Commercial Property Insurance

Comprehensive cover for commercial property risks

properties.trackTitle

properties.trackSubtitle

We understand the risks your clients face, and we know how to help

Coverage

Target risks

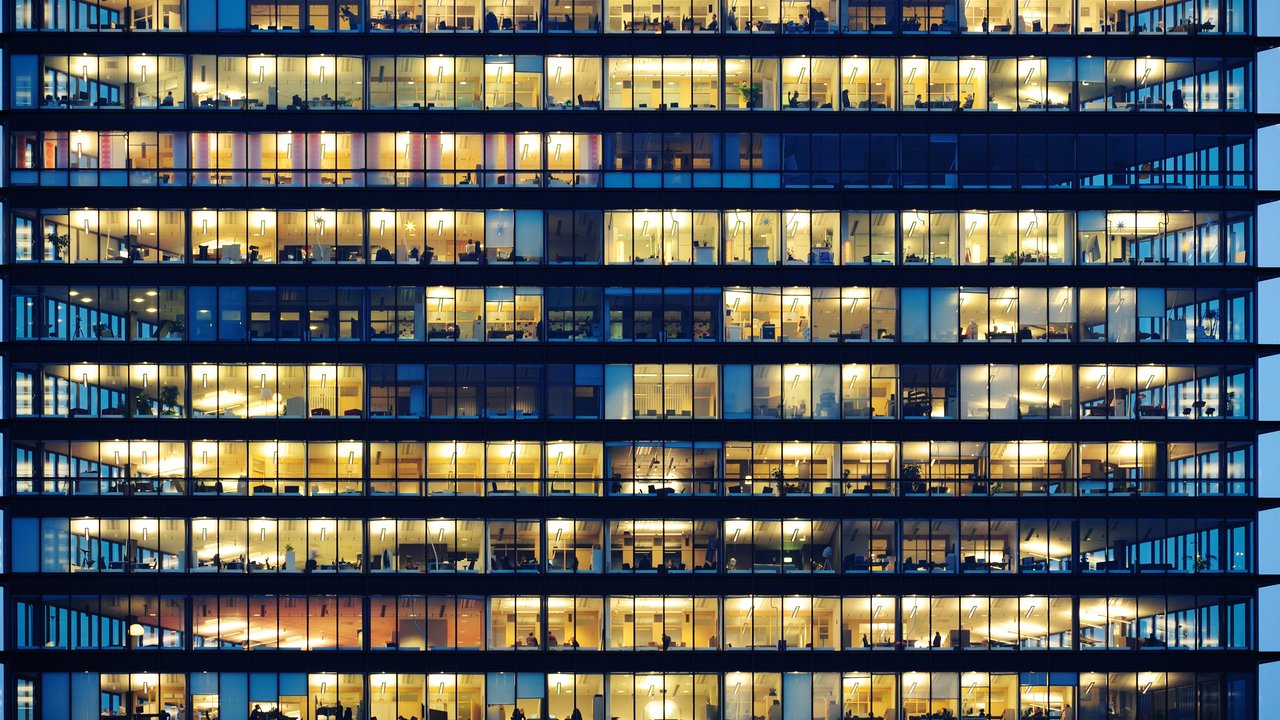

- Real estate / Office / Residential

- Hotels (excluding nightclubs etc.)

- Retail

- Hospitality

- Public buildings

- Education buildings

- Light manufacturing

Limited risk appetite

- Pharmaceutical production

- Food processing

- Computer and electrical equipment manufacturing

- Agricultural / equine industry

- Goods storage and distribution

- Unoccupied buildings

- Non-standard construction with occupancy in ‘Target risks’

- Manufacturing

- Renewables

Outside of risk appetite

Recycling or waste treatment or disposal

Petrochemical risks

Mining or underground exposures

Quarrying

Steel / plastics manufacturing

Printing presses / paper manufacturing

Plastic manufacturing / fabricators

Tyre distributors / re-treaders

Why work with us?

Accessible expertise

Our underwriting team is accessible directly, ready to support you and your clients' needs with our specialist expertise.

Strength in service delivery

The service which we deliver to brokers is something which we pride ourselves on, and our broker partners rely on.

A Munich Re company

We're part of Munich Re Specialty Group Limited, which means we're supported by the financial strength and stability of Munich Re.

Get in touch

Frequently asked questions

What is commercial property insurance?

Who needs commercial property insurance?

Does commercial property insurance include business interruption cover?

What are the main risks to property owners in Ireland?

Is property owners liability offered as an additional coverage?

You may be interested in...

The information provided in this content is intended for Irish insurance brokers acting on behalf of their prospective or existing clients.

Any description is for general information purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any product. Policyholders who have questions or wish to arrange or amend cover should contact their insurance broker. Insurance brokers can find details of how to contact us here.

Any descriptions of coverage contained are meant to be general in nature and do not include nor are intended to include all of the actual terms, benefits, and limitations found in an insurance policy. The terms of any specific policy will instead govern that policy. Any guidance for Irish insurance brokers is intended to provide general information only, and should not be used as a substitute for legal advice.