Insurance-Linked Securities: Solutions for a Resilient Future

Risk mitigation and capital efficiency with Munich Re's ILS structuring and fronting capabilities

properties.trackTitle

properties.trackSubtitle

Have you ever thought about additional (multiyear) capacity via Cat Bond? Are you aware of what Munich Re can deliver in the ILS space? Why should a reinsurer be involved in your Cat Bond transaction?

What are Insurance-Linked Securities?

- Insurance-Linked Securities (ILS) are financial instruments that allow investors to participate in the risk and return of insurance-related assets. ILS products, such as catastrophe bonds (“Cat Bonds”), enable re/insurance companies, state pools and corporates (“sponsors” or “cedants”) to transfer risk to the capital markets, providing an additional layer of financial protection and stability. By harnessing the power of ILS, sponsors can better manage their risk profiles, increase their capacity, and improve their financial resilience.

Munich Re's ILS team offers a range of solutions, including:

- Catastrophe bonds: A type of financial instrument allowing investors to take on catastrophe risk in exchange for regular premium payments (risk spread). If a catastrophe occurs, the investor's principal is used to pay claims, reducing the financial burden for the cedant.

- Sidecars: Collateralized reinsurance vehicles allowing investors to participate in the risk and returns of a specific book of business via a quota share agreement. Sidecars are typically used to provide additional capacity for peak risks, such as natural catastrophes.

- Industry loss warranties (ILWs): A type of reinsurance contract that triggers a payout based on the total losses incurred by the insurance industry as a whole (e.g. trigger based on PCS or PERILS), rather than the specific losses of the individual sponsor. ILWs provide a way to manage exposure to extreme events.

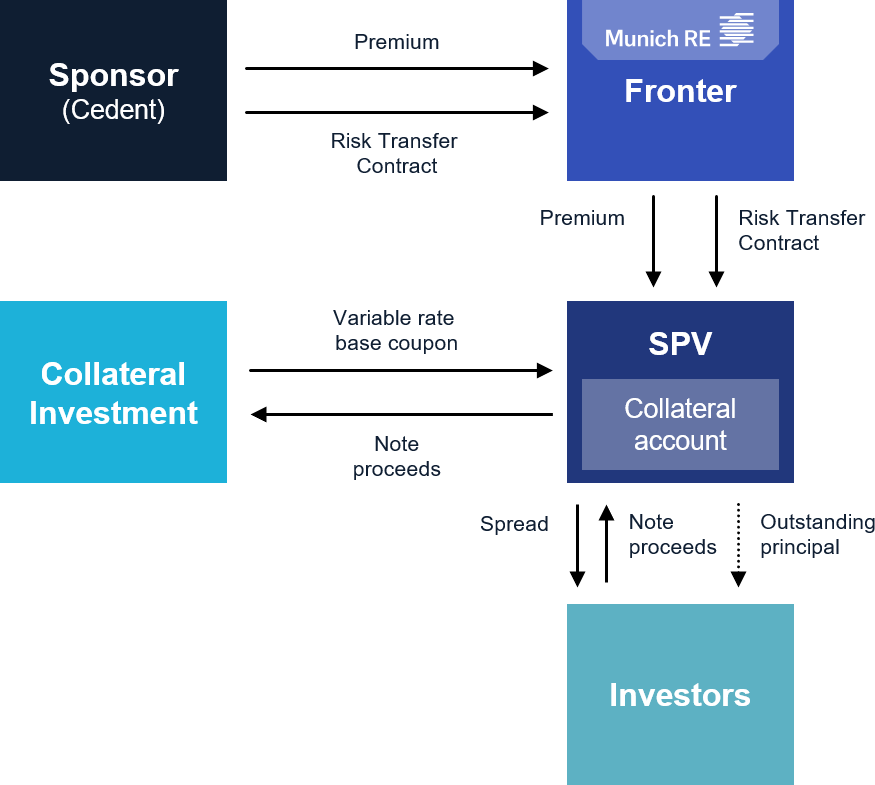

Typical structure with fronting (example)

Why working with Munich Re's ILS team?

Structuring Expertise

Unparalleled knowledge and experience in structuring and fronting ILS transactions also acting as cedent for Munich Re’s own book of business. Benefit from capital markets and reinsurance expertise.

Global Reach

Access to a global network of investors, sponsors, and market participants.

Customized Solutions

Tailored ILS solutions meeting the specific client needs.

Fronting Capability

Ability to act as Fronting Reinsurer – especially for the benefit of NatCat Pools and Corporates - enabling clients to access the capital markets and transfer risk to investors.

Risk Management

Effective risk management solutions that help clients mitigate their exposure to natural catastrophes and other risks.

Extensive Track Record

Enjoy efficient solutions based on decades of capital market experience and transaction history.

Munich Re clients will benefit from our experience of >60 structured and fronted transactions with a volume of more than 20bn USD transferred to the capital market.

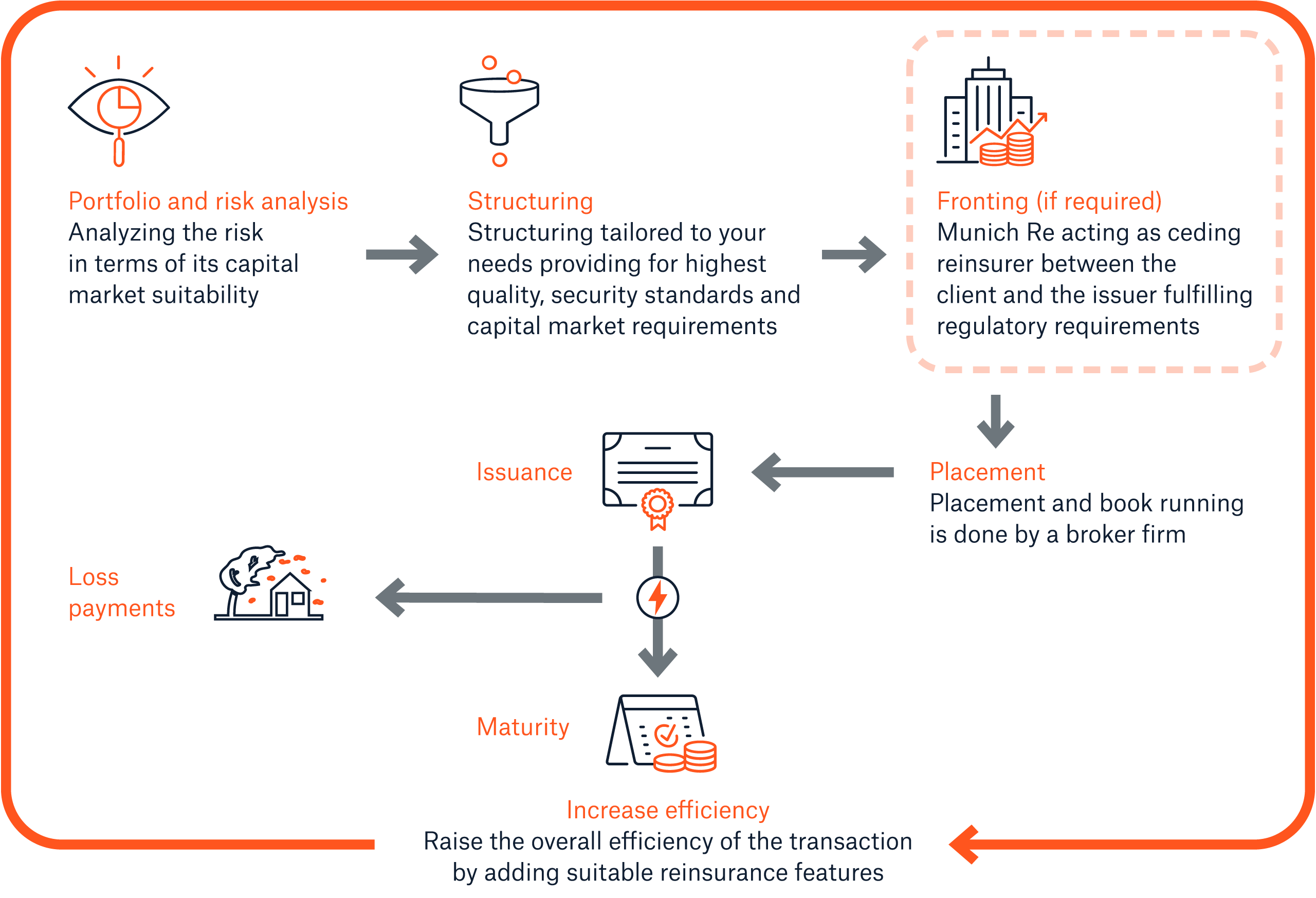

Our comprehensive support across the entire ILS value chain ensures that clients receive tailored solutions and expert guidance every step of the way

Munich Re Capital Partners ILS team delivers comprehensive services – from risk analysis, structuring & fronting to final issuance

Use cases from previous transactions

Let’s get in touch

Contact us

- Email anmueller@munichre.com

- vCard Download

- Email sdecker@munichre.com

- vCard Download

- Email sbauer2@munichre.com

- vCard Download

- Email ffrank@munichre.com

- vCard Download

ILS Success Stories

| Transaction | Issuance Date | Maturity Date | Volume | Perils covered |

|---|---|---|---|---|

| Mexican government / World Bank | Apr-24 | Apr-28 | USD 225m | Class A (Earthquake) |

| Mexican government / World Bank | Apr-24 | Apr-28 | USD 70m | Class B (Earthquake) |

| Mexican government / World Bank | Apr-24 | Apr-28 | USD 125m | Class C (Atlantic Hurricane) |

| Mexican government / World Bank | May-24 | Apr-28 | USD 175m | Class D (Pacific Hurricane) |

| Azzurro Re II DAC | Jul-20 | Jan-24 | EUR 100m | Earthquake Italy |

| Vitality Re XI Limited | Jan-20 | Jan-24 | USD 200m | US health risks |

| World Bank Catastrophe Bond for the Republic of the Philippines | Nov-19 | Dec-22 | Class A – USD 75m | Earthquake |

| World Bank Catastrophe Bond for the Republic of the Philippines | Nov-19 | Dec-22 | Class B – USD 150m | Tropical Cyclone |

| Atmos Re DAC | Feb-19 | Feb-22 | EUR 45m | Atmospheric perils, flood, snow pressure |

| Vitality Re X Limited | Jan-19 | Jan-23 | USD 200m | US health risks |

| Vitality Re IX Limited | Jan-18 | Jan-22 | USD 200m | US health risks |

| World Bank Catastrophe Bond for the Fonden | Aug-17 | Aug-20 | USD 150m | Earthquake Mexico |

| World Bank Catastrophe Bond for the Fonden | Aug-17 | Dec-19 | USD 100m | Earthquake Mexico |

| World Bank Catastrophe Bond for the Fonden | Aug-17 | Dec-19 | USD 110m | Earthquake Mexico |

| World Bank Catastrophe Bond for the Pandemic Emergency Financing Facility (PEF) | Jul-17 | Jul-20 | Class A – USD 225m | Pandemic |

| World Bank Catastrophe Bond for thePandemic Emergency Financing Facility (PEF) | Jul-17 | Jul-20 | Class B – USD 95m | Pandemic |

| Lion II Re DAC | Jun-17 | Jul-21 | EUR 200m | Europe Windstorm, Italy Earthquake, Europe Flood |

| Vitality Re VIII Limited | Jan-17 | Jan-21 | USD 200m | US health risks |

| Vitality Re VII Limited | Jan-16 | Jan-20 | USD 200m | US health risks |

| Bosphorus Ltd. | Aug-15 | Aug-18 | USD 100m | Earthquake Turkey |

| Azzurro Re I Ltd. | Aug-15 | Aug-18 | EUR 200m | Earthquake Europe |

| World Bank Catastrophe Bond for the Caribbean Catastrophe Risk Insurance Facility (CCRIF) | Jun-14 | Jun-17 | USD 30m | Caribbean Earthquake & Tropical Cyclone |

| Lion I Re Ltd. | Apr-14 | Apr-17 | EUR 190m | Europe Wind |

| VenTerra Re Ltd. | Dec-13 | Jan-17 | USD 250m | Earthquake US, Australia Earthquake & Cyclone |

| Queen City Re Ltd. | Dec-13 | Jan-17 | USD 75m | Wind US |

| Bosphorus 1 Re Ltd. | Apr-13 | May-16 | USD 400m | Earthquake Turkey |

| Tar Heel Re Ltd. | Apr-13 | May-16 | USD 500m | Hurricane US |

| Lakeside Re III Ltd. | Dec-12 | Jan-16 | USD 270m | Earthquake Canadian & US |

| MultiCat Mexico Ltd. | Oct-12 | Dec-15 | Class A – USD 140m | Earthquake Mexico |

| MultiCat Mexico Ltd. | Oct-12 | Dec-15 | Class A – USD 75m | Earthquake Mexico |

| MultiCat Mexico Ltd. | Oct-12 | Dec-15 | Class A – USD 100m | Earthquake Mexico |

| Johnston Re Ltd. Series 2011-1 | May-11 | May-14 | Class A – USD 70m | Hurricane US |

| Johnston Re Ltd. Series 2011-1 | May-11 | May-14 | Class A – USD 132m | Hurricane US |

| Shore Re Ltd. | Jul-10 | Jul-13 | USD 96m | Hurricane US |

| Johnston Re Ltd. Series 2010-1 | May-10 | May-13 | USD 200m | Hurricane US |

| Johnston Re Ltd. Series 2010-1 | May-10 | May-13 | USD 105m | Hurricane US |

| Ianus Capital Ltd. | May-09 | Jun-12 | USD 70mn | Earthquake Turkey, Europe Wind |

| Lakeside Re II Ltd. | Dec-09 | Jan-13 | USD 225m | Earthquake US |

| Muteki Ltd. | May-08 | May-11 | USD 300m | Earthquake Japan |

| Midori Ltd. | Oct-07 | Oct-12 | USD 260m | Earthquake Japan |

| Lakeside Re | Dec-06 | Dec-09 | USD 190m | Earthquake US |

| Transaction | Issuance Date | Maturity Date | Volume | Perils covered |

|---|---|---|---|---|

| Queen Street 2023 Re dac | May-23 | Dec-25 | USD 300m | US Hurricane |

| Eden Re II Ltd. (Series 2025-1) | Dec-24 | Mar-30 | USD 150m | "various perils" |

| Eden Re II Ltd. (Series 2024-1) | Dec-23 | Mar-28 | USD 150m | "various perils" |

| Eden Re II Ltd. (Series 2023-1) | Dec-22 | Mar-27 | USD 131m | "various perils" |

| Eden Re II Ltd. (Series 2022-1) | Dec-21 | Mar-26 | USD 190m | "various perils" |

| Eden Re II Ltd. (Series 2021-1) | Dec-20 | Mar-25 | USD 235m | "various perils" |

| Eden Re II Ltd. (Series 2020-1) | Dec-19 | Mar-24 | USD 285m | "various perils" |

| Eden Re II Ltd. (Series 2019-1) | Dec-18 | Mar-23 | USD 300m | "various perils" |

| Eden Re II Ltd. (Series 2018-1) | Dec-17 | Mar-22 | USD 300m | "various perils" |

| Eden Re II Ltd. (Series 2017-1) | Dec-16 | Mar-21 | USD 360m | "various perils" |

| Eden Re II Ltd. (Series 2016-1) | Dec-15 | Mar-20 | USD 360m | "various perils" |

| Queen Street XI Re dac | Dec-15 | Jun-19 | USD 100m | Hurricane US, Australian Cyclone |

| Queen Street X Re Ltd. | Mar-15 | Jun-18 | USD 100m | Hurricane US, Australian Cyclone |

| Eden Re II Ltd. (Series 2015-1) | Dec-14 | Mar-19 | USD 275m | "various perils" |

| Eden Re I Ltd. (Series 2015-1) | Dec-14 | Mar-19 | USD 75m | "various perils" |

| Queen Street IX Re Ltd. | Feb-14 | Jun-17 | USD 100m | Hurricane US, Australian Cyclone |

| Eden Re I Ltd. (Series 2014-1) | Dec-13 | Mar-18 | USD 75m | "various perils" |

| Queen Street VIII Re Ltd. | Jun-13 | Jun-16 | USD 75m | Hurricane US, Australian Cyclone |

| Queen Street VII Re Ltd. | Oct-12 | Apr-16 | USD 75m | Hurricane US, Europe Wind |

| Queen Street VI Re Ltd. | Jul-12 | Apr-15 | USD 100m | Hurricane US, Europe Wind |

| Queen Street V Capital Ltd. | Feb-12 | Apr-15 | USD 75m | Hurricane US, Europe Wind |

| Queen Street IV Capital Ltd. | Oct-11 | Apr-15 | USD 100m | Hurricane US, Europe Wind |

| Queen Street III Capital Ltd. | Jul-11 | Aug-14 | USD 150m | Europe Wind |

| Queen Street II Capital Ltd. | Mar-11 | Apr-14 | USD 100m | Hurricane US, Europe Wind |

| EOS Wind Ltd. | May-10 | May-14 | Class A - USD 50m | Hurricane US |

| EOS Wind Ltd. | May-10 | May-14 | Class B - USD 30m | Hurricane US, Europe Wind |

| Queen Street Ltd. | Mar-08 | Mar-11 | Class A - USD109m | Europe Wind |

| Queen Street Ltd. | Mar-08 | Mar-11 | Class B - USD 156m | Europe Wind |

| Nathan Ltd. | Feb-08 | Jan-13 | USD 100m | Mortality |

| Carillon Ltd. II | May-07 | Jan-11 | USD 150m | Hurricane US |

| Carillon Ltd. | Jun-06 | Jan-10 | Class A1 - USD 51m | Hurricane US |

| Carillon Ltd. | Jun-06 | Mar-07 | Class A2 - USD 23,5m | Hurricane US |

| Carillon Ltd. | Jun-06 | Mar-07 | Class B - USD 10m | Hurricane US |

| Aiolos Ltd. | Nov-05 | Apr-09 | USD 129m | Europe Wind |

| PRIME Capital | Dec-00 | Jan-04 | USD 129m | Hurricane US, Europe Wind |

| PRIME Capita | Dec-00 | Jan-04 | USD 6m | Hurricane US, Europe Wind |

| PRIME Capital | Dec-00 | Jan-04 | USD 3m | Hurricane US, Europe Wind |

| PRIME Capital | Dec-00 | Jan-04 | USD 159m | Hurricane US |

| PRIME Capital | Dec-00 | Jan-04 | USD 6m | Hurricane US |

| PRIME Capital | Dec-00 | Jan-04 | USD 3m | Hurricane US |