Corporate News

Macif to Implement Best-in-Class Underwriting SaaS Technology ALLFINANZ SPARK

07/30/2025

properties.trackTitle

properties.trackSubtitle

French mutual insurer Macif will roll out the cloud-based SaaS underwriting solution ALLFINANZ SPARK by Munich Re Automation Solutions, including the data analytics module Insight Origin. This strategic implementation supports Macif’s commitment to digital innovation, operational efficiency, and superior customer service.

Alby van Wyk, Chief Commercial Officer at Munich Re Automation Solutions, said: “We are very pleased to partner with Macif in the French market. ALLFINANZ SPARK will provide Macif with immediate underwriting decisions to enhance their straight-through processing (STP) rates, while our Insight Origin analytics module will offer quarterly reports to monitor and evolve underwriting results. The adoption of our best-in-class SaaS solutions will deliver improved customer experience for Macif, as well as increased efficiency to drive sales and reduce costs, all while managing risk.”

Fréderic Nouvian, Chief Operating Officer at Macif Health and Personal Protection, said: “Building digital leadership is an essential part of Macif personal protection. As more of our clients prefer to engage with us digitally, we believe that by enabling straight-through processing using the Munich Re Automation Solutions underwriting platform, we will be able to deliver quicker and more efficient services to our clients. Productivity gains are also a strong marker of our choice. Finally, the chosen tool will also allow our medical service to maintain a high degree of autonomy in assessing medical acceptance rules."

By adopting the SaaS-based underwriting and analytics platform, Macif gains a scalable, cost-effective solution that integrates seamlessly with existing systems and accelerates time to market.

ALLFINANZ SPARK by Munich Re Automation Solutions is a cloud-based digital underwriting and analytics solution designed to enhance sales growth and transform customer buying experience. Key features include the Rulebook Hub for creating and managing underwriting rules and the Underwriting Engine for automatic decision-making. With SPARK, insurance companies can modify underwriting rules to reflect their individual philosophy and changing business strategies, thus helping them establish faster sales processes and improve customer engagement.

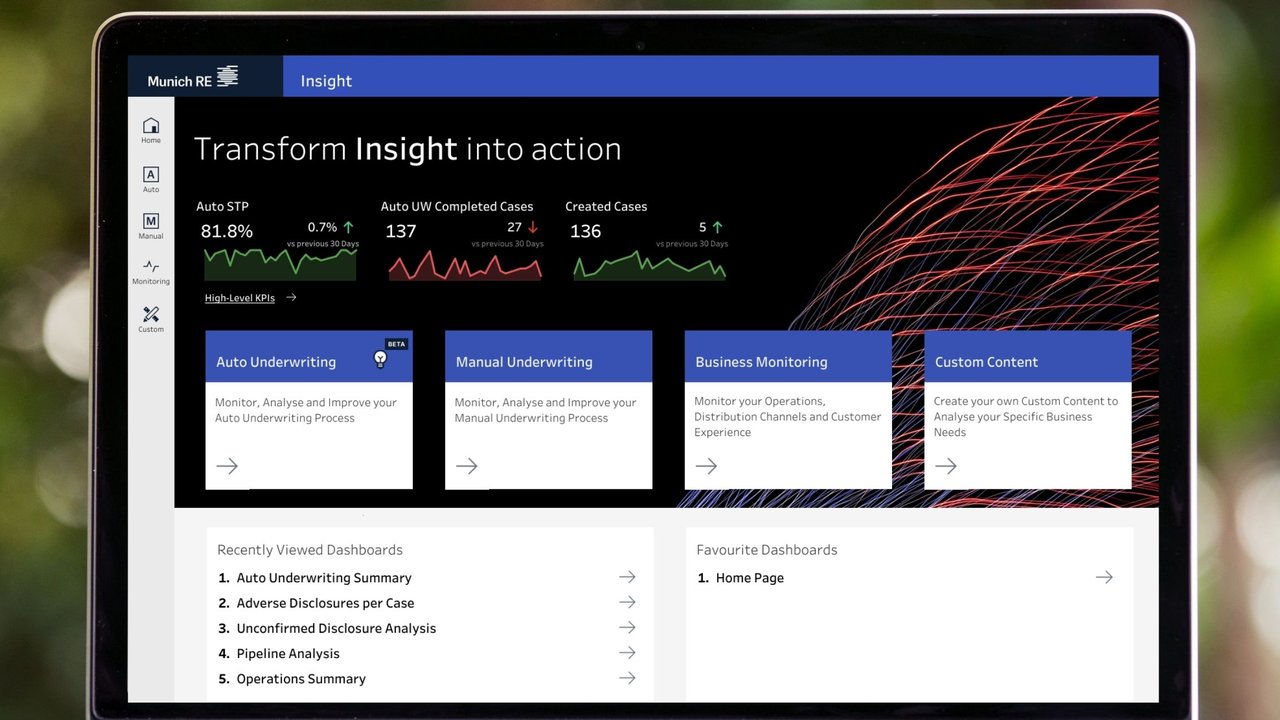

Insight Origin is a comprehensive suite of interactive dashboards, enabling collaboration and the sharing of insights with decision-makers across the company. Users can monitor the underwriting process, analyze underwriting volume and trends, rules, disclosures, and evidence requirements, as well as the manual underwriting process, distributors and agents, and rule disclosure errors.

About Macif

As a mutual insurer, Macif strives daily on behalf of its 6,3 million members and customers with uncomplicated and effective insurance products and services for property and casualty insurance, health and personal protection, and finance and savings. Macif generated a turnover of nearly €6,95 billion in 2024. Managing more than 19 million contracts, it has nearly 12,000 employees who all work in France within a network of more than 450 physical and telephone reception points. Since January 2021, Macif has been affiliated with Aéma Groupe. Aéma Groupe, which grew out of the merger between Aésio Mutuelle and Macif, envisions a fairer and more humane world every day by making foresight a central part of the relationship with its members, policyholders and corporate clients. For more information, visit www.macif.fr.