ILEC Observations:

Whole Life vs Universal Life

properties.trackTitle

properties.trackSubtitle

Monitoring industry experience (mortality, morbidity, lapses) is a key objective for Munich Re’s North American biometric research team. We hope to stimulate discussions with our business partners and across the insurance industry by sharing our key findings. We believe these discussions will lead to a better understanding of the emerging experience and its importance in assessing the underlying risk.

This paper is the third in a series looking at the data provided by the most recent Individual Life Insurance Mortality Report from the Individual Life Experience Committee (ILEC) of the Society of Actuaries. However, this paper is the first to include the latest 2014-15 calendar year ILEC data, which supplemented the prior 2009-13 study. Earlier papers explored preferred wear-off, post-level term mortality and variation in the underlying experience by the number of preferred classes and type of product (click here). This paper will further expand upon experience by product type, with a specific focus on universal life and how it compares to its term and whole life predecessors. Before diving into the experience, it is important to be familiar with the history of these products and to understand the market conditions during the time period when they were sold and why they appealed to so many policyholders.

The rise of universal life

Life insurance companies experienced a difficult period during the late 1970s and early 1980s when the United States was experiencing a period of historically high interest rates.1 At the time, yields on new investments were significantly higher than the portfolio rates credited on whole life cash value products. Policyholders began surrendering their whole life products in order to invest the cash value in the high yielding bond market.2 This, in turn, put downward pressure on term premium rates as these same policyholders replaced their whole life coverage with term insurance, materially increasing the number of new applications in the term insurance market. In order to maintain market share, companies repriced their term products on a continual basis, with rates spiraling downward. Term lapse rates began to rise significantly as healthy individuals were re-underwritten each year in order to take advantage of the new, lower premium rates.3

Insurance companies became concerned that there would be a significant shift in invested assets from cash value insurance products to the financial markets, potentially leading to liquidity and solvency pressures.4

This is the genesis of the universal life (UL) product. At the time, it was seen as a potential solution to these market conditions. As a hybrid product, it combined the benefits of illustrating high investment returns with charging competitive term insurance rates in the early years.4 Compared to whole life, the universal life design was touted widely as being “transparent,” where the

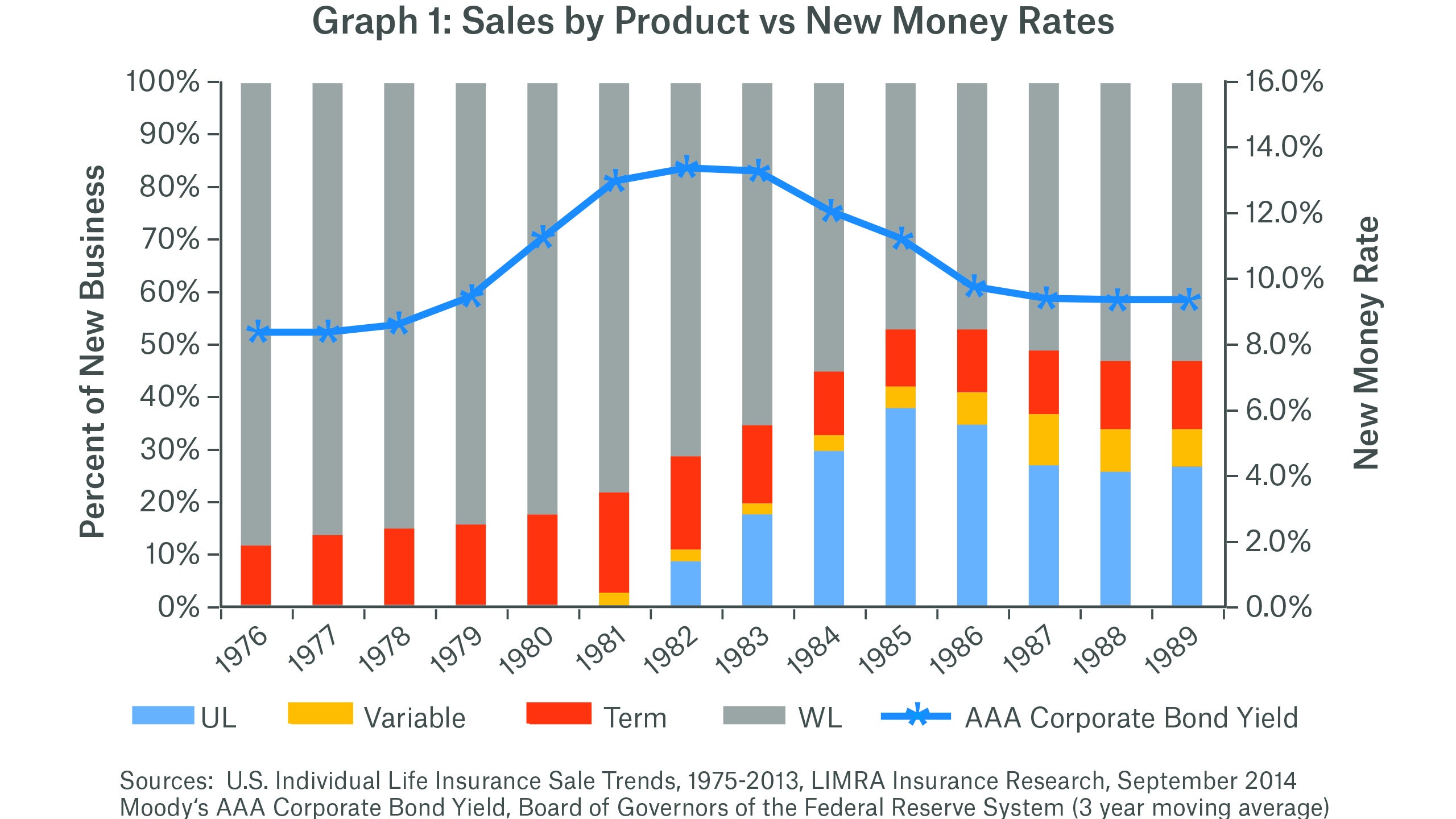

policyowner could see all the factors that determined their UL account value: premiums received, interest credited, deductions from premium loads, administrative fees and cost of insurance (COI) charges.5 Furthermore, UL insurers were able to illustrate using rates of interest significantly higher than the dividend interest rates embedded in whole life policies in the early 1980s. As such, market share quickly began to migrate from whole life to universal life, as shown in Graph 1.

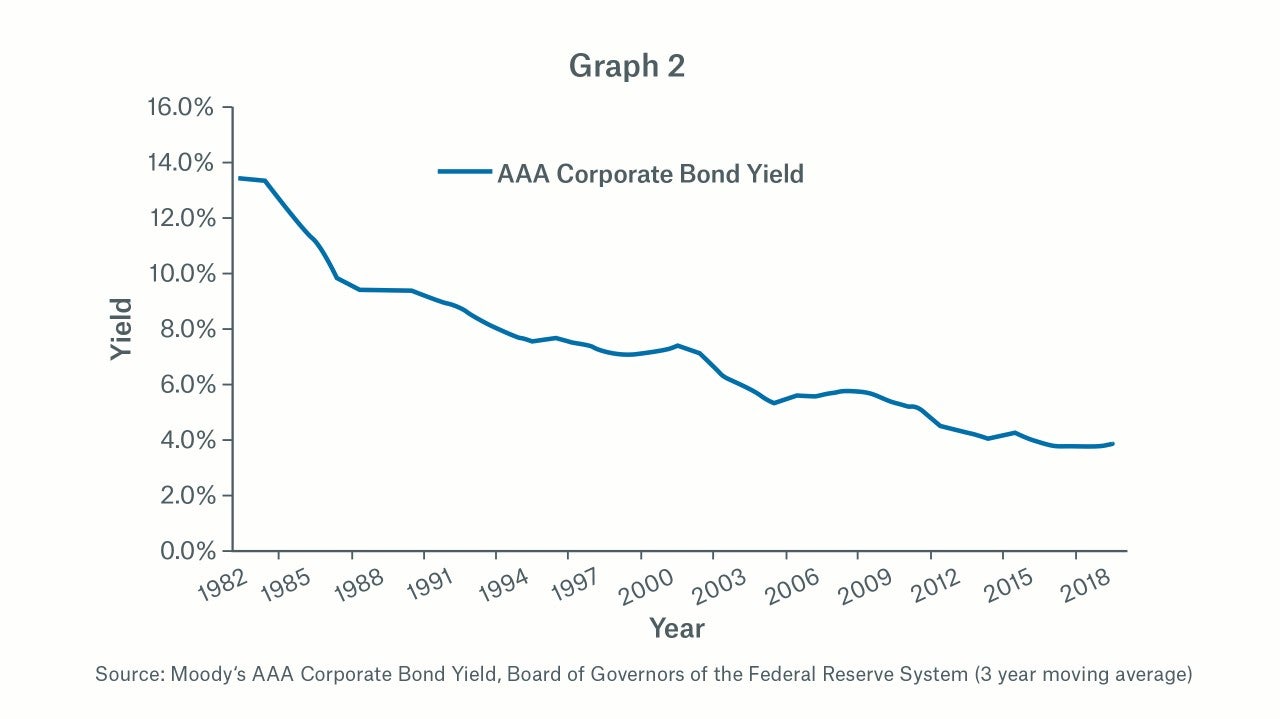

Several years later, as interest rates began to decline in the mid 1980s, so did the non-guaranteed returns of the universal life policies. Eventually, earned rates reached the guaranteed minimum rates specified in these policies, which were approximately 4-5%5 (see Graph 2). Account values started to deviate significantly from policy illustrations. In addition, the investment returns on the account values were not enough to cover the increases in cost of insurance charges, and policyholders were required to pay substantially more premiums in order to keep the policies in force.6 This resulted in reputational challenges for the life insurance industry including multiple “class action lawsuits and individual litigation claiming the insurance companies had used unrealistic projections of future interest rates in their illustrations.”7 This led to lower persistency and subsequent deterioration in mortality experience for life insurance companies.

Persistency and mortality

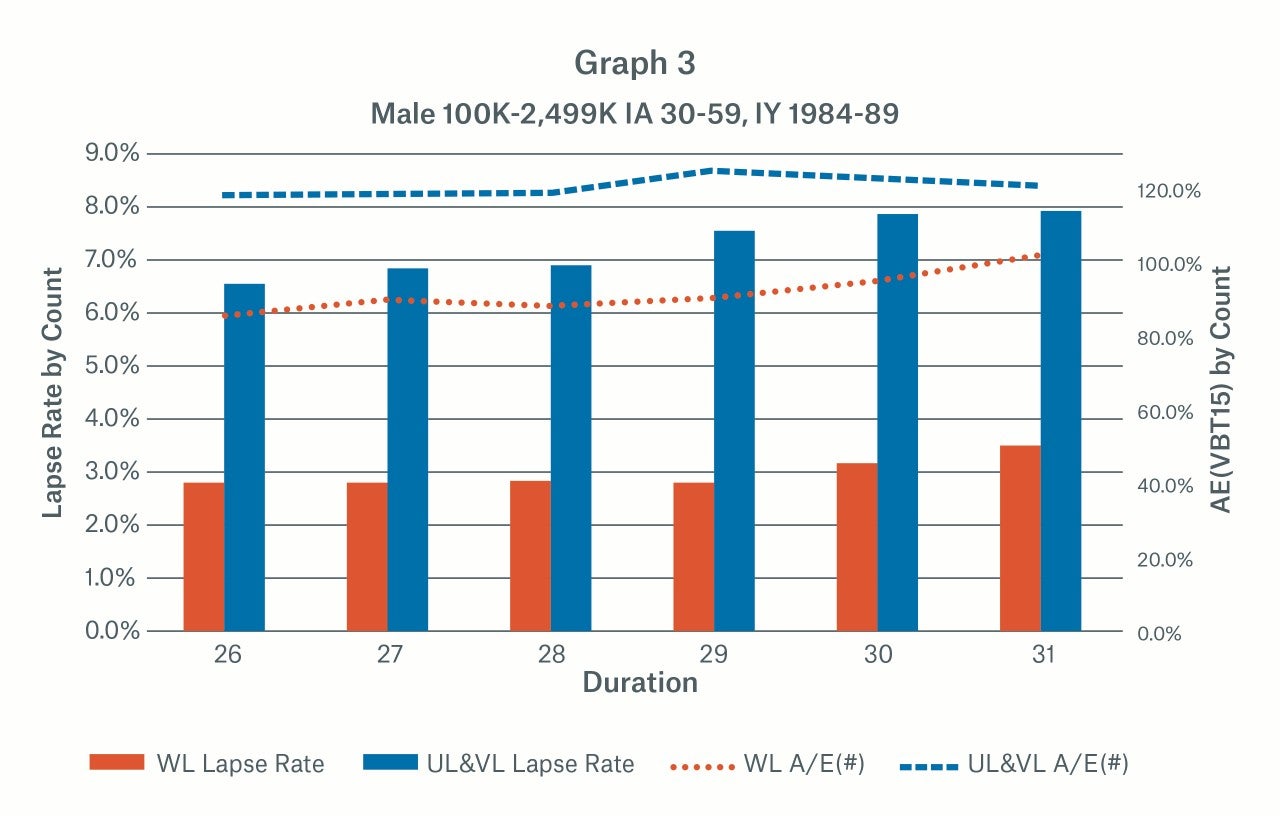

Concurrent with this lapse deviation, we also observed a corresponding increase in UL mortality that can be approximated using Duke’s MacDonald methods where the anti-selective lapse factor is set equal to the excess of the universal life lapse rates over the whole life lapse rates with a near 100% effectiveness assumption.

This same phenomenon continues into later durations and can be observed in the 2009-2015 ILEC data. Graph 3 shows the mortality A/E for universal life and whole life products for key insurance ages from the 1984-1989 sales cohort.8

Industry response and today

Since the time of the first-generation universal life products, many innovative product designs have entered the universal life market, such as the no-lapse guarantee (NLG) feature. In addition, illustration regulations were introduced to inform and protect life insurance consumers, thereby making the current sales environment much different than it had been in the past. We anticipate that these changes will flow through to policyholder behavior. For example, we do not see, and would not expect to see, the same lapse and mortality deterioration to emerge in NLG universal life product experience as we saw in the earlier UL products.

However, questions remain. First-generation universal life products were sold with returns on account values on the order of 10% 7 with contractual guaranteed minimum earned rates on the order of 5%. Currently, many UL products have a guaranteed minimum earned rate of approximately 1%. Would illustrations of 6% tempt fate to repeat the poor experience of the first generation ULs if actual investment returns significantly underperform such illustrations?

Conclusion

We have outlined some of the experience variation that could be useful in setting mortality assumptions for WL and UL products. The ILEC data is a valuable source of recently emerged industry experience. However, a significant heterogeneity of the data should be taken into account by any user in their own work. Actuaries should also try to understand the drivers in the historic data so that they can use sound judgement when setting best estimate assumptions for future business.

It is also important to keep in mind that policyholder behavior is very much influenced by external forces. So, while we can gather valuable insight from historical experience, it should be only one of many factors taken into consideration when setting assumptions.

Again, we believe that sharing some of our findings will stimulate further discussion and will lead to better under-standing of the key drivers behind emerged experience.

Note: The ILEC data files can be found at https://www.soa.org/resources/research-reports/2019/2009-2015-individual-life-mortality/

- The US Prime rate hit a record high of 21.50% on December 19th 1980. http://www.fedprimerate.com/wall_street_journal_prime_rate_history.htm

- Transactions of Society of Actuaries, 1980, Vol. 32, Pricing a Select and Ultimate Annual Renewable Term Product, Jeffery Dukes & Andrew M. MacDonald. https://www.soa.org/globalassets/assets/library/research/transactions-of-society-of-actuaries/1980/january/tsa80v3216.pdf

- Record of Society of Actuaries, 1985, Vol. 11, No. 1, New Developments – Term Insurance, https://www.soa.org/library/proceedings/record-of-the-society-of-actuaries/1980-89/1985/january/RSA85V11N119.pdf

- A Brief History of Universal Life, Douglas C. Doll, The Universal Life Study Note, https://www.soa.org/globalassets/assets/library/monographs/50th-anniversary/product-development-section/1999/january/m-as99-3-06.pdf

- Further Observations on Life Insurance, James H. Hunt, 2013, https://consumerfed.org/pdfs/Evaluate-June-2013.pdf

- Universal Life Insurance, a 1980s Sensation Has Backfired, Leslie Scism, The Wall Street Journal, https://www.wsj.com/articles/universal-life-insurance-a-1980s-sensation-has-backfired-1537368656

- The Financial Basis for No Lapse Universal Life Insurance, Academy of Financial Services, 2010 Annual Meeting, Lise Graham & David R. Lange, https://academyoffinancialservices.wildapricot.org/resources/Documents/Proceedings/2010/4A-Graham-Lange.pdf

- Although the ILEC study is a mortality study and not a lapse study, we have calculated implied lapse rates based on changes in the exposures. The results are consistent with what we observe in proprietary studies.