Growing digital motor insurance in Southeast Asia

Applying customer-centric and data-driven propositions in one of the world's most vibrant regions.

properties.trackTitle

properties.trackSubtitle

REimagine the possible in Southeast Asia

Southeast Asia (SEA) has been well known for its strong economic growth and relatively low insurance penetration. Undoubtedly, SEA offers huge opportunities for motor insurers to grow their business by making insurance more accessible, flexible and personalised. This can be achieved by capturing the right elements of digitalisation, customer experience, ecosystems and data analytics.

We understand the unique characteristics of SEA motor markets, with experience built over decades of working with our partners. Our digital motor solutions are designed for you to seize the most significant growth opportunities. As your trusted reinsurance partner, we embrace a partnership and co-creation model to drive insurance innovation and achieve business goals.

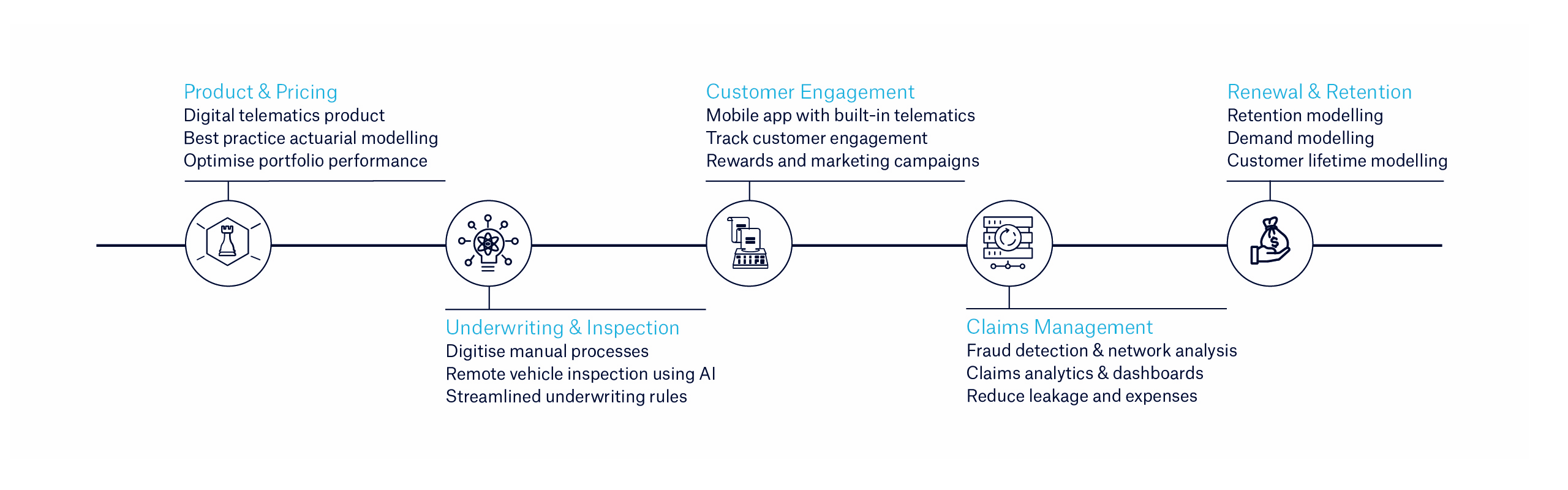

End-to-end digital motor suite by Munich Re Insurance Consulting

Seize opportunities in SEA's untapped markets

Motor insurance in SEA has enormous potential with healthy growth rates and rising customer interest in personalised products and services tailored to their needs and lifestyle.

As the region moves toward a more digital-oriented lifestyle, it has paved the way for SEA insurers to build a digital motor portfolio. However, this is easier said than done. For example, whilst telematics technology empowers motor insurance to be more personalised and transparent, adoption rates remain insignificant. Therefore, it is imperative to understand the dynamics of individual markets and design suitable solutions to deliver the desired business objectives.

< 5%

of SEA currently offers Telematics as an insurance product

70%

of ASEAN consumers are willing to pay for and show interest in personalized products

>15%

CAGR forecasted of the SEA automobile market until 2030

Explore SEA customer needs in digital motor and telematics

5,000+

Respondents

10+

Personas

5

SEA Markets

500,000+

Data Points

- Based on inputs from more than 5,000 drivers across 5 SEA markets, our latest study takes an in-depth look at customer needs regarding digital motor and telematics insurance.

- Developed from over 500,000 data points, the study provides insights into customer awareness, barriers to adoption, needs and preferences.

- This has enabled us to collaborate with our partners to develop innovative motor insurance solutions which are relevant, transparent, meaningful and highly tailored, allowing for higher engagement and more accurate targeting of customer segments.

- This customer-centric approach has greatly enhanced the likelihood of successful adoption and satisfaction with these advanced technologies in the SEA markets.

Gain valuable insights into

Customer insurance protection awareness

Customer pain points and needs in insurance purchase

Driving factors to encourage digital insurance adoption

Telematics insurance awareness and interest

Customer concerns and desired Telematics benefits

Infographic: Highlights of telematics insights

REalign your business values

Munich Re's digital motor solutions enable you to REthink motor insurance and make relevant pivots.

Our solutions place considerable emphasis on the six business values that cover key dimensions your motor business.

Market entry & growth

Broaden your reach with technology and tap into uninsured or new segments

Brand image

Strengthen your market positioning and improve customer engagement through meaningful experiences

Easy implementation

Plug-and-play solutions with lean integration for a swift go-to-market strategy

Customer-centricity

Build a customer-obsessed brand around customer experience

Technology with a new purpose

Digital motor to serve your customers and the community better with a more responsible vehicle usage

Cost savings

Improve portfolio performance with better risk management and fraud analytics capabilities

Case studies in SEA

Publications

The InsurTech Solution

Post-COVID, with so many insurers already deep into their digital development, the unique offerings of InsurTech have become more commonplace. Munich Re's Dr Weihao Choo shares how there is space for start-ups to have value in the industry.

Asia Insurance Review | April 2023

Telematics in the driver's seat

Motor insurance in Asia will increasingly have to adopt technology to become more relevant for digitally- savvy customers. Munich Re's Dr Weihao Choo speaks about how telematics can be made integral to motor insurance in Asia.

Asia Insurance Review | June 2022

Would you like to know more?

Get in touch with our experts right away

Contact our experts