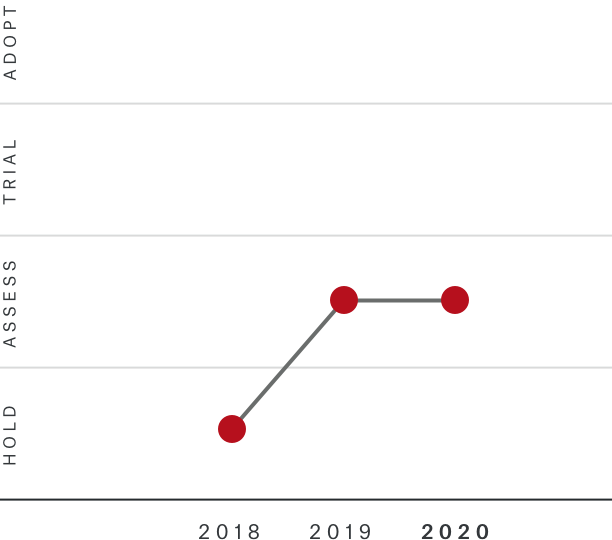

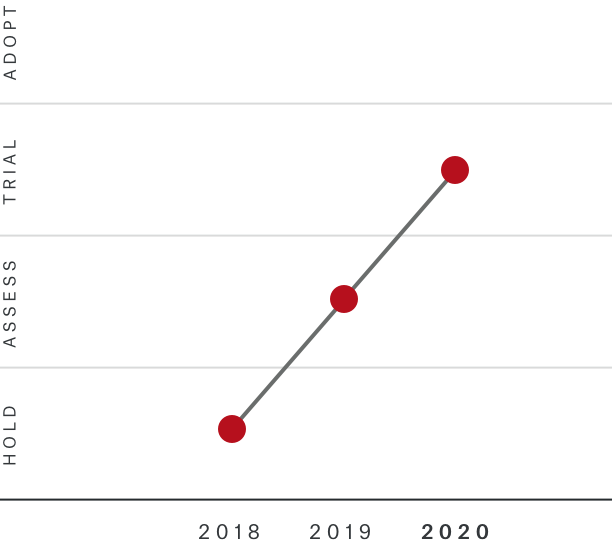

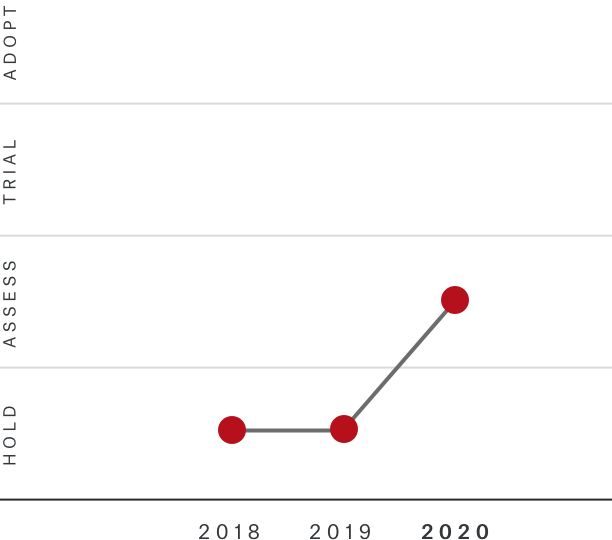

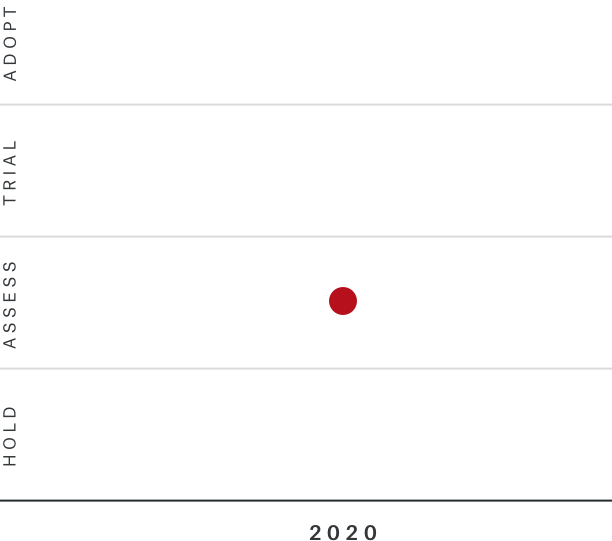

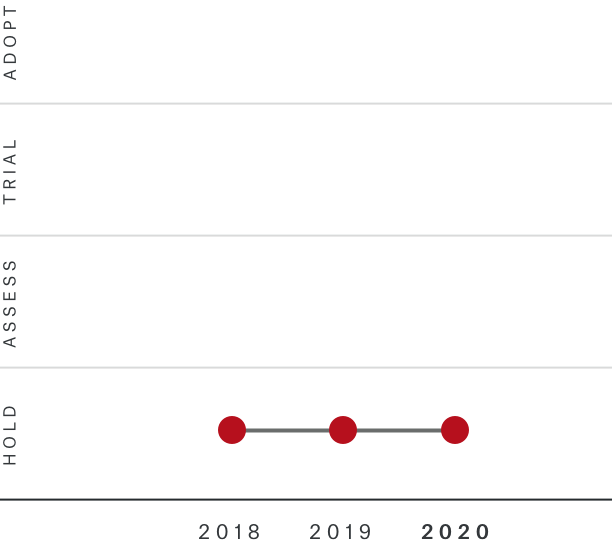

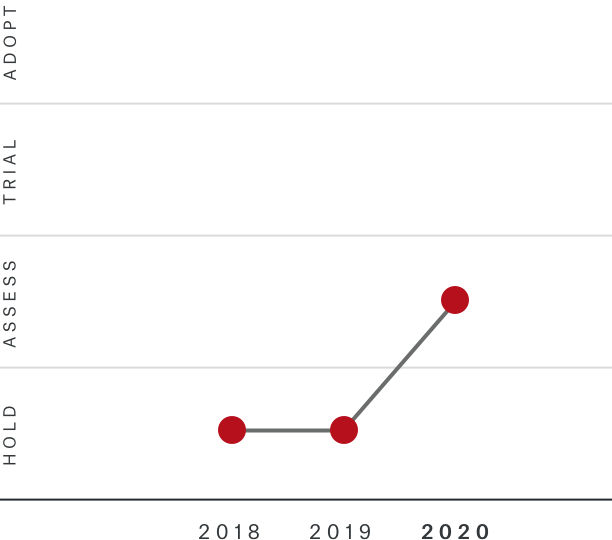

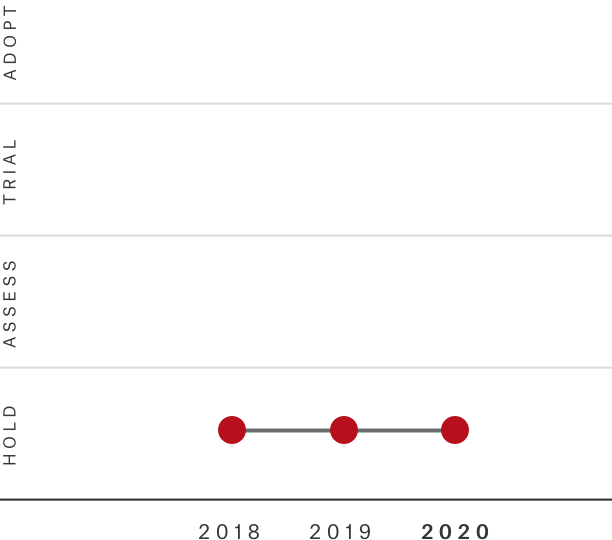

We also assess the maturity of each trend:

- Hold: Add it to your watch list

- Assess: Consider what it may mean for your business

- Trial: First initiatives should be underway in the most affected business areas

- Adopt: Start taking full advantage of this technology

In addition to exploring each of the 52 trends, you can also discover some of the innovative technology solutions Munich Re offers in each of the trend fields.

A downloadable report is available at the bottom of this page that gives you a deep-dive into the trends that we consider to be most mature and worth considering adopting in your business.

Technology is an important driver of future business. It’s our hope that the Tech Trend Radar will serve as a valuable tool as you assess how emerging technological developments may impact your organisation.

Tech Trend Radar Future Technologies 2020

- Payment Models

- Digital Identity

- Biometric Recognition NEW

- Digital Ecosystems

- Behavioural Analytics

- Location-based Services

- Virtual Assistants NEW

- Deepfake Defence NEW

- Mixed Reality

- Haptic Technologies

- Smart Spaces

- Digital Health Services

- Industrial IoT

- Open API

- Open Data

- Precision Farming NEW

- Deep Mapping

- Data Fabric NEW

- Autonomous Things

- Digital Twin

- White Biotech NEW

- Microsatellites NEW

- Smart Textiles

- Human Enhancement

- Smart Dust

- Computer Vision

- Natural Language Processing

- Conversational User Interfaces

- Machine-driven Decisions

- Augmented Decision-Making

- Cognitive Automation

- AutoML

- Generative Adversarial Networks

- Knowledge Graphs

- Explainable Machine Learning

- Cognitive Cyber Security

- Hardware-Embedded AI

- Artificial General Intelligence

- Cloud Enablement

- Cloud Edge

- Personalised Medicine NEW

- 5G

- Distributed Ledger

- Swarm Intelligence

- 3D Printing

- Neuromorphic Hardware

- Volumetric Display

- Robotic Health NEW

- Advanced Batteries NEW

- Quantum Computing

- Programmable Materials

- Brain-Computer Interface

- MIRA Digital Suite

- Realytix

- Infrastructure Risk Profiler

- NatCatSERVICE

- Solution for location risk assessment

- Data risk intelligence

- IMPROVEX

- What the Hack!? Cyber Solutions

- IoT Solutions

- Epidemic Risk Solutions

- Data analytics for life insurers

- FIVE

- Remote Industries

- One Cat

Realytix

User Centricity

Next level automated underwriting solutions

Benefits at a glance

- Significantly reduced time to market

- Customisable, flexibly implementable platform

- Digital distribution

- Increased (process) efficiency, cost and time savings

Infrastructure Risk Profiler

User Centricity

Holistic risk assessment for infrastructure investments

Benefits at a glance

- Holistic, objective and transparent perspective

- Solid basis for an informed investment decision to better secure the return on their investments

- Thorough analysis within up to 4 weeks

- Comparability of different infrastructure projects that match their individual appetite

NatCatSERVICE

User Centricity

Complex risk modelling with regard to natural perils

Benefits at a glance

- Flexible, easy to use and fast

- Reliable data on natural catastrophes back to year 1980

- Hazard-specific analyses (e.g. tropical cyclones, hurricanes/typhoons, earthquakes)

- Charts can be shared directly (social media channels/download)

Solution for location risk assessment

User Centricity

Assessment of risks associated with climate change and natural hazards

Benefits at a glance

- The modular structure of the SaaS allows for an extension of the solution with the other module of the assessment model

- An on-demand version, without any contractual commitment, allows purchase and download of assessments reports

Data risk intelligence

User Centricity

Simplify and accelerate the process of data and information protection

Benefits at a glance

- Weak legal points regarding data protection are identified and can be resolved in the further course of the process

- A user-friendly, configurable dialogue and workflow system

- Optional modules, for instance for data breach management, can be seamlessly integrated into the solution

IMPROVEX

Connected World

Data driven excellence for your portfolio

Benefits at a glance

- Strengthens participants’ competitive position and opens up new possibilities to identify attractive business potential

- Interactive heat map helps to identify “white spots” and allows to challenge the underwriting and growth strategy

- Next-level empirical pricing parameters make it possible to optimize excess pricing and attachment point strategy

What the Hack!? Cyber Solutions

Connected World

A new kind of cyber insurance – beyond traditional reinsurance

Co-operation and underwriting services include

- Legal advice and wording analyses

- Workshops, training and client seminars

- Technical risk assessment support

- White-label concept design for cyber products

- Threat intelligence sharing and cyber-claims information exchange

- Innovative cyber products and co-creation in the cyber network

IoT Solutions

Connected World

Integrating tech, risk management & financing

Benefits at a glance

- Cutting edge technology (hardware, software and retrofitting)

- Use-case development

- Risk management services

- Ecosystem partners

- Tailored financial solutions

MIRA Digital Suite

User Centricity

Accelerating life insurers’ underwriting and claims handling

Benefits at a glance

- Faster processing times for underwriting and claims handling

- Transparency and insights to improve risk results

- SaaS-based turnkey solutions

- High level of flexibility in which modules to use

- Access to the latest range of insurance solutions, which are continually updated

Epidemic Risk Solutions

Artificial Intelligence

Holistic solutions saving lives, protecting economies

Benefits at a glance

- Revenue stability

- Balance sheet protection

- Indemnification of lost revenues or profits

FIVE

Artificial Intelligence

Rules-based investment strategies

Benefits at a glance

- Access to a selection of quantitative investment strategies

- Better risk transfer by sourcing complete investment solutions directly from Munich Re

- Attractive payouts with guarantees and insurance covers

Data analytics for life insurers

Artificial Intelligence

Innovative approaches to data analysis

Benefits at a glance

- High-performance infrastructure meets all the requirements for extremely efficient and fast analyses on a grand scaleds

- Analytical capability from a large pool of experts in all relevant disciplines

- Unparalleled international data bases (e.g. covering up to 80% of the entire portfolio in the German life insurance sector)

Remote Industries

Enabling Technologies

Remote claims settling in real-time

Benefits at a glance

- Improved claims management

- Cost, time, and resource savings for insurers

- Enhanced experience for policyholders

One Cat

Enabling Technologies

Comprehensive and rapid response to natural catastrophes

Benefits at a glance

- Parametric triggers ensure rapid recovery

- Covers previously uninsurable risks from natural catastrophes

- Unprecedented level of transparency

- No deductibles

- Reduced claims-related expenses

Digital Ecosystems

User Centricity

Digital ecosystems enable a company to interact with customers, partners, other industries and competitors.

Opportunities

- In combination with other technologies such as Blockchain, digital ecosystems may allow for a complete unbundling of services. The main functions of banks, such as lending, money transfer and safekeeping of assets could be offered by a group of separate providers in a digital ecosystem.

- There's a shift in the business model to a “layer player“ pattern. This means that one step in the value chain is offered to a large number of customers. For example, collaboration with specialists for the underwriting of exotic risks or for more efficient claims handling.

- Digital ecosystems offer access to capabilities and resources on a global scale and have the potential to reshape entire markets. On-boarding costs for consumers should be low, since all data can be shared within the ecosystem.

Risks

- Since digital ecosystems comprise several partner companies, open communication and clear rules are paramount to prevent misuse and data leakage.

- Insurers have started designing, establishing and running digital ecosystems. They often underestimate the platform complexity of combining an intuitive customer-facing frontend with a legacy-heavy backend, data governance and compliance standards.

- Platforms require an advanced technological basis in order to be cost-effective.

- A digital ecosystem typically follows a two-role concept: The platform owner as gatekeeper and product contributors for its marketplace of services. Certain companies in the ecosystem may play a crucial role and therefore become indispensable or act as a bottleneck.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

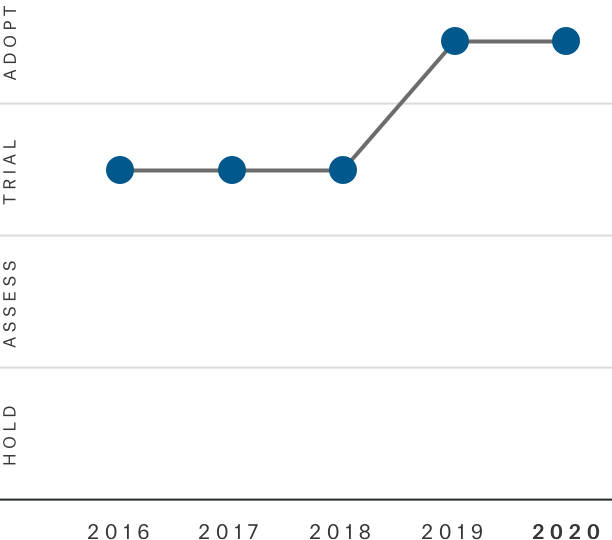

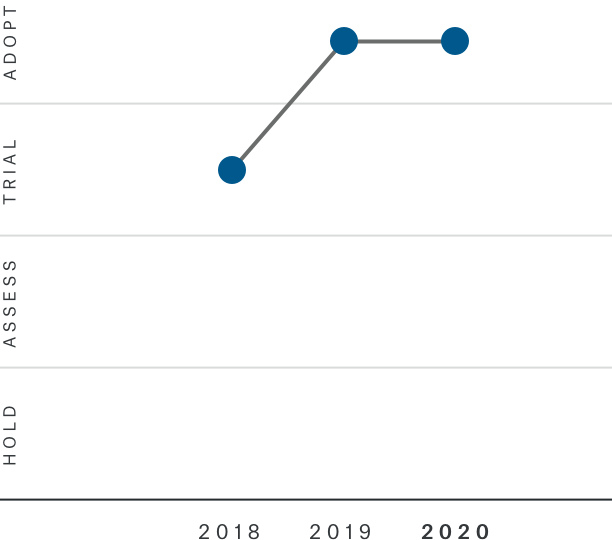

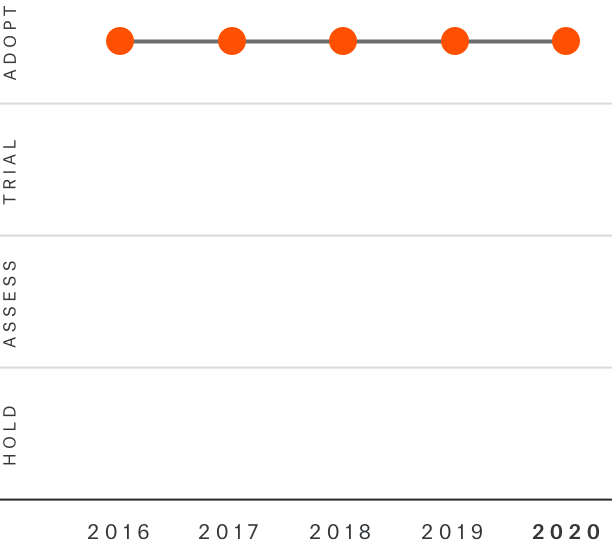

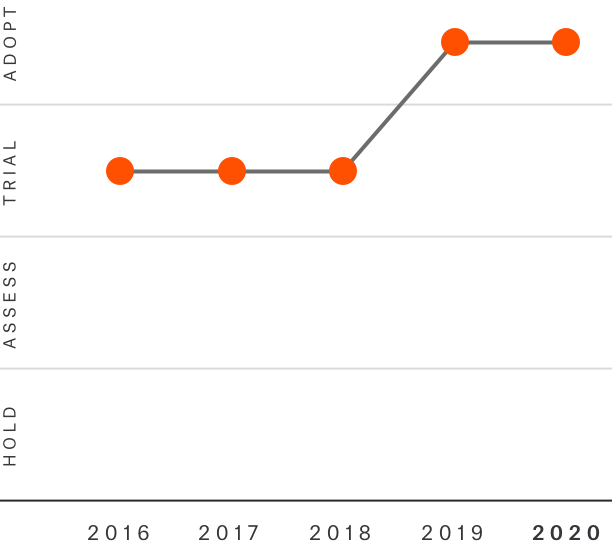

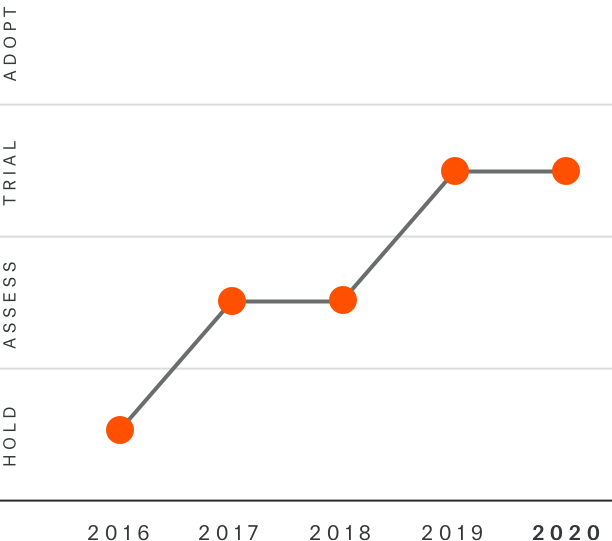

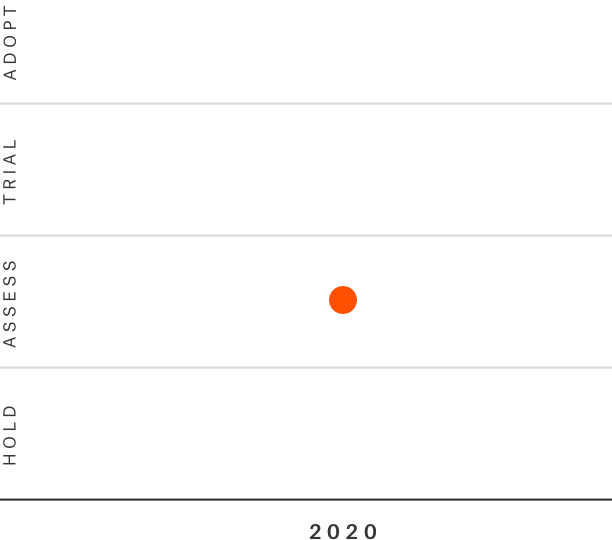

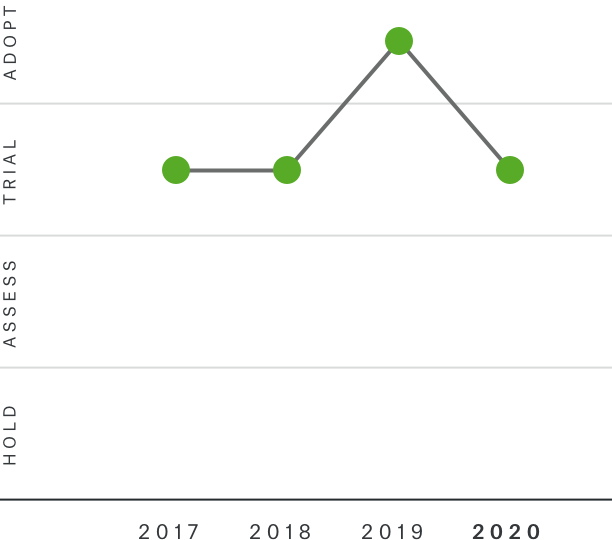

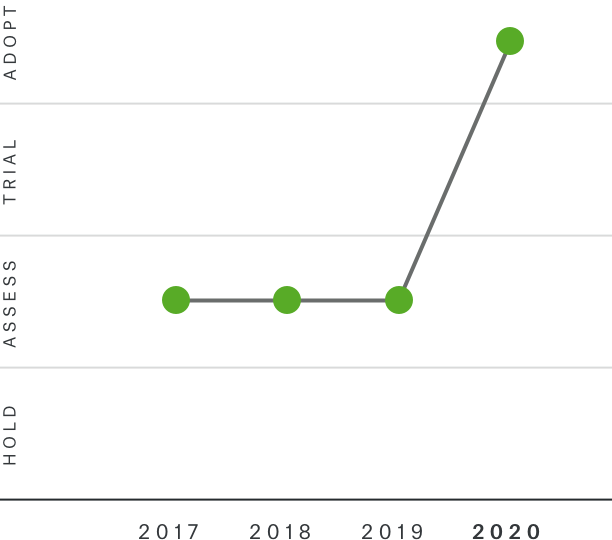

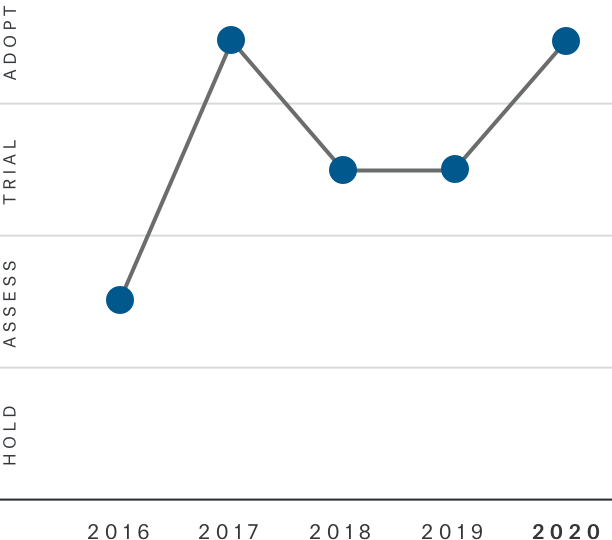

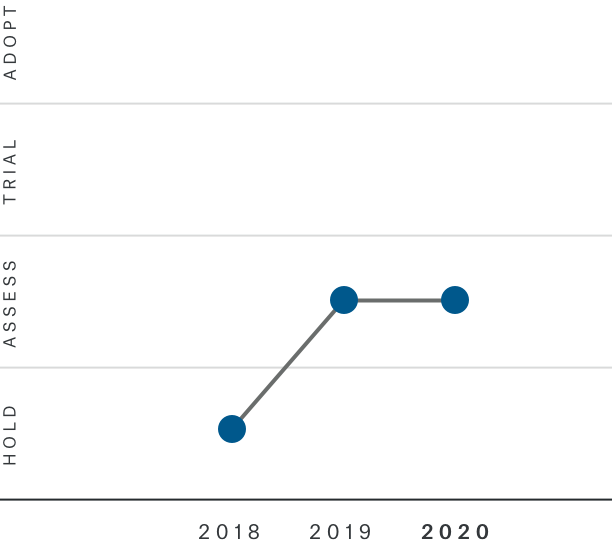

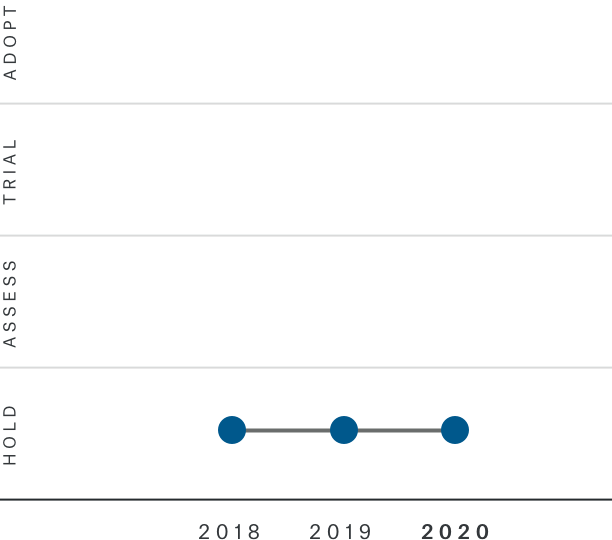

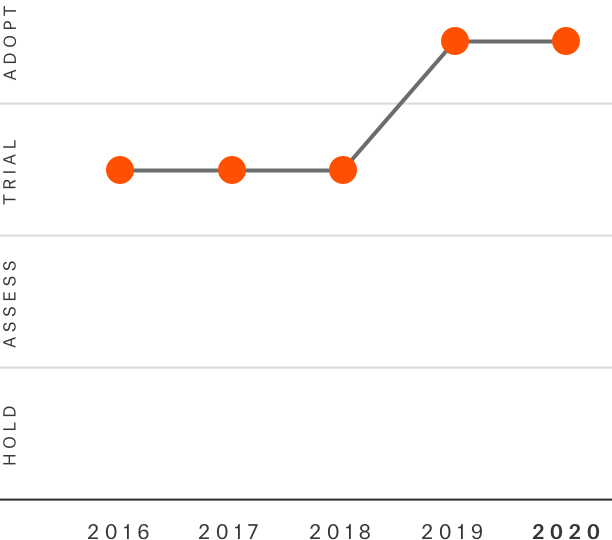

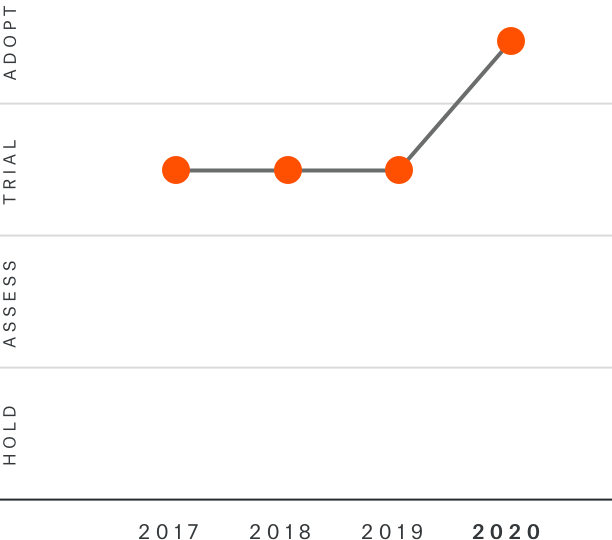

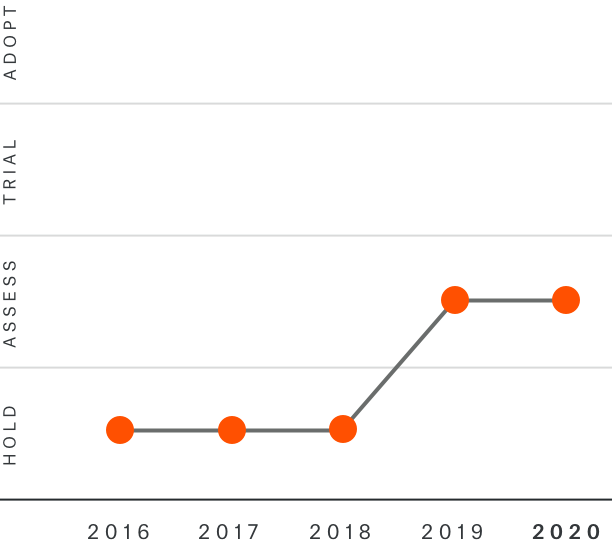

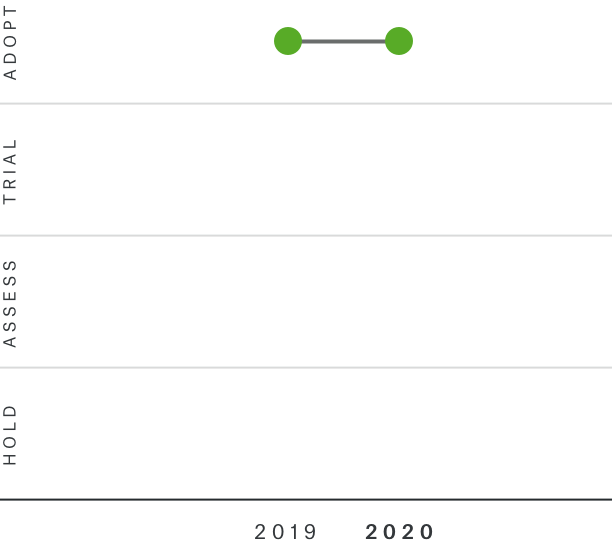

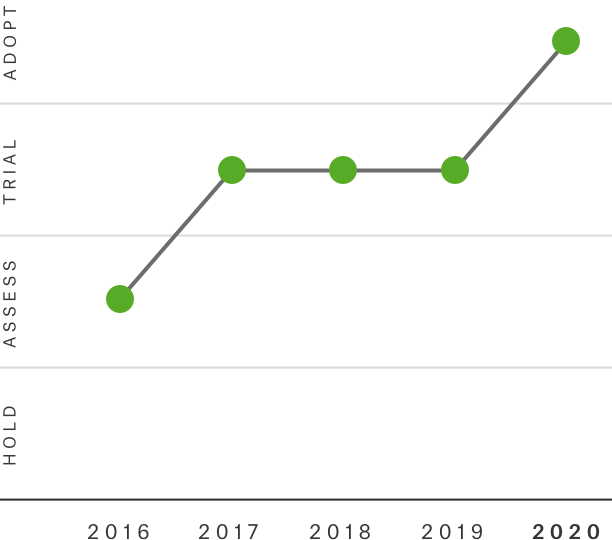

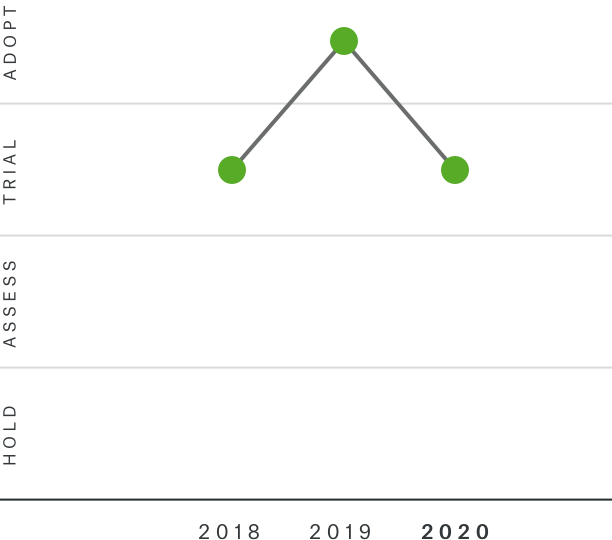

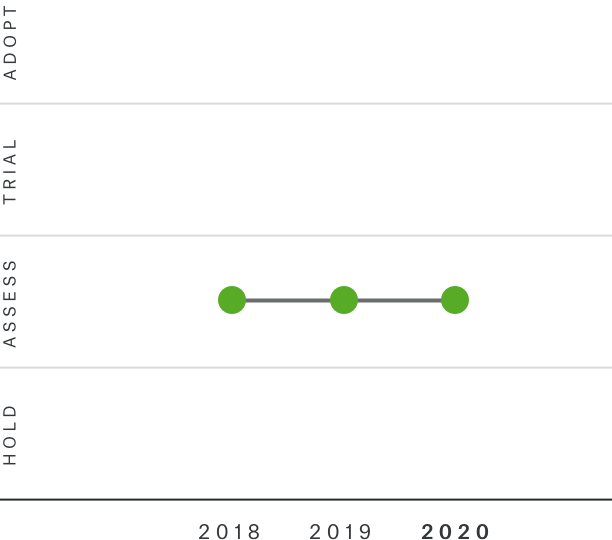

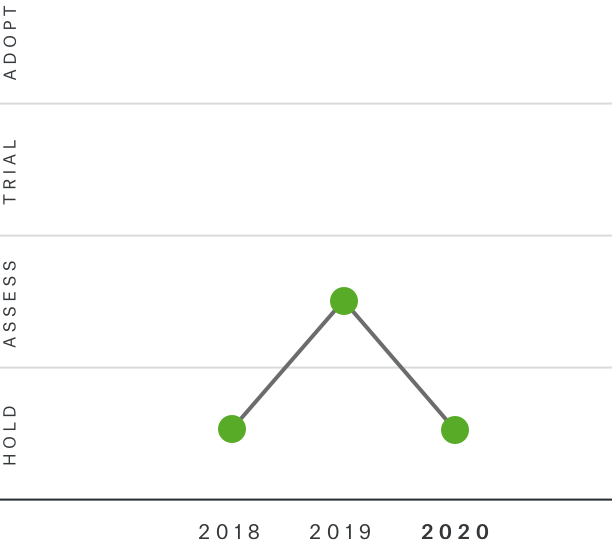

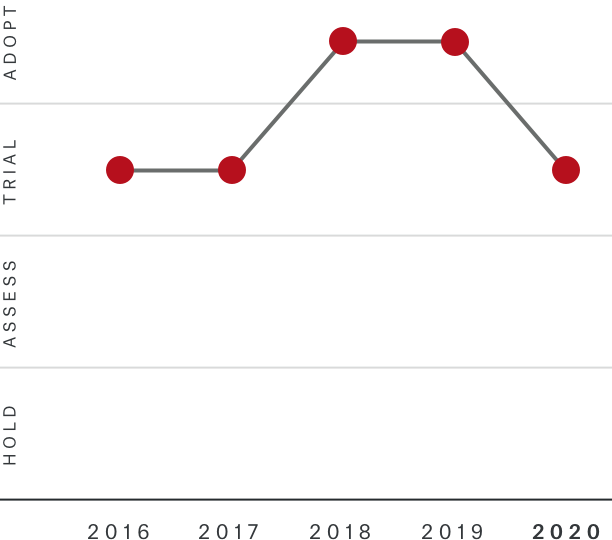

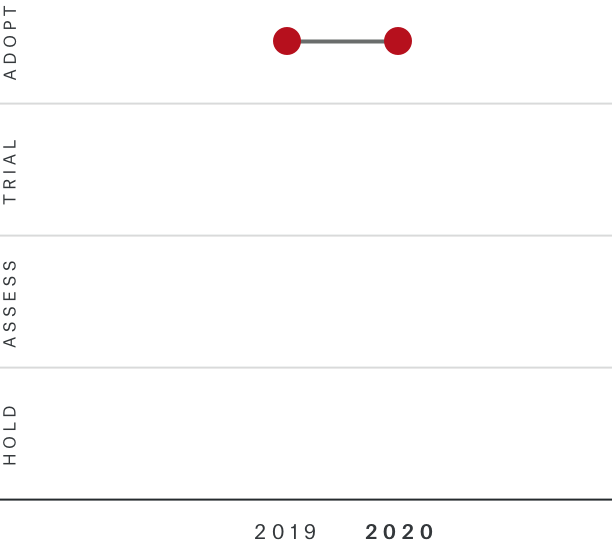

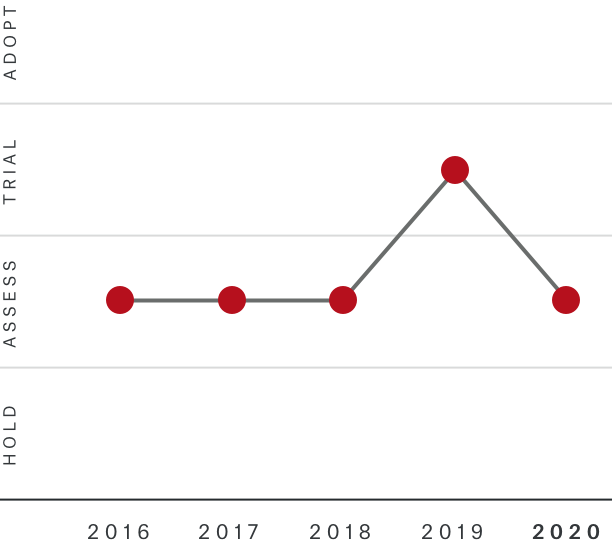

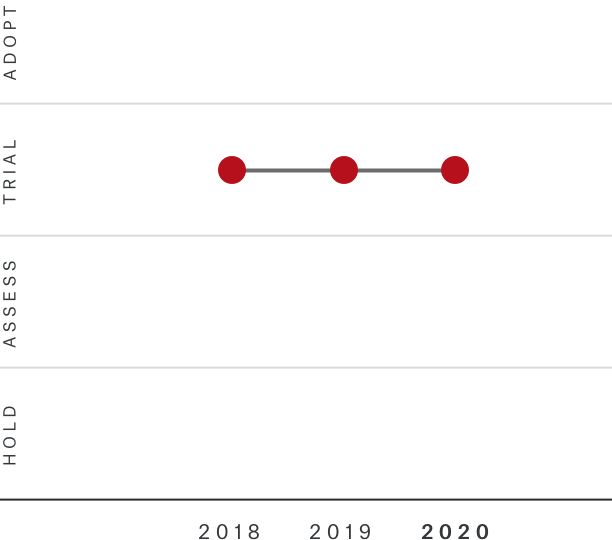

History of the Trend's Relevance

Related Trends

- Open API

- Distributed Ledger

- Payment Models

- Digital Health Services

Digital Identity

User Centricity

A digital identity is a body of information about an individual or organisation that exists online.

Opportunities

- Digital identities reduce fraud risk, since they are much more difficult to copy or fake than paper-based documents.

- Consumers can save time and effort, since customer on-boarding and identity checks (particularly in the financial industry) only need to be done once.

- Consumers may command their own digital identity and decide which elements of it are disclosed to which counterparties. Health insurers e.g. only need access to the health information of the customer, but not his or her overall financial situation.

- Risk assessment for insurance coverages may be completely based on digital identities. In health insurance, a complete health record of the patient would make extensive questionnaires obsolete, for example.

Risks

- Privacy: although conceptions of privacy differ from culture to culture, countries require a stable framework for data protection that covers the storage, linkage and use of data.

- Digital identities need to be protected from theft and abuse.

- Digital authentication requires high privacy protection by mitigating risks of unauthorised access to individuals’ information.

- Digital identities may be faked in order to pretend to be someone else or will be hijacked as a type of security attack to control identity.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

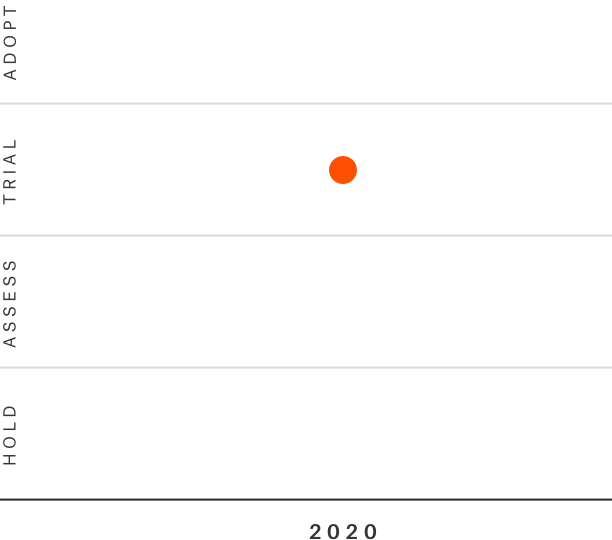

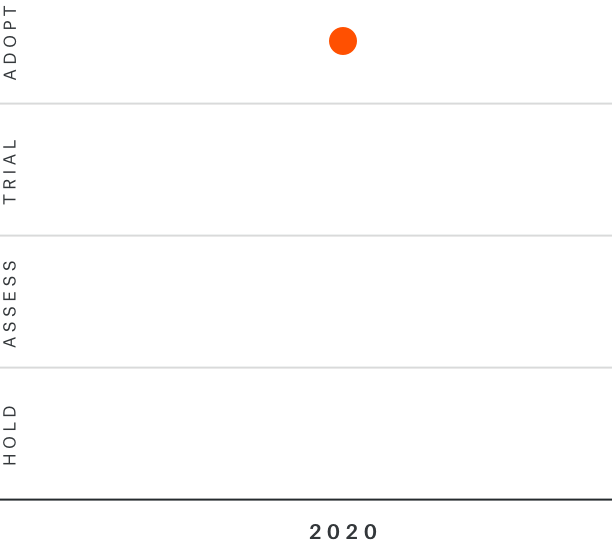

History of the Trend's Relevance

Related Trends

- Payment Models

- Distributed Ledger

- Behavioural Analytics

- Deepfake Defence

Digital Health Services

Connected World

Advanced technology enables the monitoring of health indicators, provides detailed analyses and can make initial diagnoses.

Opportunities

- Digital Health Services enable personalised therapies for critical/complex illnesses and thereby reduce follow-up treatment costs.

- Data can speed up claims handling, since illnesses and the corresponding treatments are detected and reported automatically.

- Insurance premiums can be adjusted to reflect the altered risk situation due to digital health services monitoring.

- Participation in the digital health ecosystem may bolster health insurance sales.

Risks

- Digitally shared health data needs high protection against data leakage and hacking attacks.

- Personal information could be used to the disadvantage of the insured.

- Device failure could have dangerous consequences for patients.

- Reduction of contact with human medical experts may have unanticipated mental consequences due to missing empathy.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

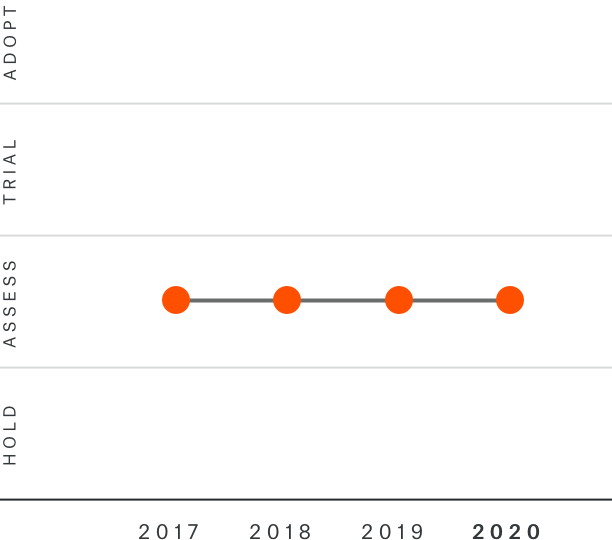

History of the Trend's Relevance

Related Trends

- Robotic Health

- Personalised Medicine

- 5G

- Human Enhancement

Open API

Connected World

An open API is a proprietary software or application programming interface that is publicly available to developers.

Opportunities

- Open APIs increase competition between providers, since everyone can integrate their systems and contribute to better products and services. Consumers are thus likely to benefit from cost-effective services tailored directly to their demands.

- Open APIs enable the growth of a digital ecosystem, allowing for complete and seamless integration with service providers.

- Open APIs decrease the need for individual development of certain digital solutions, since the software and systems from specialised providers can be integrated into the existing IT architecture. Open APIs can be used to access the large community of freelance developers to create innovative applications.

- Open APIs increase the production of new ideas without investing directly in development activities.

Risks

- Individuals may lose control of their data and cannot trace it to see whether it is used for fraudulent activities.

- Third parties providing the actual services related to the open API might push insurers into the background and dismiss them as mere transaction providers.

- Loss of competitive advantages due to lock-in effects.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

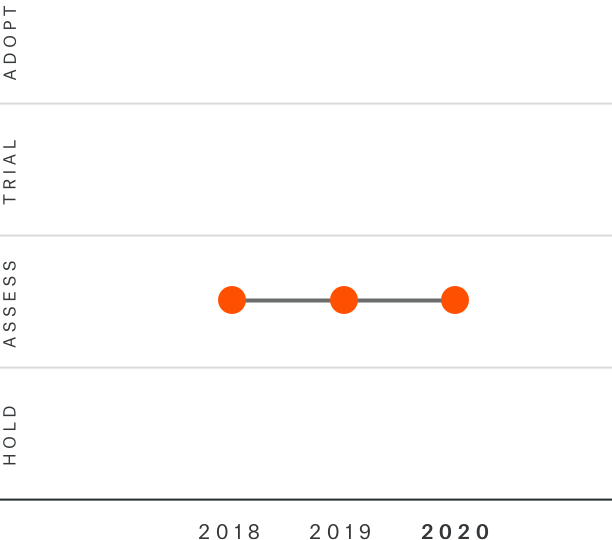

History of the Trend's Relevance

Related Trends

- Open Data

- Behavioural Analytics

- Digital Ecosystems

- Distributed Ledger

Digital Twin

Connected World

A digital twin is a virtual counterpart of a real object that enables IT systems to interact with it rather than the real object directly.

Opportunities

- Digital twins allow exploration and improvement in production processes without expensive physical prototypes, something that will be particularly important in the Internet of Things (IoT) era.

- Companies can use digital twins to show their products to customers or other third parties during the manufacturing process.

- Insurance companies could maintain a digital counterpart of the computer system in an insured's car in order to monitor usage-based (mileage-based) car insurance contracts (through sensors in the physical product).

- Digital twins may be created on a Blockchain to reflect ownership rights of physical objects. This could replace comparable existing ledgers such as land registers.

Risks

- Particularly for products with long lifetimes, such as buildings, aircraft, ships, etc., digital twins might become unusable at some point (due to software issues).

- Firms employing digital twins provided by third parties face a lock-in risk with their vendor, since switching to other vendors may become very costly at some point.

- A digital twin could be hacked in order to fake damage, which, in turn, triggers a claim payment from the insurer.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Industrial IoT

- Digital Ecosystems

- Mixed Reality

- Open Data

White Biotech

Connected World

Industrial biotechnology is replacing industrial goods, sources and processes with sustainable components.

Opportunities

- The purpose of White Biotech is to improve human health by replacing harmful chemical components in food or medicine and thus, reduce long-term side-effects that often result in cancer or other chronic diseases.

- Applying White Biotech solutions mitigates the epidemic or pandemic spread of bacterial and viral diseases transmitted from animal to animal or animal to human thanks to the resulting decrease in intensive animal husbandry.

- Reducing the demand for livestock farming, White Biotech reduces the carbon footprint of the food industry, which is the number one source of CO² pollution.

Risks

- White Biotech solutions are often costly in production and therefore not scalable enough to reach a mass market.

- A mindset change in behaviour in global markets is required to increase demand and reach a critical mass of consumers.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

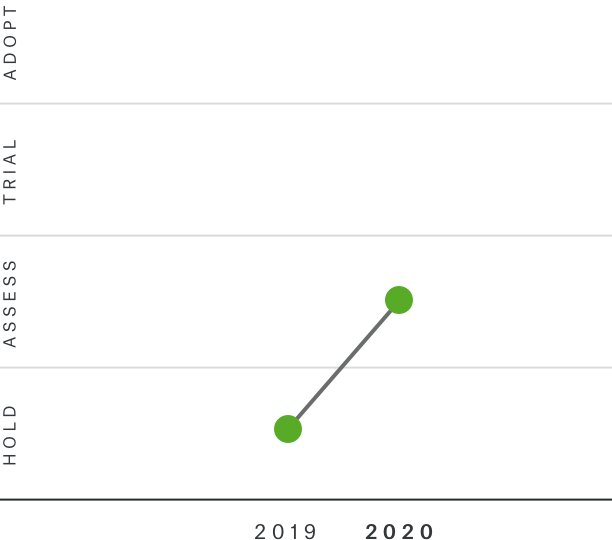

History of the Trend's Relevance

Related Trends

- Precision Farming

- Machine-driven Decisions

- Hardware-Embedded AI

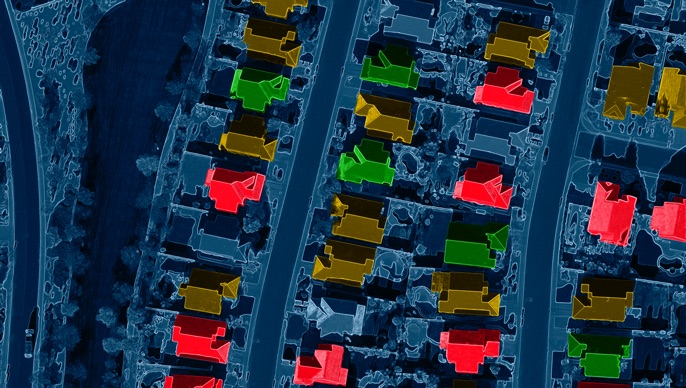

Microsatellites

Connected World

Miniaturised satellites for communications, earth observation and remote sensing.

Opportunities

- Improved claims and fraud detection for disaster insurances via accurate photos from space.

- Continuous satellite monitoring allows for predictive analytics solutions to enhance AI-based risk assessment tools with image data. Also, AI-empowered image detection can detect abnormalities and report at early stage.

Risks

- The more accurate satellite images become, the more privacy concerns there are.

- Increasing space debris. Though nano-sized, obsolete satellites contribute to the amount of space waste in the Earth's orbit. Standards for mitigating space debris as defined by the UN Committee on the Peaceful Uses of Outer Space are expected to become mandatory.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

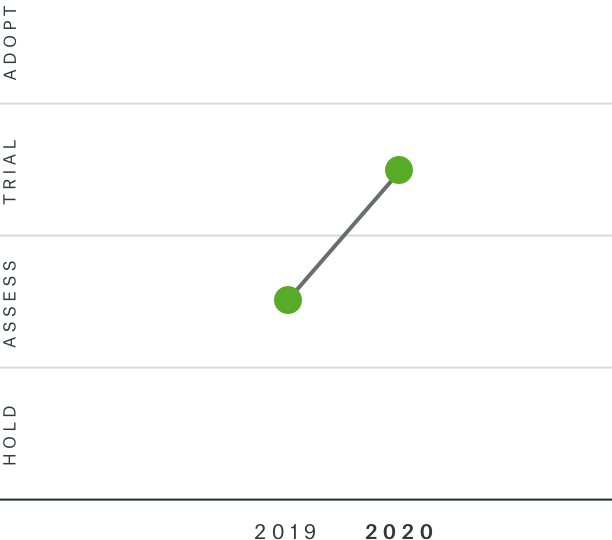

History of the Trend's Relevance

Related Trends

- Hardware-Embedded AI

- Data Fabric

- Computer Vision

- 5G

Cognitive Automation

Artificial Intelligence

Cognitive Automation allows companies to automate business processes with human-like cognitive capabilities.

Opportunities

- Cognitive automation improves employee satisfaction levels since it assumes monotonous tasks. Employees can thus concentrate on activities that are more important.

- Focus on core business as operational tasks can be automated.

- Cognitive automation is processing non-digital data more and more.

- Cognitive automation systems interact non-invasively with any type of infrastructure.

- Through the combination of Artificial Intelligence, NLP and Cognitive automation it is possible to develop Intelligent Process Automation (IPA) solutions that foster significantly more efficient customer support operations, financial accounting and complaint management.

Risks

- In General, Cognitive automation does not yet provide fully intelligent cognitive solutions and is therefore unable to learn. Hence, continuous monitoring and adjustment is necessary.

- Depending on the programming, inputs need to be in an identical format. However, this does not work for insurance documents, particularly for the different business lines.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Digital Ecosystems

- Virtual Assistants

- Machine-driven Decisions

- AutoML

Computer Vision

Artificial Intelligence

Computer vision enables computers to gain high-level understanding from digital images or videos.

Opportunities

- By identifying objects on smartphone pictures, image recognition may offer cross-selling opportunities for insurers. Computer Vision allows insurers to improve their risk underwriting since it extracts and analyses visual information (e.g. images of property).

- This is particularly interesting for small-scale risk coverages such as smartphone or pet insurance, which require an accurate premium. If the premium is too high, low-risk customers are likely to switch provider. If it is too low, loss ratios will explode.

- Computer vision may be used to reconstruct accidents or collisions from a smartphone's camera and accelerometer data.

- Brick-and-mortar stores could use computer vision to provide their customers with product recommendations during their shopping experience, based on the items already added to their shopping trolley.

Risks

- The computer vision algorithm must be trained to become reliable.

- In insurance claims handling, the application of computer vision additionally needs to be fraud-proof.

- Implementation on a larger scale may require an investment in computing power.

- Training data should be validated.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Cognitive Automation

- Mixed Reality

- Explainable Machine Learning

- Precision Farming

Natural Language Processing

Artificial Intelligence

NLP can ease human-computer interaction and lead to machines understanding and acting on natural-language content.

Opportunities

- Insurers can use this technology to develop services that help customers understand their insurance contracts, i.e. explain wordings, technical terms, etc.

- NLP can be used by insurers to process claims and policy information, transforming them into structured information.

- Data collected through speech recognition could potentially be applied for other business purposes.

- NLP is likely to significantly accelerate claims handling since documentation can be done much quicker, leading to higher efficiency.

- There are many high quality 3rd party or open source algorithms / approaches which can assist with early gains.

Risks

- The results of NLP are statistical in nature which can lead to errors. There needs to be a retraining process if the type of content being processed significantly changes.

- Unauthorised usage of NLP-enabled applications could lead to the conclusion of contracts or products/services purchases without the necessary legal prerequisites being fulfilled. For example, children or people who are not contractually capable might be able to conduct transactions.

- The provider must ensure that user commands are not misinterpreted and therefore result in erroneous transactions.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Hardware-Embedded AI

- Cognitive Automation

- Behavioural Analytics

Conversational User Interfaces

Artificial Intelligence

Conversational User Interfaces, such as chatbots or personal assistants bring a paradigm shift in how humans interact with the digital world.

Opportunities

- In terms of privacy, CUI threads are transparent and accessible for the consumer, whereas this does not hold true for apps/websites. The customer can therefore access any information at any time.

- If embedded in a company’s website, consumers do not need to install a software or an app in order to use the services. Thus, on-boarding is much quicker and more efficient.

- Since all digitally connected user generations are used to chatting on WhatsApp and WeChat, they may prefer a CUI as a means of interaction with their insurance company as well. The customer files a claim using the chat window by simply sending a picture of the damage, together with a short description of the incident.

Risks

- CUIs are subject to cyber security issues; for example hacking of a conversation might result in loss of sensitive data.

- Voice-based interfaces such as Amazon Echo are usually installed in the consumer's home and therefore raise privacy concerns, since the providers could theoretically overhear each and every conversation.

- Certain issues may be hard to describe and clarify using Conversational Interfaces in the chat form. This could be mitigated by voice-based interfaces.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Natural Language Processing

- Machine-driven Decisions

- Digital Health Services

- Smart Spaces

Cognitive Cyber Security

Artificial Intelligence

Cognitive capabilities integrated into cyber security systems enable them to “understand” information from external sources such as blogs, social media as well as internal systems to identify cyber security risks.

Opportunities

- Cyber security systems that use cognitive technologies enhance the early-warning systems of IT security departments.

- Cognitive cyber security enriches and strengthens the service portfolio of organisational and industry related cyber security. Executives have identified cognitive technologies as disruptive technology to strategically invest in.

- Intelligent cyber security systems may enable insurers to better understand and control cyber risks and therefore underwrite larger limits of cyber coverage.

Risks

- Cognitive cyber security is not yet established as a reliable and trustworthy cyber security solution. Highly specialised resources that combine the fields of cognitive technologies and cyber security first need to be built and convincing investment plans drawn up. Operational costs may increase substantially.

- As cognitive cyber security solutions mature, they will become vulnerable to next generation hackers.

- Reliance on cyber intelligence may give institutions a false sense of security against cyber attacks.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Digital Ecosystems

- Quantum Computing

- Distributed Ledger

- Machine-driven Decisions

Advanced Batteries

Enabling Technologies

Next-generation advanced batteries provide autonomous things, smart and any other sensor-equipped objects with electric power.

Opportunities

- Equipped with advanced batteries, electrified vehicles, autonomous and smart objects will make their long predicted breakthrough in the mass consumer market. Insurance products for smart spaces and e-mobility need to become more sophisticated.

- Long-awaited sustainable solutions for the energy sector are an attractive investment for insurers’ looking to improve climate change resilience.

- IoT devices will be able to last longer and as a consequence be stored less accessible locations, thereby mitigating risk.

Risks

- Scalability and efficiency in battery production has to improve. High-cost production with rare-earth metals is not a viable option.

- Battery technology takes longer to get to market than expected.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Autonomous Things

- Human Enhancement

- Programmable Materials

- Smart Textiles

Quantum Computing

Enabling Technologies

Instead of working in bits of 1 or 0, quantum computing makes a whole new form of computers possible and stands for unprecedented computing power.

Opportunities

- Quantum computing is particularly useful for training and teaching AI devices since it can handle large amounts of data in a short time. Furthermore, AI could learn from experience or correct itself once a false decision is likely to be made.

- Quantum computing could improve drug development through analysing an almost infinite number of molecule interactions in a second. Moreover, it could develop drugs tailored to the individual by analysing human gene sequences much faster and more efficiently than is possible today.

- Full automation of business processes in insurance (underwriting, claims handling) based on data from sensor measurements gathered on smart devices (smartphones, smart home devices, wearables, etc.) may require quantum computing.

Risks

- The current standards of data security will no longer be sufficient once quantum computing becomes available, as current encryption systems could easily be cracked using quantum computer.

- A substantial leap in computing power may be especially problematic for technologies such as Blockchain, whose security features rely on the limitations of current generation computers.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Artificial General Intelligence

- Neuromorphic Hardware

- Distributed Ledger

Payment Models

User Centricity

Advances in mobile and computer technologies are creating digital payment models that will shape the future of monetary transactions.

Opportunities

- Payment models can reduce response times for claim processes and other insurance-related services. This improves productivity and customer service.

- For example, AXA is now offering insurance using Blockchain technology. It gives direct, automatic compensation to policyholders whose flights are delayed.

- Payment models create the need for new insurance products, e.g. protection of online wallets.

- If transactions can be conducted on a globally recognised payment system with a single token of value, exchange rates and capital transfer restrictions become less of an issue.

Risks

- The technological infrastructure and regulatory environments are too inconsistent to support electronic payments in developing markets.

- With payment security a key concern in today’s risk-averse environment, and a prime factor in consumer receptiveness to mobile wallets, risk mitigation has been a particular focus for innovation in this area.

- Payments based on cryptocurrencies are currently not very reliable for large-scale applications, since their exchange rates with fiat money are highly volatile.

- Blockchain-based payment systems such as Bitcoin offer anonymity and may therefore be abused for criminal activity.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Location-based Services

- Digital Identity

- Distributed Ledger

- Open API

Biometric Recognition

User Centricity

Biometric recognition systems can identify and verify individuals by detecting physiological and behavioural characteristics.

Opportunities

- Reduction in fraud through advanced fraud detection and increased efficiency in claims management as facial recognition reduces the amount of time it takes to identify objects and people in images and videos.

- More accurate risk detection, e.g. body scanners used for personal health risk assessment.

- Whereas the opportunities of voice recognition, prominently used as Amazon Alexa Skills, lie in increasing customer convenience, object and face recognition systems offer great opportunities in risk management.

- Reduction of claims caused by machine-related failures. Low-cost sensor solutions originally applied in consumer electronics are making their way into industrial applications where they optimise manual quality-control processes and provide machine-based insights on failure rates.

Risks

- Severe civil risk of manipulation, ethical abuse and spread of fake identities. Products such as Amazon Rekognition are heavily criticised by civil rights groups for being sold for the purpose of law enforcement, delivering poor accuracy and thus, encouraging discrimination.

- Public concerns about privacy are rising and civil rights movements are legally fighting against the installation of facial recognition systems in public spaces.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Computer Vision

- Natural Language Processing

- Deepfake Defence

- AutoML

Virtual Assistants

User Centricity

Virtual Assistants execute trained and automated administrative tasks and deliver results directly to its users.

Opportunities

- Virtual Assistants help users to focus on high-impact work by taking over time-consuming administrative tasks.

- New service channel with boosted lead generation as Virtual Assistants know their users best. In insurance, Virtual Assistants could greatly improve the customer experience in on-boarding, underwriting and claims handling. They are available around the clock and interact with the consumer in a familiar interface - an important step toward invincible insurance.

Risks

- Virtual Assistants have to be able to provide just the right amount of information and be transparent to serve as a trustworthy task agent.

- Insurance customers are becoming more aware of digital tools to help them plan their financial future, and also more demanding of useful features. Adoption of Virtual Assistants might differ from user to user depending on their digital habits and trust in algorithms.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Open API

- Digital Identity

- Natural Language Processing

- AutoML

Behavioural Analytics

User Centricity

Behavioural analytics monitor, analyse, measure and interpret people’s actions, intentions and characteristics from user’s digital footprint.

Opportunities

- Risk assessment for insurance products can be more precise, taking the personal profile of an individual into account. E.g. careless behaviour inferred from behavioural analytics may hint at a higher probability of moral hazard issues.

- Fraud prevention in insurance may rely on profiling of the customer, like the discovery of risky sports that were not disclosed by the customer in the risk questionnaire for accident or life insurance.

- Behavioural Analytics can be provided via Open APIs as a service, e.g. assist the insurance sales process by providing brokers and agents with key information about customer's lifestyle and coverage needs. It also offers new distribution channels as any company can integrate insurance coverage in their offerings to match specific customer needs. For example, information on marital status or homeownership indicate a potential need for term life insurance.

Risks

- Abuse of data for manipulations (e.g., in elections or purchase decisions).

- Discrimination against people based on their preferences.

- Requires companies to protect personal data and privacy.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Data Fabric

- Open API

- Virtual Assistants

- Location-based Services

Deepfake Defence

User Centricity

Technological solutions to combat the spread of manipulated information.

Opportunities

- Increased accuracy in claims management using recognition systems.

- Better fraud detection.

- Emphasis on veracity safeguards can create a company culture where people are more aware of threats and less likely to fall prey to false information.

Risks

- Statistical methods to validate a fact are overruled by deepfake manipulation techniques. Even (untrained) human review is not reliable when it comes to detecting deepfakes.

- Deepfakes have made their way from humorous fake news and a potential national security concerns to faked corporate or client communication. Dedicated and regular training not only for IT security staff but also for client, key account or demand managers is essential.

- Training material and professional deepfake detection is still not widely available in 2020.

- The scalability of semantic deefake detection techniques for data-rich systems such as social media are still in their infancy.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Biometric Recognition

- Generative Adversarial Networks

- AutoML

- Behavioural Analytics

Location-based Services

User Centricity

Location-based services use real-time geodata from mobile devices to provide information, entertainment or security.

Opportunities

- Risk-prevention measures based on the location of the customer, such as early hailstorm warnings to avoid damage to cars.

- Automatic insurance protection based on the geolocation of the insured person, such as travel insurance when crossing borders or product insurance when entering high-risk zones (e.g. bike insurance around the central railway station).

- Establish a detailed risk profile of the customer based on geolocation data to offer tailor-made coverage.

- New distribution channels, enabled through loc-based services, offer insurers the possibility to communicate with their customers in specific contexts, with proactive product suggestions.

Risks

- Measuring privacy may be a major barrier in the success of ubiquitous solutions.

- The consumer cannot know in which way the generated location information is used in other contexts beyond the requested service.

- Things such as location and automated transactions can be traced back to the user.

- Identity theft and abuse. Hackers may use the geolocation profile in combination with other data pertaining to the individual to impersonate others in the digital world.

- When the information generated by permanent tracking ends up in the wrong hands, it allows criminals to time their activity with the absence of individuals. For example, burglars may break into a house, explicitly knowing that the owners are away.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Deep mapping

- 5G

- Open Data

- Machine-driven Decisions

Mixed Reality

User Centricity

Real, augmented and virtual worlds are increasingly merging and changing people’s perception of their environment.

Opportunities

- Insurance customers can experience claims scenarios first-hand – in an augmented real-world environment – to illustrate how important and valuable insurance coverage is.

- Although the potential of the technology is impressive, there will be many challenges and roadblocks. Identifying key target personas and exploring targeted scenarios.

- In the field of car insurance, virtual reality can provide a range of personal driving-assistance functions including augmented driving, collision warnings and “black-box” services such as video recording.

- Assist insurance brokers in the selling process by visualising loss scenarios in the surroundings.

Risks

- In a mixed reality, unreal objects can appear and real ones disappear. Mixed reality’s health risks for all ages can include the physical and the psychological. There is the prospect of purposely harming or instilling fear in an AR/VR user and risk of property destruction and injuries in the real world while being active in a virtual-world scenario. In combination with haptic interfaces, virtual-reality can lead to motion sickness, extreme stress reactions and loss of the sense of reality.

- The potential is high, but adoption rates are still slow as overall awareness grows. As Second Life or Google Glass have shown, to date customer never fully accepted mixed forms of reality.

- Malicious application can lead to data leakage regarding the user’s field of view and current location.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Computer Vision

- Haptic Technologies

- Smart Spaces

- Human Enhancement

Haptic Technologies

User Centricity

Haptic technologies enable users to touch things inside a virtual world, thus opening up a new dimension in mixed realities.

Opportunities

- Haptic technologies could improve the claims process of insurance companies by allowing claims adjusters to assess damages from a distance. The possibility to gather a haptic impressions could complement imagery (e.g. taken by drones). Thus, costly on-site visits may become less central for accurate claims handling.

- Touch interfaces could aid several e-commerce business models by allowing online shoppers to touch the products before purchasing. An example are fashion web shops, which could offer consumers the possibility of touching the fabric in order to assess its quality.

- Scientists are incorporating haptic technology into touchable maps for the blind. Using a haptic interface device, a blind person can feel, along with audio cues, a city's or building's layout.

Risks

- Haptic technology is in the early stage of development in financial services.

- It is still unclear what the human haptic capabilities and limitations are.

- Because of today’s technical limitations and the complexity of the sense of touch, compromises in the development of electro-mechanical haptic devices need to be considered.

- In combination with virtual-reality and augmented-reality, haptic interfaces could lead to more frequent cases of motion sickness and loss of the sense of reality.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Mixed Reality

- Robotic Health

- 5G

- Smart Spaces

Industrial IoT

Connected World

Industrial IoT is the integration of intelligent and connected systems in industrial processes resulting in smarter manufacturing and factories.

Opportunities

- In-built sensors can communicate the current condition of a product or machine and help the insurer to optimise the risk/ premium calculation (renewal business), or to handle claims faster.

- Based on information submitted by IoT machines, insurers might also provide risk mitigation, prevention and assistance services to their clients.

- Connected and smart machines that interact with each other could report key risk or safety indicators to the insurer and automatically add coverage if needed.

- IIoT is likely to significantly increase the demand for cyber security and insurance.

Risks

- Industrial IoT requires high investment upfront and an adequate infrastructure (e.g. big data analytics hardware and software) that is able to process the collected data quickly. Speed is critical since it should not take long to automatically shut down a machine once a sensor detects a failure in the system.

- Particularly companies that operate production plants globally face the risk of cyber attacks that could hamper their processes and steal critical data.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Digital Twin

- Digital Ecosystems

- 5G

- Smart Spaces

Smart Spaces

Connected World

A system of sensors, interconnected devices and services in private homes, buildings and public spaces.

Opportunities

- The installation of IoT technology may substantially increase property value and provide damage reduction and prevention.

- Smart devices can track and learn individuals' daily routines and therefore allow people to monitor their elderly relatives without invading their privacy.

- Insurers benefit from smart devices since they lower an owner’s risk profile, deliver big data for underwriting purposes, and improve the efficiency of claims settlement processes.

- Smart technology will lead to a wide range of new products, e.g. flexible household insurance based on tracked (and shared) application data.

Risks

- IoT systems create a back door for hackers to steal data, control important functions such as opening the front door, adjusting the heating system, etc.

- Only a few private technology companies are likely to serve the smart space market in the future and must therefore be strictly controlled to avoid data misuse, such as monitoring behaviour, purchase decisions, etc.

- Smart systems increase the dependency on a provider (lock-in effect). Furthermore, an electricity supply is constantly needed to keep the system “working”.

- 360-degree monitoring by sensors may raise privacy issues, especially in public spaces.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Open API

- 5G

- Digital Ecosystems

- Biometric Recognition

Deep Mapping

Connected World

Deep mapping is the layering of multiple types of geo-tagged data within a GIS (geographic information system).

Opportunities

- Establish a detailed risk profile of the customer based on geolocation data. After that, it is possible to offer tailored coverage.

- In mobility, deep mapping provides a high-definition mapping and localisation service designed to support millions of cars while keeping map quality high, map consumption highly efficient, and cost very low.

- Support what a site really looks like with real geo coordinates instead of schematic floor plans

- Flexible 3D maps of the interior and immediate surroundings of complex buildings for more precise building security and claims management.

- Improved risk management due to richer context oriented information.

Risks

- Abuse of data for manipulation.

- Data leakage/hacking attacks.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Open Data

- 5G

- Digital Ecosystems

- Location-based Services

Data Fabric

Connected World

Fabric-like data management infrastructure for distributed networks that unify and enable sharing of formerly disparate, inconsistent data.

Opportunities

- Improve the value of data by providing seamless data access and sharing data in one consistent distributed data network.

- Manage fast growing data generated by the rise of AI-platforms for insurers and network ecosystems with a variety of applications.

Risks

- High implementation costs for bespoke data fabric forces to re-design static infrastructure and enable a mesh network environment.

- Strong data security and access policies and technologies are needed to ensure the proper sharing of data.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Mixed Reality

- Open API

- Cloud Edge

- Machine-driven Decisions

Autonomous Things

Connected World

Autonomous Things are machines that are designed to work independently and without active human supervision. As AI improves their functions are becoming more accurate and effective.

Opportunities

- Autonomous Things are particularly helpful in tasks that are dangerous for humans, such as working with hazardous objects/substances, at extreme heights, etc. By taking aerial photos and videos, drones provide insurers with accurate data that can be used to calibrate their risk models accordingly.

- Autonomous Things that share their workplace with humans, e.g. in warehouses, require innovative liability insurance solutions. Similarly, new insurance solutions are required since both soft- and hardware for objects could be subject to malfunctions.

- Autonomous Things allow insurance companies to improve their underwriting of property & casualty risks through upfront inspections. Moreover, periodic inspections indicate whether the current coverage is still appropriate.

Risks

- Drones taking aerial pictures or robots applied in households might intrude on individual privacy.

- If Autonomous Vehicles cause an accident or drones fall from the sky, there is a significant risk of property damages and bodily injuries. The question of insurability of algorithms becomes a practical challenge in claims management.

- Robots pose a critical danger to mankind since they could make life or death decisions autonomously without any human control.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Industrial IoT

- Robotic Health

- 5G

- Microsatellites

Open Data

Connected World

The idea behind open data is about sharing data freely to allow everyone to use them as they wish, without copyright or patent restrictions.

Opportunities

- Open and accessible public data can benefit individuals, companies, communities and government by unleashing new social, economic, and civic innovations and improving government accountability and transparency.

- In the context of the health care system, Open Data enables recommendations for services for medical institutions and for customer treatment from the insurance side.

- Greater access to data fosters and improves competition.

- Open geo-spatial information is fundamental to planning and decision-making in most situations, including disaster and risk management.

Risks

- Open data can also pose substantial privacy risks for individuals whose information is collected and shared by the city.

- Open data sources could provide incorrect figures and correlations.

- Open data can be unreliable because of the potential for respondents to self-select. Data quality issues arise and a good understanding is required.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Digital Ecosystems

- Distributed Ledger

- Explainable Machine Learning

- Cognitive Automation

Precision Farming

Connected World

Precision Farming increases efficiency and quality of agricultural products by applying IoT and AI-related technologies.

Opportunities

- Improved underwriting for agriculture insurances and lower claims rate thanks to improved predictability of natural risks from extreme weather or natural catastrophes and monitoring of natural assets.

- The technological solutions are still expensive for farmers in rural areas facing industry-typical financial pressure. Insurers have the chance to build insurance products that make the technology more affordable.

Risks

- Slow adoption by farmers, especially in European farming markets where connectivity is still underdeveloped.

- The initial cost of implementation may discourage smaller farmers.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Autonomous Things

- Machine-driven Decisions

- 5G

- Computer Vision

Smart Textiles

Connected World

Smart textiles can do many things that traditional fabrics cannot, such as communicate with their environment.

Opportunities

- Just like other wearables, smart textiles provide the opportunity to collect data on the insurance holders well-being, which can help to personalise insurance products.

- Smart clothes open up new service potential based on vital checks (heart rate, etc.) and can be used for medical and healthcare monitoring and diagnostics.

- Gesture recognition through smart textiles enables consumers to operate smart devices such as smartphones, laptops, IoT devices, etc.

- Smart textiles can be used in nursing homes to detect when a patient's health condition or hygienic situation deteriorates.

- Data collection and statistics on professional athletes in sports can be improved.

Risks

- It is unclear how practicable such sensitive textiles are for the consumer, particularly with respect to their robustness (e.g. how often can they be washed, etc.).

- When wearing smart textiles on a regular basis, consumers become completely transparent to data collectors.

- The General Data Protection Regulation (GDPR), the new European privacy regulation, also treats health data as a “special category” of personal data, one that is considered intrinsically sensitive.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Digital Ecosystems

- Swarm Intelligence

- Digital Health Services

Human Enhancement

Connected World

Soon, people may have the possibility to alter themselves in ways that, up to now, mostly existed in science fiction.

Opportunities

- One of the most important developments involves a gene-splicing technique called “clustered regularly interspaced short palindromic repeats“ (CRISPR). This method improves scientific capabilities of editing the human genome in both embryos and adults.

- An exoskeleton looking pretty similar to the “Iron Man suit“ may soon make soldiers much stronger and largely impervious to bullets.

- Enhanced humans may pose lower risks and therefore obtain cheaper insurance coverages. Human enhancements could even be used to cure severe sicknesses or chronic health conditions.

- Improved reactions and reflexes may lead to lower frequency and severity of accidents and, in turn, insurance claims.

Risks

- Long-term side effects of such enhancements may be hard to anticipate. Substantial health risks and associated costs for insurers could be the consequence.

- Diversity of human life may slowly be reduced due to standardised human enhancements employed by the majority of people. Those who are not prepared to accept an enhancement could be isolated from the larger society.

- Human enhancement may completely change the way professional sporting competitions are carried out today. A fair tournament may be very hard to organise if participants exhibit different levels of body enhancement.

- Additional questions arise around potential enhancements of the brain. Would this entail the risk of altering the subject's personality and mind?

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Digital Ecosystems

- Digital Health Services

- Brain-Computer Interface

- Robotic Health

Smart Dust

Connected World

Smart dust are tiny chips, as small as a few millimetres or less, that contain communication, computation, and sensing technologies.

Opportunities

- Smart dust technology may be applicable for automated damage assessment of insured objects. After a car crash, for example, smart dust-enhanced paint could potentially measure dents and scratches on the bodywork, and report the results to a smart contract for an automatic payout to the policyholder.

- Smart dust will create new ways for businesses to deliver services. This will have wide-ranging implications for businesses' technological, social, economic and legal practices across the globe.

- This could present a comprehensive solution to collect real-time data for people, industries, cities and the natural environment.

Risks

- Smart-dust-covered objects are potentially associated with privacy concerns, since they may be able to comprehensively monitor their surroundings.

- Smart dust may entail unanticipated health risks for human users.

- Even when deployed for science or for public use, some people will probably get a Big Brother feeling – the uncomfortable sense of being under constant, secret surveillance – from the idea of deploying trillions of monitors all over the world.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Industrial IoT

- Smart Textiles

- Digital Ecosystems

- 5G

Augmented Decision-Making

Artificial Intelligence

Driving insight-driven decision making, augmented analytics combine key the technologies of analytics and AI.

Opportunities

- Save time and costs when analysing enterprise data and putting it into intelligible formats to aid in decision-making on the executive level.

- Democratise analytics jobs like root-cause-analyses, which were formerly limited to the competencies of data scientists but now open to a broader base of staff members.

- More comprehensive data sources provide more relevant insights.

- Organisational culture shift is required: Leaving behind habits of hiding data and “beautifying” reports towards transparent data management and openness for learning and improving based on past data.

Risks

- Black box machine learning provides answers that cannot always easily be explained. Back-testing based on historical data serves as one means to prove data correctness and accuracy.

- There is a need for new data governance policies as data sources broaden across business units and subsequently, the decisions taken affect more entities.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Natural Language Processing

- Computer Vision

- Explainable Machine Learning

Machine-driven Decisions

Artificial Intelligence

Machine-driven decisions are business decisions that are derived and backed by verifiable, quantitative data analysis.

Opportunities

- Data on an individual's driving behaviour has been shown to be the most accurate predictor of claims costs; machine-driven decisions therefore allow motor insurance providers to flexibly adjust their premiums if risky driving behaviour is observed.

- High-quality statistical predictions through machine-driven decisions could free employees from repetitive tasks.

- In contrast to individuals, machine-driven decisions stick to clearly defined decision criteria and are not influenced by personal moods that might negatively affect decision-making.

- In combination with smart contracts, machine-driven decisions can automate claims payments in insurance. The machine may measure temperature and decide to execute a smart insurance contract based on a given set of trigger conditions.

Risks

- In order to implement machine-driven decisions, some decision criteria need to be implemented at the beginning and on-the-fly adjustments are hardly feasible. So wrong decisions at the outset are likely to become expensive in the course of the project.

- Distortions or changes in the informational content of the data underlying the decision algorithm might result in unintentional and, in some cases, even systematic errors.

- In contrast to artificial general intelligence, machine-driven decisions may still be inferior to the judgement of human experts.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Cognitive Automation

- Distributed Ledger

- Virtual Assistants

- Explainable Machine Learning

Knowledge Graphs

Artificial Intelligence

Knowledge Graphs are used in AI to contextualise data by creating relationships between data.

Opportunities

- Graph-based solution enriches data with missing data. Their capabilities can identify entities, e.g. people, by analysing unstructured data from various sources.

- By building up rich knowledge networks from unstructured data graph-based technology can compensate the lack of human reasoning in AI solutions.

- With their contextualising capabilities, knowledge graphs draw connections between data that would otherwise remain distinct, e.g. from individuals.

- Knowledge graphs do not necessarily come as stand-alone AI market solutions. Their potential lies in implementation in broader AI and cloud platforms and services.

Risks

- The fate of Knowledge Graphs is closely tied with the platforms they are implemented into.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Industrial IoT

- Natural Language Processing

- Cloud Enablement

- Deepfake Defence

Explainable Machine Learning

Artificial Intelligence

It constantly analyses new data, machine learning algorithms adjust program actions according to recognised patterns and make autonomous decisions.

Opportunities

- Machine Learning is very powerful if enough data is used as input. In combination with new and large amounts of data, such as is generated by Internet of Things (IoT) devices, insurers can significantly improve their efficiency.

- Insurers could collect usage-based data such as driving behaviour in motor insurance and draw on Machine Learning to improve their risk analysis and pricing models.

- Advanced Machine Learning may allow automated underwriting of risks, saving time and costs in the process. One example is determining quotes for life insurance coverage based on smartphone selfies.

- Machine Learning simplified by explainability tools could also be applied in broader business use cases like claims handling, substantially freeing up the capacity of human claims adjusters.

Risks

- To begin with, since the technology needs to learn in order to improve itself, insurance companies that use it for underwriting and pricing may have to protect themselves against inflated loss ratios.

- In the vast majority of cases, supervised learning is necessary. This binds a lot of resources before any efficiency gains can be made.

- Insurers are required to learn the underlying mechanics and shortcomings of an algorithm. Otherwise, they run the risk of making wrong decisions that are likely to be associated with high costs, fewer customers, etc.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- AutoML

- Industrial IoT

- Cognitive Automation

- Machine-driven Decisions

AutoML

Artificial Intelligence

AutoML tries to emulate the functions of the inner layers of the human brain.

Opportunities

- Thousands of vendors are exploring the applicability of AutoML to a range of fields, such as computer vision, conversational systems and bioinformatics.

- Heavyweights like Google, Apple, Microsoft and Facebook are constantly increasing their deep learning skills. For example, deep learning is behind Apple's Siri, Google's Google Now, Microsoft's Cortana and Amazon's Alexa.

- Data and analytics leaders of modernisation initiatives should revisit previously intractable cognitive problems relating to text, images, video and speech analytics, as well as problems that involve complex data.

Risks

- Many current deep learning applications, once trained, usually work on input data for classification and recognition purposes for an application that read inputs from files or the network; attackers can potentially construct malformed input.

- Image recognition applications take training samples, which can be polluted or mislabelled if training data come from external sources.

- Deep learning applications can also be attacked if the developers use models developed by others.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Explainable Machine Learning

- Digital Ecosystems

- Computer Vision

- Cognitive Cyber Security

Generative Adversarial Networks

Artificial Intelligence

A GAN is a network architecture based on two algorithms challenging each other in order to reproduce patterns of data, like images or motions.

Opportunities

- In test management, GANs can generate test data if not available.

- GANs can be used to explain neutral networks and find weaknesses AI algorithms.

- In cybersecurity GANs can help to find platforms in order to destect threats in the data system.

Risks

- The capability of mimicking is exposed to misuse for false identities and fraud.

- Invented by scientist Ian Goodfellow at the University of Montreal in 2014, the potential of GANs in machine-learning and beyond is not yet assessable.

- GANs can create fake pictures, videos and texts and thereby generate wrong decisions.

- Like other deep learning technologies, GANs can be used to prevent cybersecurity attacks and threats associated with persuasive computing.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- AutoML

- Mixed Reality

- Quantum Computing

- Deepfake Defence

Hardware-Embedded AI

Artificial Intelligence

The integration of AI into hardware creates smart automation solutions with benefits like energy savings and cost efficiency, as well as the elimination of human error.

Opportunities

- Based on the ability to recognise and interpret patterns, machines with hardware-embedded AI could perform more complex tasks than simple smart devices in the area of IoT.

- In an autonomous car, for example, hardware-embedded AI could evaluate traffic flows to recognise patterns that will allow it to optimise the route to the destination in real-time.

- An advanced insurance product could rely on AI embedded in wearables or smart textiles that evaluates data from the customer's environment in real time and automatically adjusts coverage based on certain patterns.

- A hardware-embedded AI in autonomous drones or robots could be highly useful for the automation of underwriting and claims handling.

Risks

- Failure of hardware-embedded AI in critical fields such as autonomous cars could have fatal consequences.

- Reactions of hardware-embedded AIs will be much less predictable than the reactions of simple smart devices that follow “if and then” instructions.

- Allowing AI to decide, instead of simply following pre-programmed orders, is a first step in the direction of completely autonomous machines with all the associated risks for humanity.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Autonomous Things

- Smart Spaces

- Brain-Computer Interface

- Cognitive Cyber Security

Artificial General Intelligence

Artificial Intelligence

Artificial general intelligence (AGI) – also called “strong AI” – does not yet exist, since today's AI technology cannot be proven to possess the equivalent of human intelligence.

Opportunities

- In contrast to other technologies, AGI does not require any technical know-how or highly-trained employees with particular IT skills.

- In theory, it could fully replace human employees throughout the organisation.

- By combining advanced computing capabilities with human-like self-reliant cognitive skills, AGI could help companies solve the most complex and demanding tasks.

- Take cyber risks: AGI might be the appropriate technology to autonomously prevent attacks, detect and fix security leakages in software, and evaluate and apply potential countermeasures, etc.

Risks

- Since AGIs do not exhibit any human feelings like love or hate, they only aim to achieve their goals, which, in turn, may not be in line with human goals.

- Even for beneficial ends, an AGIs might be prepared to use malevolent means.

- AGIs might be misused by unscrupulous organisations, countries, etc.

- Depending on its development, AGI might be incomplete and misinterpret or ignore contexts and commands.

- Several open questions remain with respect to privacy, data security, legal responsibilities, etc.

Insurance Value Chain

-

Product Design & Pricing

-

Sales & Distribution

-

Underwriting

-

Risk Management

-

Customer Engagement & Services

-

Claims

History of the Trend's Relevance

Related Trends

- Industrial IoT

- Autonomous Things

- Brain-Computer Interface

- Hardware-Embedded AI

Distributed Ledger

Enabling Technologies

Distributed ledger technology eliminates the need for a trusted central authority. It is further decentralised, and safe and thus, a transparent data network.

Opportunities

- Distributed ledgers do not have a single point of failure and are therefore robust in terms of hacking attacks and can be conducted at low cost.

- Blockchain technology significantly increases the transparency of transactions for all parties involved. No further alterations or deletions are possible.

- Modern Blockchains such as Ethereum are capable of running smart contracts that allow for the automatic execution of transactions if certain requirements are fulfilled.

- It enables the complete tracking of objects or individuals over their life cycle.

- An idea is to create a distributed ledger that stores the health history of individuals, which could then grant access to health insurers to facilitate the underwriting process.

Risks

- Since no intermediary is involved, individual parties now face risks that have previously been managed by the central authority.

- The underlying consensus mechanism of certain Blockchains (e.g. Bitcoin) is complex and requires huge computational capacity, which is associated with high power consumption.