Munich Reinsurance America, Inc. announces new U.S. inland flood insurance product, providing more options for homeowners

2015/08/04

Press Release

properties.trackTitle

properties.trackSubtitle

Princeton, NJ - Munich Reinsurance America, Inc. announces a new personal lines inland flood insurance product designed to provide more options for homeowners in low-to-moderate-hazard flood zones.

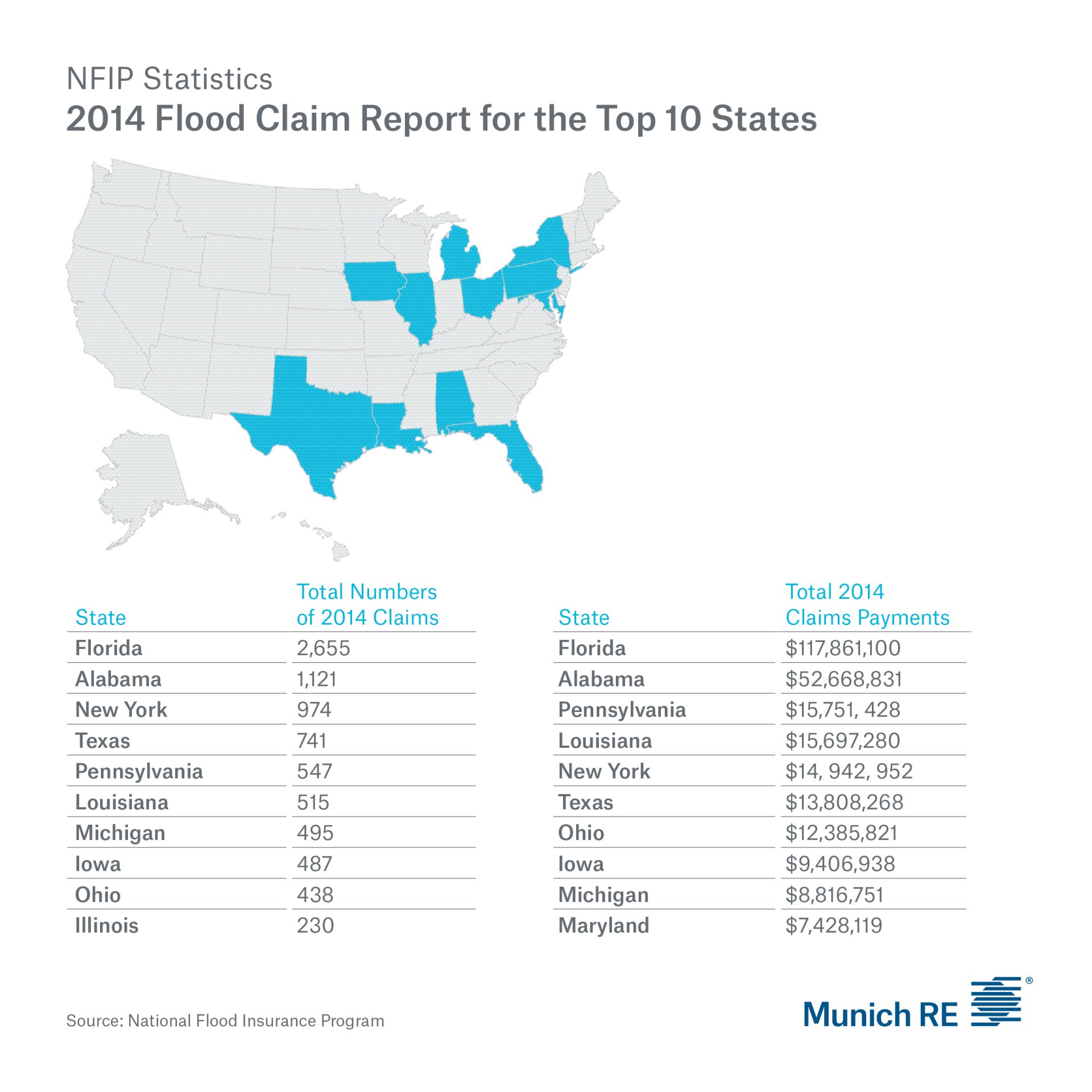

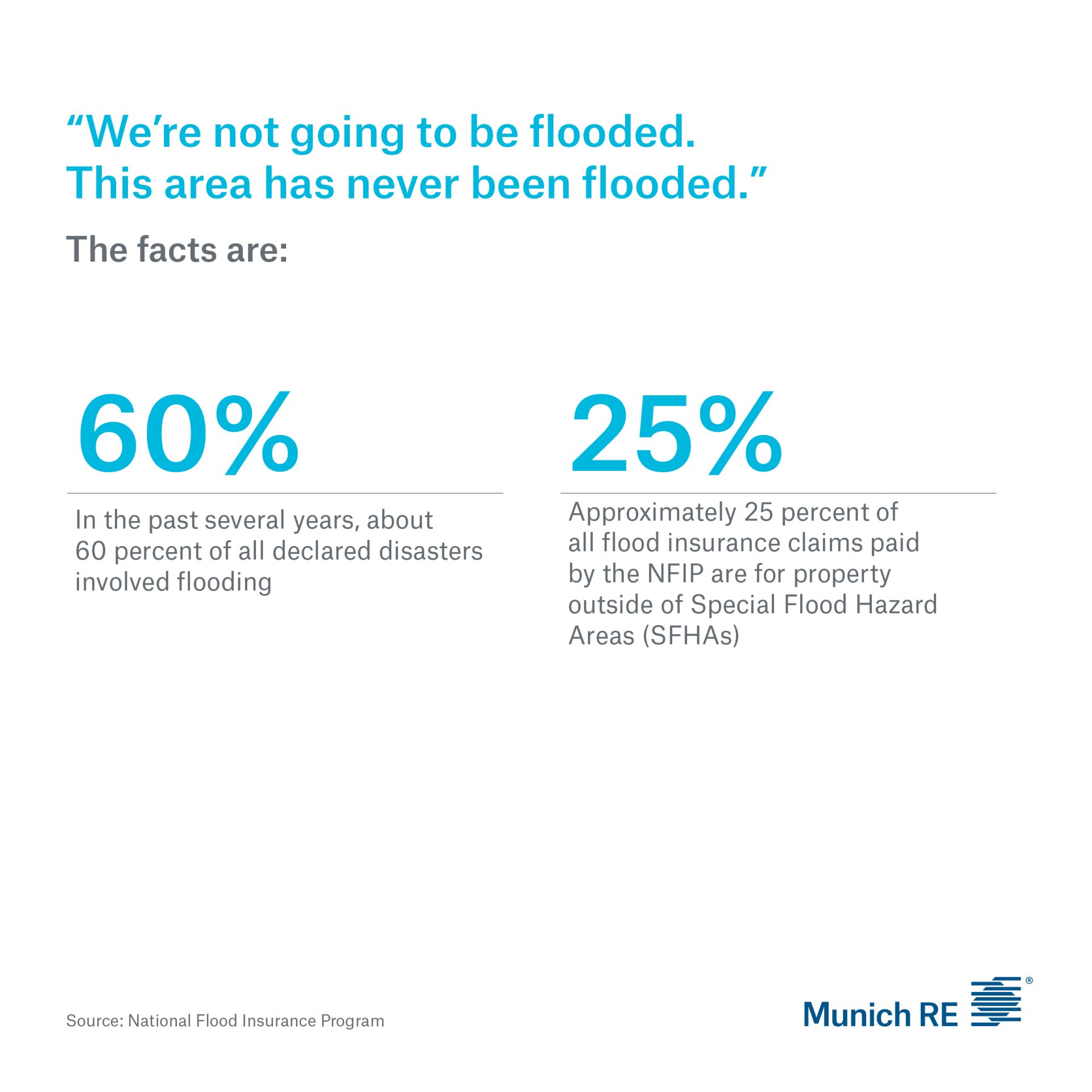

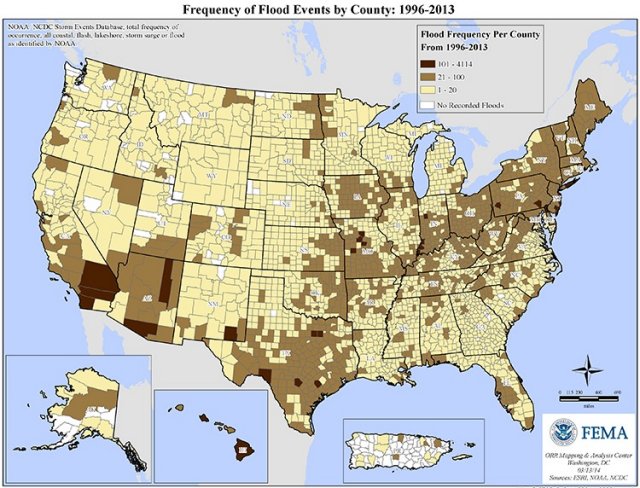

According to the National Flood Insurance Program (NFIP), flood is the most common natural disaster in the United States and all 50 states have experienced floods or flash floods over the past five years. However, many homeowners who live outside of Atlantic and Gulf coast areas do not have insurance coverage for flood.

Most homeowners insurance policies do not cover flood. Instead, flood coverage must be purchased separately through the NFIP. In low-to-moderate-hazard flood zones, the reported NFIP purchase rate is estimated at only around 1%, yet NFIP data shows those areas account for over 20% of NFIP claims and one-third of Federal Disaster Assistance for flooding.

“Our innovation around flood coverage is designed to address an underserved market, particularly given the increased risk of flooding due to more intense annual precipitation over the last decades,” said Steve Levy, President, Munich Re America’s Reinsurance Division. ”This product is an attractive alternative for non-coastal homeowners looking for competitively priced, lower-limit coverage to protect their homes and personal property. It is a first step into the private flood insurance marketplace, and one we are taking cautiously and deliberately.”

Munich Re America’s new Inland Flood Coverage Endorsement can be attached to a consumer’s existing Homeowners insurance policy purchased through a participating insurance carrier. Discussions with prospective carriers and state regulatory authorities are currently in progress.

“Average homeowners in a lower flood hazard area seek basic protection for their home and personal property at a competitive price,” said Tim Brockett, Munich Re America’s Senior Vice President, Reinsurance Division Strategic Products. “Our new Inland Flood Coverage Endorsement is designed to solve that need; it can be offered at lower limits and tailored to the underlying homeowners policy, thus eliminating the cost and administrative burden of a separate, stand-alone flood policy."

An independent research survey of insurance agents conducted for Munich Re in the US found that 78% of agents surveyed said this new Inland Flood Coverage Endorsement fills an unmet need that currently exists in the marketplace, and 81% said the coverage would appeal to consumers.

Full implementation services for insurance carriers that choose to offer the Inland Flood Coverage Endorsement will be provided by Hartford Steam Boiler Inspection and Insurance Company, an affiliate of Munich Reinsurance America, Inc.

Flood claims management services will be available through Specialty Insurance Services Corporation (SIS). SIS is an affiliate of American Modern Insurance Group® and Munich Reinsurance America, Inc.

Product and services provided by Munich Reinsurance America, Inc. and its affiliates. Any descriptions of coverage contained in this press release are meant to be general in nature and do not include nor are intended to include all of the actual terms, benefits and limitations found in an insurance policy. The insurance policy and not this press release will form the contract between the insured and insurance company, and governs in all cases. This press release is for information purposes only and is not intended to be legal, underwriting, financial or any other type of professional advice and the recipient should consult with its own advisors with respect to the information contained herein and its applicability to the recipient’s particular circumstances.

Further Information

/Ashleigh-Lockhart.jpg/_jcr_content/renditions/cropped.square.jpg.image_file.120.120.file/cropped.square.jpg)