Climate risk and how it can affect banks in Australia

properties.trackTitle

properties.trackSubtitle

Although climate risk has typically been in the domain of the insurance industry, increasing insurance affordability challenges in some regions is shifting the risk towards the banking industry.

The Risk Is Already Here

Climate change is not only real—it’s already having an impact.

The Financial Impact of Physical Climate Risk on Home Lending

While climate change itself occurs over a long period of time, its impacts will likely play out in the financial system as event-driven shocks that shift the system into a new state of asset devaluations, heightened credit risk and increased costs. And following severe weather events such as floods and tropical cyclones, growing numbers of uninsured and underinsured mortgagees could face greater probability of default. In turn, banks would see significant loss at default through both damage to house structures and declining land values. The physical risks due to climate change present several financial risks to the banking industry, which include:

- Serviceability risk: Increasing incidence of catastrophes combined with rising under and non-insurance may impact creditworthiness and default rates in highly exposed areas.

- Land devaluation risk: There may be a systemic decline in land values in highly exposed areas as the effects of climate change are priced in.

- Balance sheet volatility: Heightened volatility in revenues and losses due to severe weather coupled with increased capital requirements.

Munich Re set out to better understand how Australian banks might be impacted by climate change. To this end, it conducted extensive analysis on how tropical cyclones and floods might affect the 8.6 million residential homes in Australia and the likely financial impacts under different scenarios. The fact that, as one of the world's largest reinsurers, Munich Re has over 4 decades’ catastrophe modelling experience makes it eminently qualified for the task.

Exclusive whitepaper

Managing Physical Climate Risk

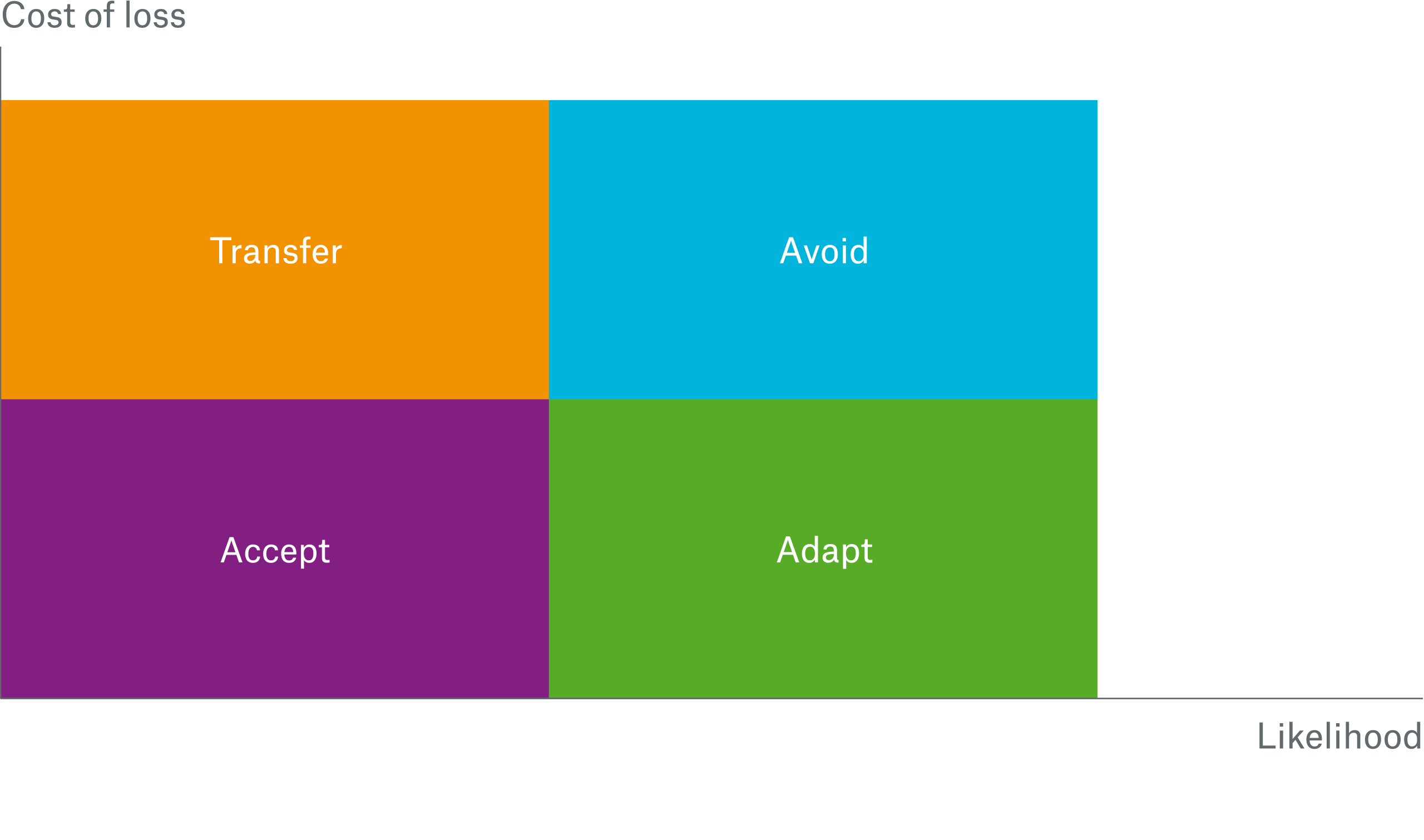

Physical climate risk can be managed within a portfolio by accepting palatable risks, avoiding extreme risks, reducing risk through adaptation and mitigation, and through risk transfer. The optimal balance of these different strategies will depend on a number of factors including the bank's risk appetite, competitive forces, market realities and regulatory requirements. Essentially banks can choose to:

- Accept: Low levels of climate risk in a diversified portfolio may be accepted within the bank’s risk appetite.

- Adapt: Moderate to high risks must be addressed by adaptation strategies over the long term, as these risks present unsustainable strain on risk models where insurance becomes unaffordable.

- Avoid: Extreme risks (e.g. houses in exceptionally high-risk flood zones) are undesirable and may be best avoided via risk selection. This may, however, often be difficult to achieve due to historical composition of property portfolios and the practical realities of customer needs.

- Transfer: Alternatively, moderate to high risks may be transferred to risk markets, such as reinsurers, which would allow banks to continue to offer competitive mortgages in higher risk areas without attracting higher capital charges or inviting greater results volatility.

All these approaches can be adapted to serve both new lending business and back book portfolios. For a bank’s existing portfolio, options to avoid or adapt may be fairly limited so the focus would be on accept or transfer. Whatever approach is taken, it will be imperative for banks to integrate high-resolution physical climate risk data sources into their processes to inform robust decision-making.

Financial services risk managers can understand the impact of future climate scenarios at both a location and portfolio level using Munich Re’s risk modelling solution Location Risk Intelligence which has been recently upgraded to incorporate various climate scenarios.