Natural catastrophe review for the first half of 2017: A series of powerful thunderstorms in the USA causes large losses

07/20/2017

Press Release

properties.trackTitle

properties.trackSubtitle

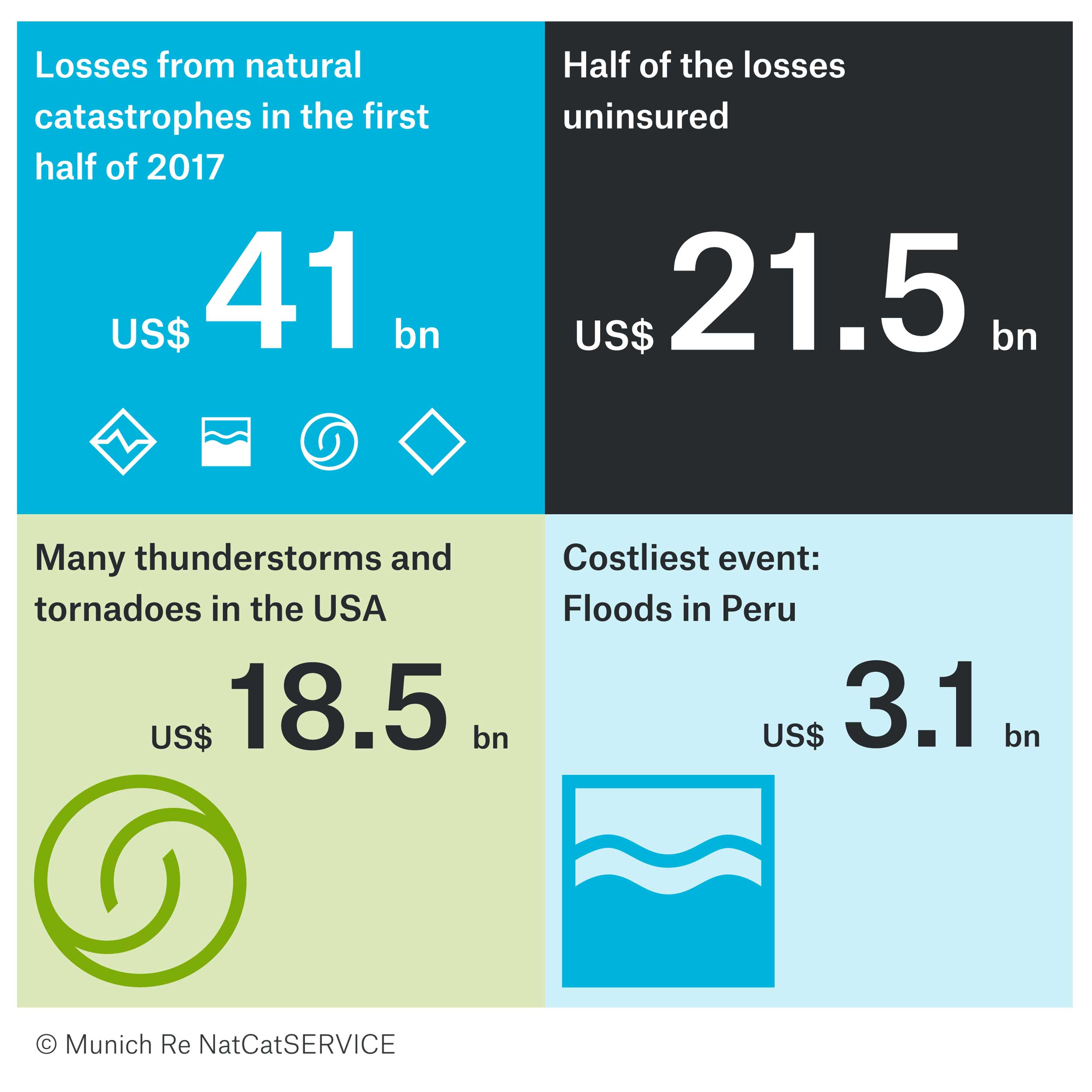

Overall losses came to US$ 41bn. The corresponding figure for the first six months of 2016 was US$ 111bn; the average for the last ten years US$ 102bn. Insured losses totalled US$ 19.5bn (previous year: US$ 32bn; ten-year average US$ 29bn).

With less than half of the losses uninsured, the share of insured losses was higher than usual. This is due to the major thunderstorm losses in the USA, where insurance density is high. The previous year, and the ten-year average, saw more than two thirds of losses uninsured.

The highest overall losses in the first half-year were caused by the floods in Peru in February and March with a figure of US$ 3.1bn, US$ 380 million of which was insured. The costliest event for insurers was a powerful thunderstorm in the USA in early May, with insured losses of US$ 1.8bn and overall losses of US$ 2.2bn.

In Europe, the overall losses of US$ 5bn (€4.4bn) and insured losses of US$ 1.9bn (€1.7bn) were also below the average (US$ 13.4bn and 4.7bn). Just one year earlier, the headlines had been dominated by a series of flash floods and river floods in Germany and France. Nat cat losses in Asia/Pacific and Australia in H1 2017 totalled US$ 9.2bn, with US$ 2.1bn of these insured.

By the end of June 2017, Munich Re’s NatCatSERVICE database had recorded 350 loss-relevant natural catastrophes, less than the previous year’s figures (390) but more than the ten-year average (310).

The high number of severe thunderstorms in the USA is presumed to have been at least partially influenced by a natural climate phenomenon, especially in the first quarter of 2017: the tropical eastern Pacific off the northwest coast of South America was exceptionally warm, a phenomenon that the Peruvian authorities have dubbed “coastal El Niño”, despite the fact that it is not a full-blown El Niño event. At the same time, it was significantly cooler than usual further west. This difference in temperature can cause teleconnection events that alter the atmospheric circulation over the USA, increasing the likelihood of a large number of severe thunderstorms with tornadoes and hail.

Munich Re Board member Torsten Jeworrek: “The exceptional accumulation of severe thunderstorms in the USA highlights just how important it is for insurers to have in-depth knowledge of natural catastrophes and how these are affected by climatic changes. This is true of both natural climatic changes and those that are man-made. Insurers not only help to overcome losses, they also improve our understanding of what triggers them. This is a fundamental basis for preventing future losses.”

Peter Höppe, Head of Munich Re’s Geo Risks Research: “The unusual atmospheric conditions in the USA in the first half of 2017 provided the perfect conditions for powerful supercell thunderstorms, which frequently bring major hailstorms and tornadoes. The number of tornadoes observed in the first quarter of 2017 was twice as high as the average for the last ten years.”

Thunderstorms in the USA were responsible for three of the world’s five costliest loss events in the first half of the year, each causing economic losses of over US$ 2bn. The total economic loss from these storms amounted to US$ 18.5bn, of which US$ 13.5bn was insured.

Tony Kuczinski, President and CEO of Munich Reinsurance America, Inc: “During the first half of 2017, we continued to clearly see the impacts of tornado and hail events in the United States in terms of damage to homes and business, which ultimately result in direct and indirect losses to the economy. Munich Re continues to participate in important research being conducted to improve the way we build our homes and businesses, with the ultimate goal to make them more resistant to the impacts of weather related events. Preventative measures can reduce vulnerability, and preparing for loss or damage can increase resilience. These measures protect assets and save lives.”

The coastal El Niño phenomenon was also responsible for the costliest economic loss in the first half-year, the February and March floods in Peru. High sea temperatures and the subsequent increase in evaporation rates brought torrential rainfall to Peru, triggering numerous landslides and river floods close to the capital city of Lima and in rural areas in the north of the country. Overall losses came to US$ 3.1bn. Due to the low insurance density in Peru, the insured loss was only a tenth of this figure, at just US$ 380m. “Emerging countries in particular would benefit from higher insurance density as it would allow them to recover more quickly from the financial impact of natural disasters”, explained Jeworrek.

Cyclone Debbie, which hit the Queensland coast of Australia in late March, was the second-most expensive nat cat event of H1 2017, with overall losses of US$ 2.7bn and insured losses of US$ 1.4bn. Debbie made landfall on 28 March in the sparsely populated area around Airlie Beach. It was a category four cyclone (second-highest category) with wind speeds of up to 190 km/h (gusts up to 260 km/h). High winds and torrential rain damaged countless buildings.

Hermann Pohlchristoph, Munich Re Board member responsible for Asia-Pacific: “In terms of actual loss amounts, Asia and Australia were not as badly hit by natural disasters as they often are. The loss pattern of Cyclone Debbie in Australia clearly shows that exposure in certain areas continues to be high and that industry needs to address this issue through improved structural measures and professional insurance cover.”

Find more details and charts on the natural catastrophe figures for the first half of 2017 in our Topics Online magazine.

Further Information

Media Contacts

/Ashleigh-Lockhart.jpg/_jcr_content/renditions/crop-1x1-400.jpg./crop-1x1-400.jpg)