Capital Management

Latin America

Non-Conventional Reinsurance for Non-Conventional Challenges

properties.trackTitle

properties.trackSubtitle

Beyond traditional risk transfer, Munich Re is a critical financial partner in managing the strategic goals and ambitions of its clients.

"In today's changing environment, both business and regulatory, new opportunities arise along with financial challenges. It is the combination of these that makes return on capital even more demanding for insurers, requiring not only a deep understanding of the changing market landscape, but also the ability to develop custom solutions. For this reason, at Munich Re we have created a financial engineering unit specialized in advising and providing this customization of reinsurance to our clients in Latin America and Europe. We are a team of experts in multiple locations dedicated to designing customized solutions on a wide range of products from the Life and Health lines."

Gaizka GorospeHead of Financial Reinsurance Unit

Why structured reinsurance and not other more well-known financial instruments?

Greater flexibility both by volume and by structuring schemes.

Solutions that do not have the need to involve investors or third parties to carry them out (investment banks, advisors, etc.).

Easy to implement and manage as they are based on traditional reinsurance structures (Quota Share, Surplus, etc.).

Prices are competitive compared to structures in the financial sector or even intra-group.

Adaptability is part of our DNA, based on the diversity of the client's specific needs.

How do we work from Munich Re?

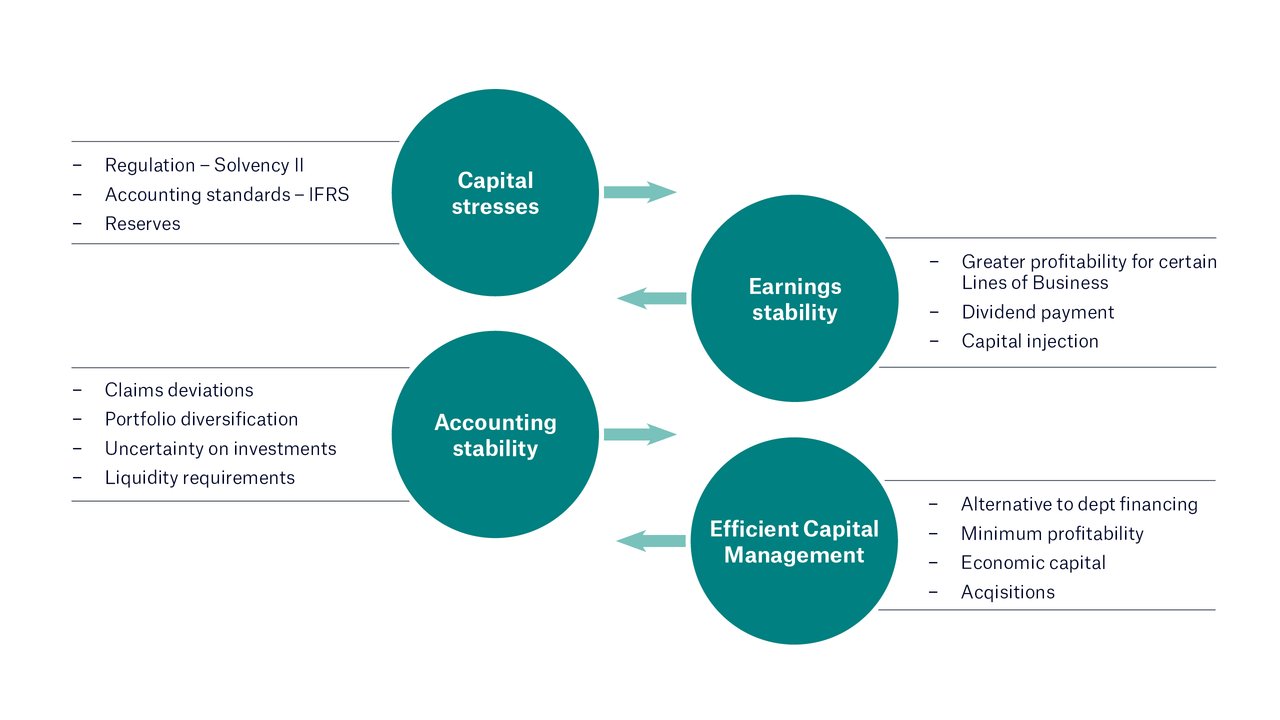

What are the most common motivations our Clients have?

What kind of solutions do we offer?

We structure solutions tailored to our clients, examples:

- optimization of regulatory capital and reserve requirements for Life and Health portfolios

- financing to cover acquisition costs, compliance with financial obligations or other specific projects, through the monetization of the future value of insurance portfolios

- mechanisms to guarantee stability in the future results of insurance portfolios

- protection of minimum guarantees in unit-linked products

Why Munich Re?

As leading international reinsurers, we have the necessary experience, technical knowledge, and a strong capital base from which our clients benefit directly. With each solution, we distinguish ourselves by putting the client's needs and motivations at the center, and we strive to build timely, efficient and innovative solutions.

We have a record of executing transactions in different jurisdictions and regulatory contexts (Solvency I, II) that position us at the highest and most demanding level of service.

We are pioneers in the markets and work hand in hand with regulators and major market players to make the insurance industry a financially healthier industry.

Financial Strenght

Knowledge and Experience

We put the customer at the center and think of tailor-made solutions

Our Solutions

VIF Monetization

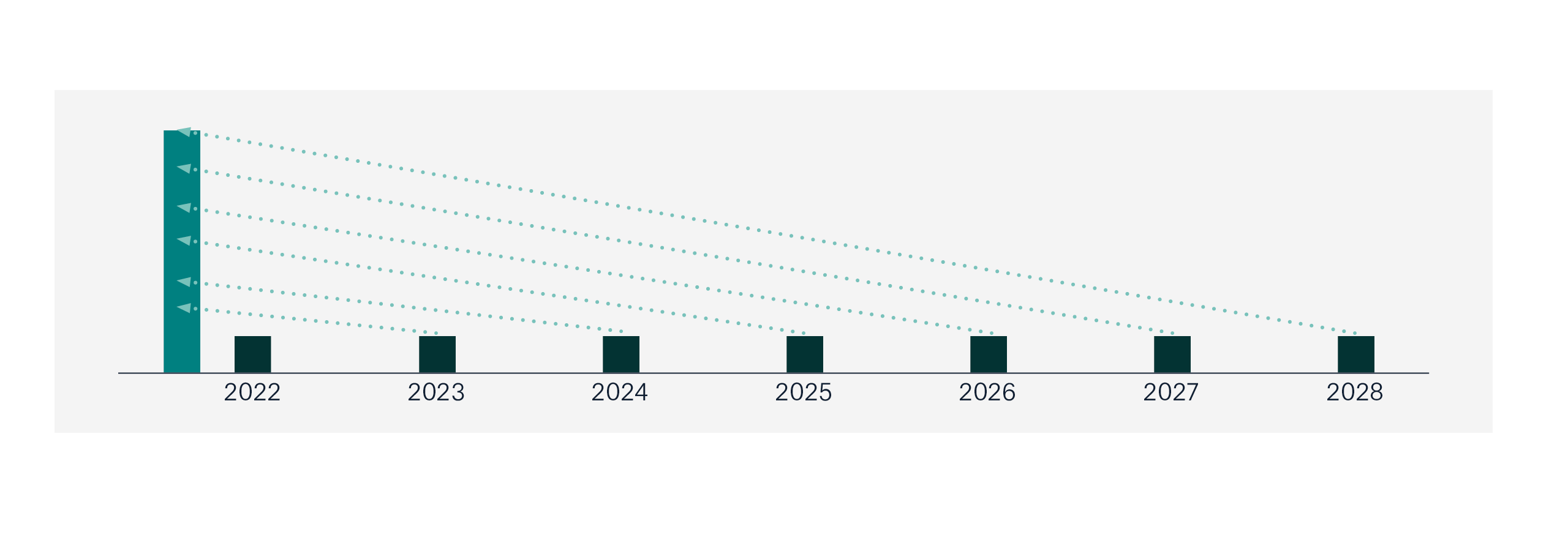

VIF Monetization

As is known, the times set by the market are not always in harmony with the opportunities, challenges or obligations. With this type of operation, the insurance company anticipates the margins of its business so that it can actively manage where to invest future profits.

With a simple Quota-Share reinsurance contract that grants a participation in profits, the insurer receives an initial injection of assets

- in cash, to provide liquidity, or

- as an irrevocable commission, to improve the capital position at a lower cost,

without creating a liability on your balance sheet. This advance payment is amortized in future years according to the technical margins generated by the business, and according to a stipulated initial duration.

Flexible Financing Facility

It is possible that the need for financing (in time and amount) depends on certain circumstances that are initially unknown. However, we also contemplate that the injection of assets may be anticipated through various installment payments as needed over time, as if it were a line of credit, and at the company's discretion.

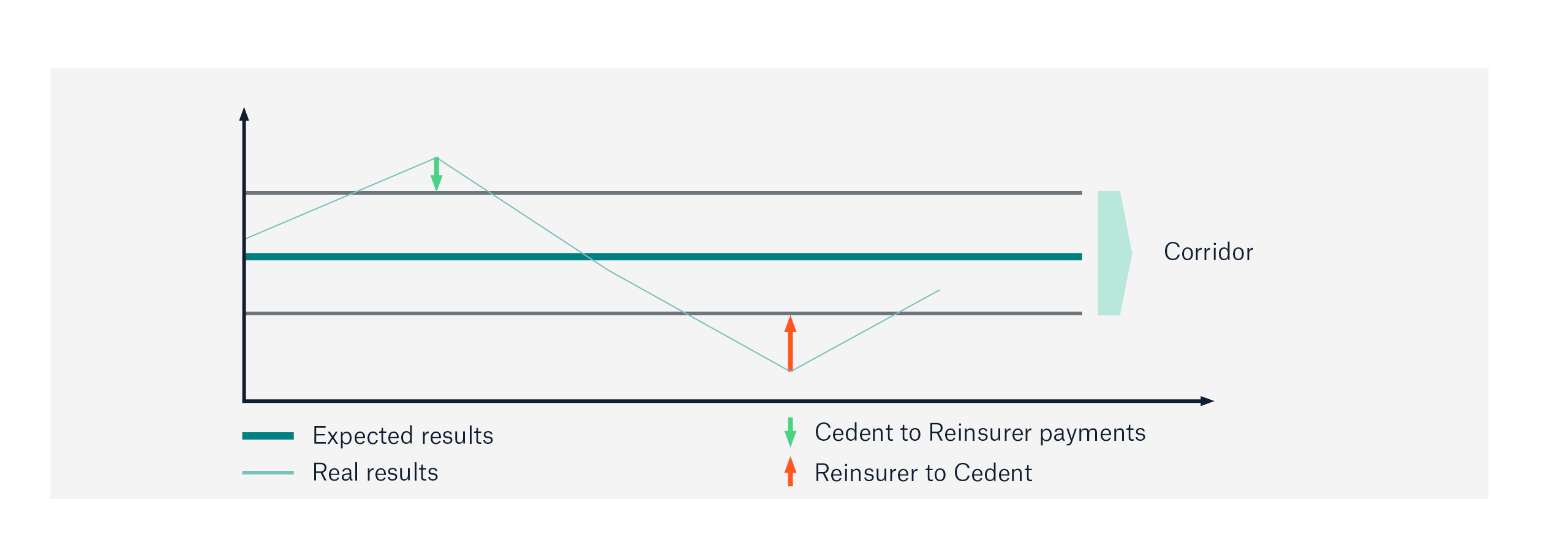

Earnings Stabilization

Earnings Stabilization

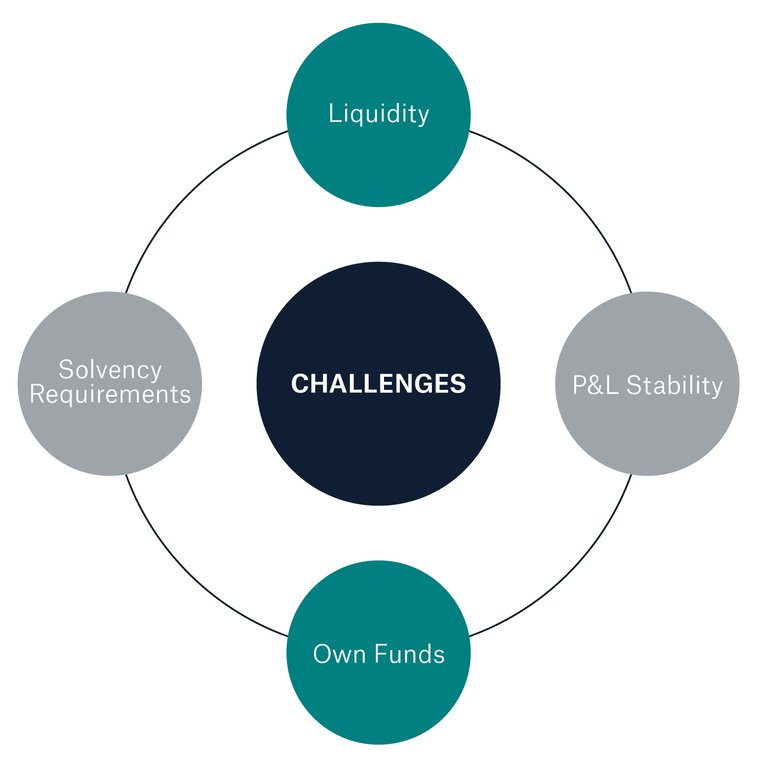

There are many circumstances in which companies need to guarantee a minimum technical result, such as to resolve tensions over results volatility, own funds or solvency requirements.

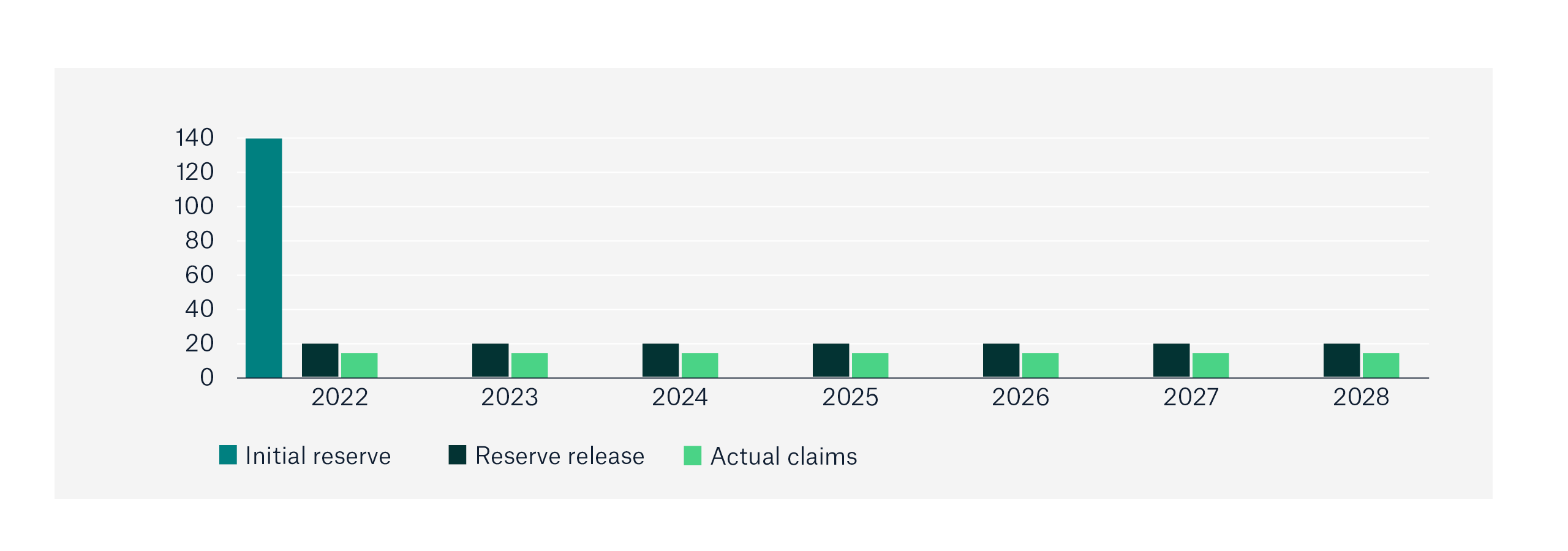

Reserves Release

Reserves Release

The volatility in reserves, as well as the high allocation of capital due to regulatory requirements, can act as a brake on the growth of the company, new lines of business, or even the optimization of the cost of capital.

The Reserves Relief solution responds to the disagreement with the management of reserves and ambitious business plans. It allows:

- mitigate the impact of the reserve constitution requirement with conservative technical bases

- mitigate volatility in reserves

- positively impact the P&L

Our experts

Our experts