Capital management for life and health insurers

Active capital management is playing an increasingly important role for life and health insurers. Munich Re develops tailor-made solutions for your goals, offering you new options.

properties.trackTitle

properties.trackSubtitle

Capital management through reinsurance

Solvency II, persistently low interest rates and increasing capital requirements make these challenging times for life and health insurers. Demand from providers for tools they can use to optimise their financial KPIs effectively, flexibly and discreetly is understandably high. Munich Re has therefore developed just such tools and adapts them to individual requirements.

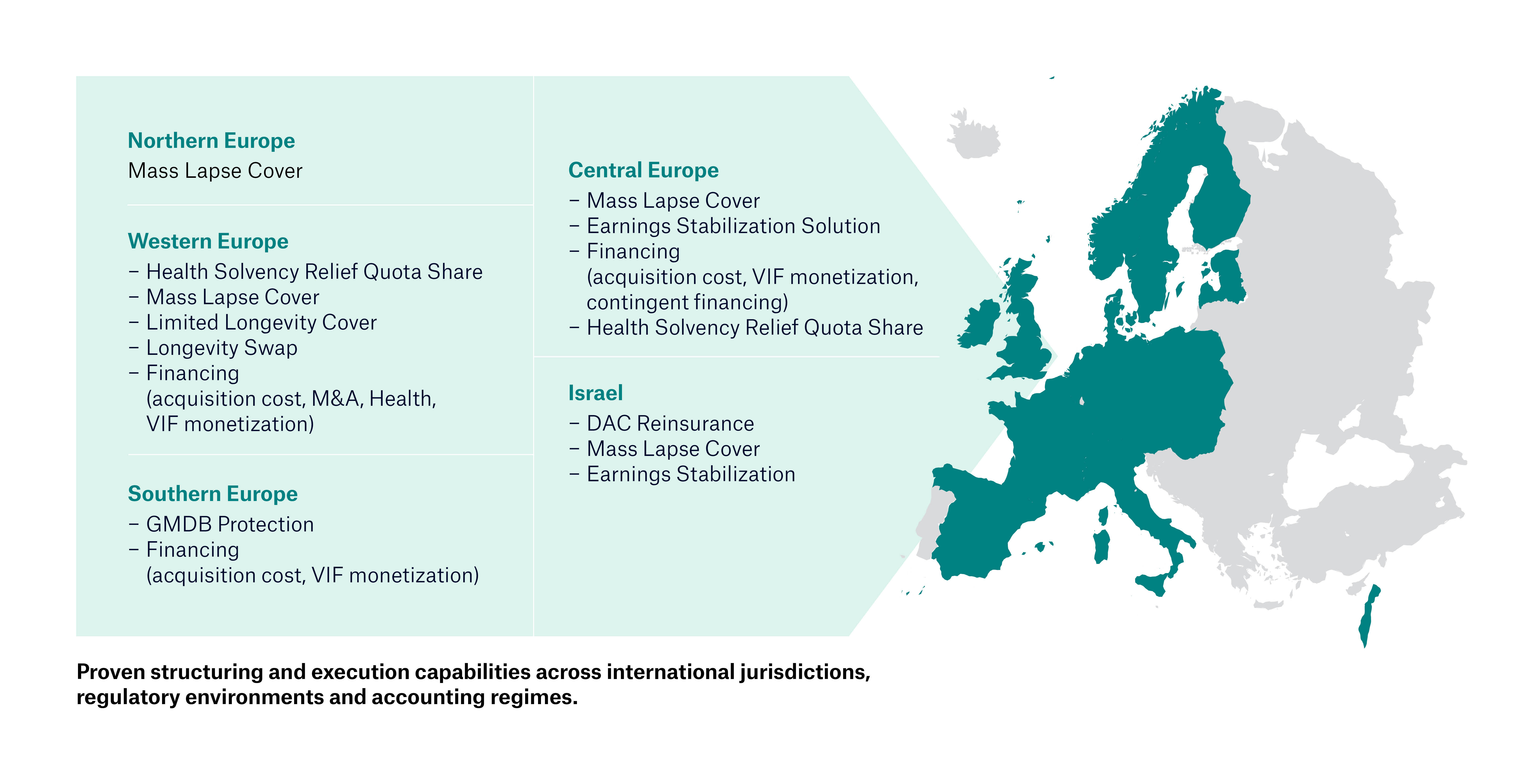

We have proven structuring and execution capabilities across international jurisdictions, regulatory environments and accounting regimes. Our Capital Management team for Europe is well connected with teams from Americas and Asia – and solutions are transacted successfully world-wide.

Our track record of capital management solutions in Europe

What makes us the partner of choice for such solutions? As leading international reinsurers, we have the necessary experience, know-how and a strong capital base that you benefit from directly. With each solution, we place our capital strength and internal model at your disposal. That takes the pressure off your company and enables you to actively manage your KPIs and, in particular, your results over time.

Compared to traditional capital market solutions, this works flexibly and at attractive conditions. As our solutions are based on tried-and-tested reinsurance structures, their implementation, accounting and modelling do not present you with any new challenges.

3 reasons to choose Munich Re

Financial

solidity

Innovative reinsurance concepts

for capital management

Expert knowledge and

many years of expertise

Our range of services

Capital management and active balance sheet management

Structured reinsurance solutions prove to be very effective tools where management of the balance sheet is concerned. Take new business, for example. A life or health insurer who brings an innovative product onto the market and is very successful with it generates high acquisition costs in the year of the product launch. These put a strain on the balance sheet.

Balance sheet relief through reinsurance

The solution: Munich Re reinsures part of the new business and in return pays a reinsurance commission. The primary insurer thus receives funding which it repays in subsequent years from its mortality result and other business performance, if the results allow. The contract then ends.

Advantages: With this form of funding, short-term pressure on the balance sheet can be spread over several years, effectively and at little cost. The liquidity required for the new business is provided by the reinsurer.

Smoothing of operating results through contingent capital

Building on tried-and-tested and frequently used reinsurance financing, Munich Re developed a contingent capital solution and was the first reinsurer to successfully implement it in the market. This reinsurance solution provides you with capital on demand for several years, in order to offset burdens on the profit and loss account or keep unadjusted earnings stable. There are many possible applications: the solution demonstrates its strengths when used to finance subsequent reserving or the additional interest rate reserve, as well as to stabilise return on investment or policyholder bonuses.

Risk management through solvency relief and an increase in own funds

The level of the solvency ratio is one of the key indicators of the financial performance of life and health insurers. At Munich Re, we support our primary insurance clients with innovative reinsurance solutions, each of which is individually structured.

Under Solvency II, life and health insurers must back temporary deviations from the expected income from their insurance business with an appropriate amount of solvency capital. This applies with respect to both underwriting risks and market risks. Tools that allow the solvency ratio to be actively and accurately managed are therefore needed.

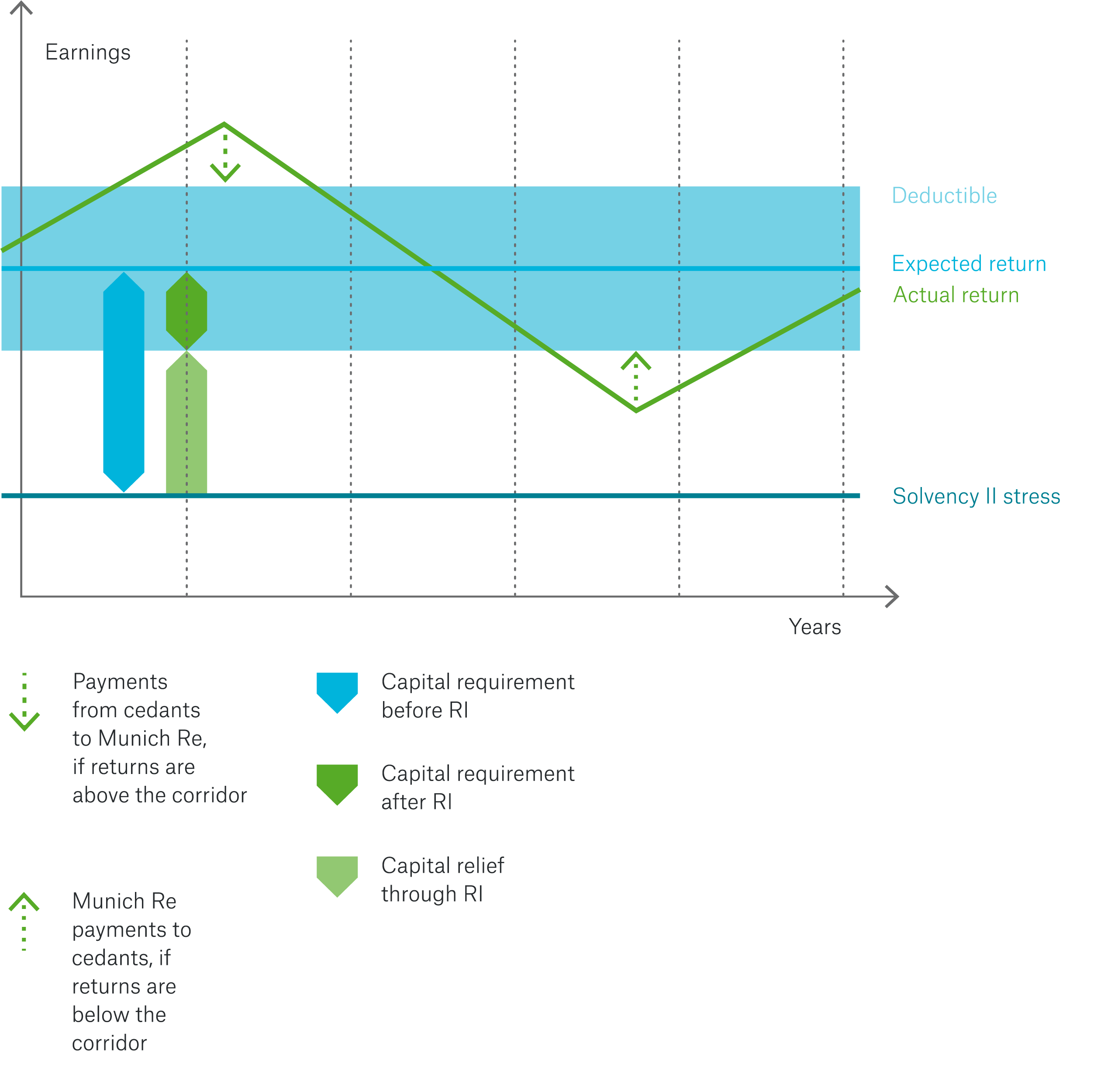

Earnings stabilisation with Munich Re

Munich Re has developed these tools, for example the Earnings Stabilisation tool (see diagram). The principle is easily explained: Solvency II determines the level of the solvency ratio based on a portfolio’s sensitivity to stress scenarios. This is where Munich Re comes in.

For underwriting risks, we jointly define with you a corridor for the maximum desired fluctuation range. If income falls below the corridor, our reinsurance cover is triggered and covers income shortfalls up to the lower corridor limit. Where income exceeds the corridor, payments go in the opposite direction.

Advantages:

- Future income is always within the defined corridor

- The solvency capital requirements are reduced to a scalable extent

- Unadjusted earnings are also stabilised

In addition to capital relief, reinsurance also affects the following items:

Reducing the risk margin

Underwriting risks are often not the main driver for the total capital requirement, as the effects of reinsurance on the capital requirement in a submodule are also subject to diversification. However, the amount of the capital requirement within the underwriting risk modules directly affects the risk margin. A significant reduction can be achieved with the help of reinsurance, strengthening own funds.

Reducing the effect of options and guarantees

By hedging the market risk, the amount of the technical provision for options and guarantees can also be reduced.

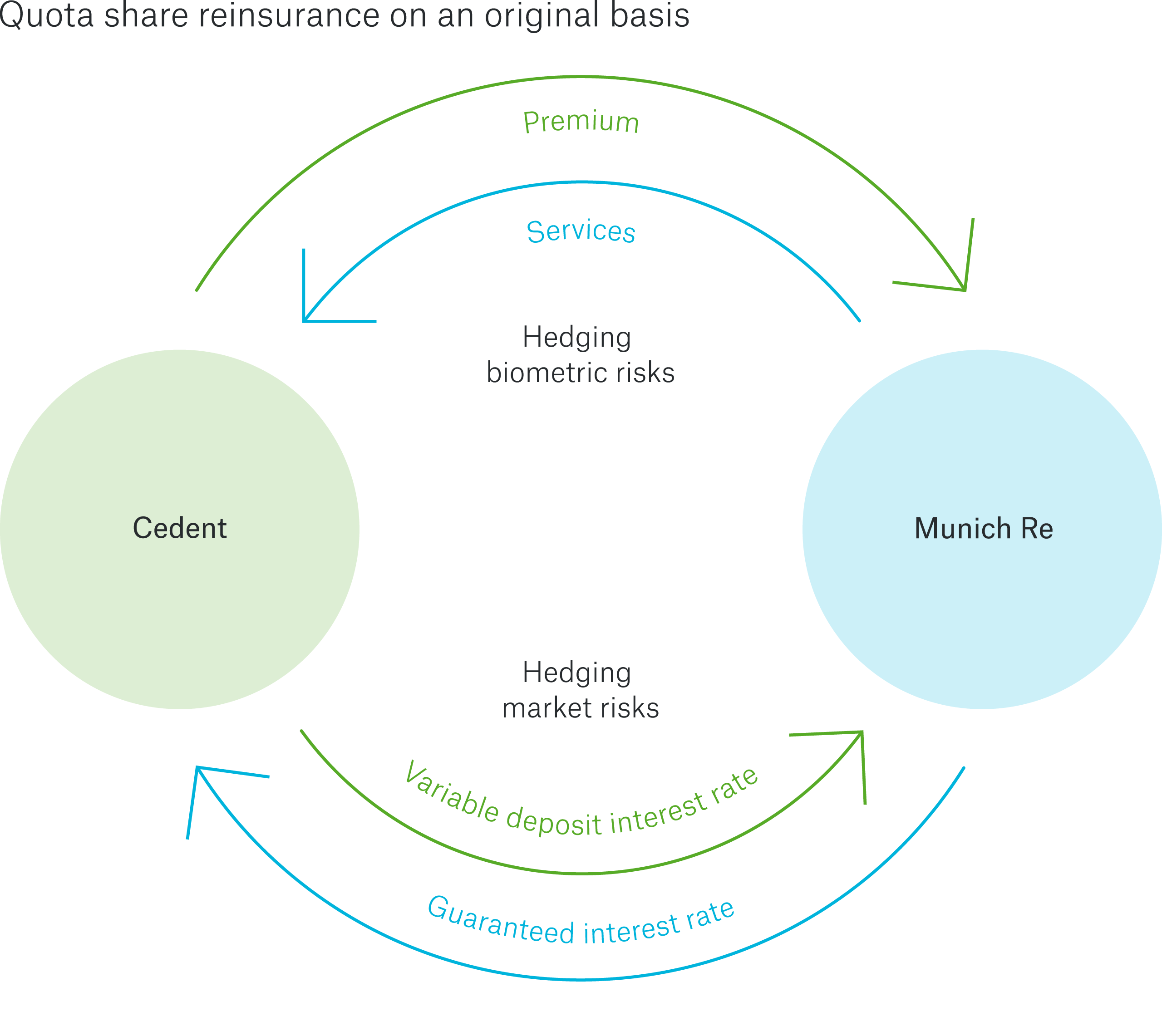

Reinsurance of market risks

Biometric risks are transferred to the reinsurer in the usual way via quota share reinsurance on an original basis. New: capital market risks can now also be covered using the same principles. For example, Munich Re assumes a cedant’s future interest liabilities and in return receives a variable deposit interest rate linked to market rates.

Balance sheet alignment of accounting principles

A decisive advantage compared to capital market solutions is the balance sheet alignment of insurance and reinsurance contracts. In accounting, the same accounting principles – under IFRS (International Financial Reporting Standards), local GAAPs (generally accepted accounting principles) and Solvency II balance sheet – apply to both types of contract, which means there is no accounting mismatch.

M&A projects and run-offs

The life and health insurance market is going through a phase of consolidation. Strategic mobility and the financial leeway needed for this are therefore more important than ever – for life insurers who want to merge or acquire additional market shares, as well as for companies in run-off.

In all cases, we can expand players’ strategic options with precisely targeted and structured reinsurance solutions. The strengths of our offering: with a suitable reinsurance solution, the necessary capital can be provided much more quickly, flexibly and at lower cost than would be possible by increasing capital through the financial market, for example. Furthermore, reinsurance is a discreet tool that doesn’t attract public attention or raise concerns on the part of shareholders.

Individually structured for M&A goals

In the area of M&A, structured reinsurances perform a dual function. On the one hand they can free up capital for financing acquisitions. On the other, it is possible to both smooth out the results of the target company and improve its capital position – with a correspondingly positive impact on the company’s rating, value and attractiveness. The effects depend on the structuring. We structure our capital management solutions individually to your requirements.

Contact our experts

/glaser_berthold_sou.jpg/_jcr_content/renditions/crop-1x1-400.jpg./crop-1x1-400.jpg)

/Heinz_Riccardo_X11.jpg/_jcr_content/renditions/crop-1x1-400.jpg./crop-1x1-400.jpg)