Munich Re’s

Risk Suite

Turn risks into resilience at the click of a mouse

properties.trackTitle

properties.trackSubtitle

Munich Re ’ s Risk Suite is a range of modular risk management and compliance solutions provided as software as a service by Risk Management Partners, a division of Munich Re. It offers you access to the risk management and compliance tools based on the knowledge and experience of 141 years of one of the world‘ s leading providers of reinsurance, primary insurance and insurance-related risk solutions.

Since the introduction of NATHAN (now Natural Hazards Edition), Munich Re has been a pioneer in the global assessment of natural hazard risks. Munich Re’s Risk Suite offers a selection of well-engineered risk assessment and compliance solutions for technical underwriting, data protection, investment decisions and climate change analysis.

In addition, Munich Re’s Risk Suite draws on years of experience in global data transfer under regulatory requirements. With this extensive know-how, highly efficient solutions for data protection and IT security management have been developed. These solutions provide organisations with a comprehensive set of tools that cover the management of all risk aspects relevant to a company.

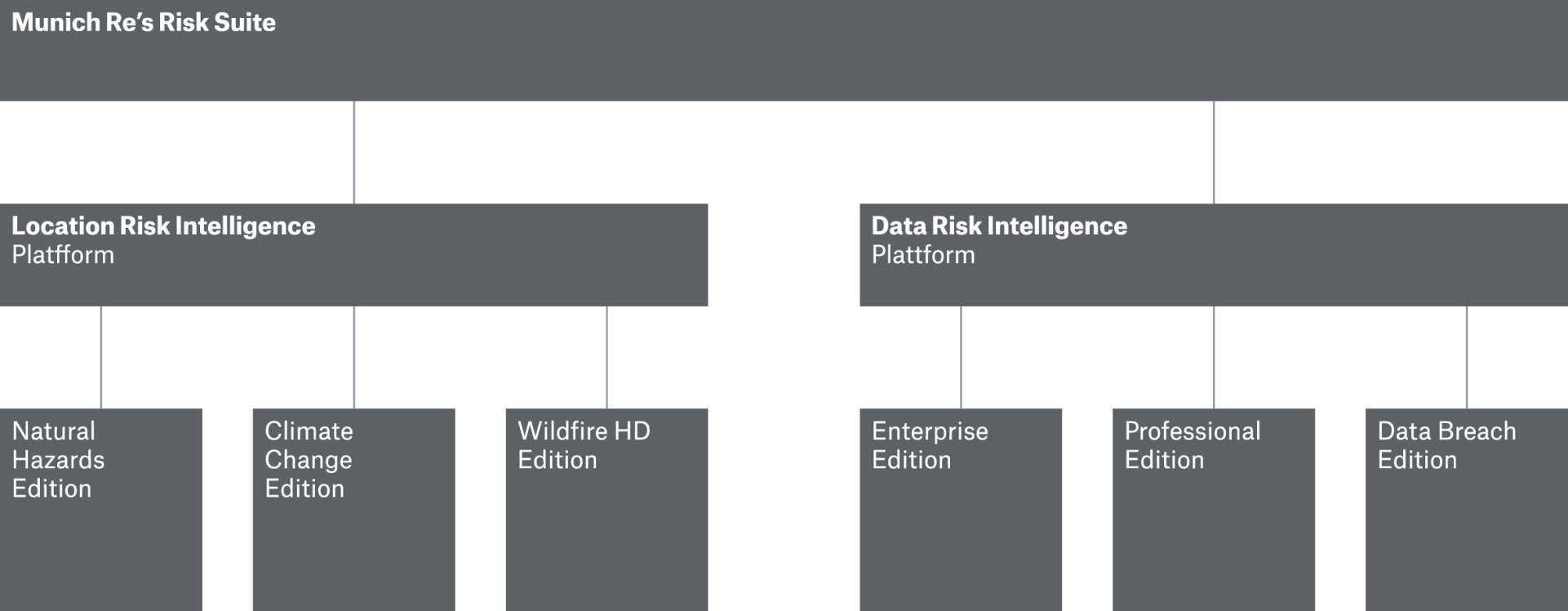

Munich Re’s Risk Suite at a glance

/christof_reinert_373x210.jpg/_jcr_content/renditions/cropped.square.jpg.image_file.320.320.file/cropped.square.jpg)

Munich Re’s Risk Suite is a globally unique software-as-a-service offering for risk management. On the one hand it covers the physical and financial risks to which an organization’s assets are exposed as a result of natural catastrophes and the effects of climate change, and on the other it ensures the GDPR-compliant management of risks relating to data protection and IT security.

Munich Re’s

Location Risk Intelligence Platform

This modular SaaS solution keeps you in full control of natural disaster and climate change risk analysis.

You can choose from three different editions: Natural Hazards Edition to generate assessments on the basis of data from past events, Climate Change Edition for future-related assessments on the basis of climate change models, or Wildfire HD Edition with higher resolution to better resolve Wildland Urban Interface (WUI) - the key zone for high risk and high-value locations.

How you benefit from Munich Re’s Location Risk Intelligence Platform.

As an Underwriter …

- … you have access centrally to all locations and to the Munich Re risk scores for your risk assessments

- … you can add technically-based acceptance criteria such as standard risk ranking and geographical accumulation analyses to your risk assessments

- … your decisions will be even better because they will be substantiated, as you have access to Munich Re's expert knowledge gained over 141 years of risk assessment, which is unparalleled anywhere in the world

Recommended solution: Natural Hazards Edition

As a Risk Manager …

- … you will optimise your portfolio by evaluating your risk profile

- … you will take decisions much more quickly and hence more efficiently, because you produce your risk analyses globally at a central location

- … you can better quantify your risk appetite, because you can identify and visualise risk hotspots

- … you will take substantiated decisions on approving loans using Munich Re risk models

Recommended solution: Natural Hazards Edition

As an ESG Manager …

- … the solution will support you in the production of your TCFD report by translating physical events into a clear scale model with graphic illustrations

- … your assessments of the risks resulting from climate change will be even better because they will be substantiated, as you have access to Munich Re's expert knowledge gained over 141 years of risk assessment, which is unparalleled anywhere in the world

- … you can clearly differentiate the changes in risks for your portfolio expected as a result of climate change from the existing risks, and adapt your strategy accordingly

Recommended solution: Climate Change Edition

As a Real Estate Portfolio Manager/Investor …

- … you will have access to Munich Re's expert knowledge gained over 141 years of risk assessment, which is unparalleled anywhere in the world, so your decisions will be even better because they will be substantiated

- … you can identify an accumulation of risks at an early stage and move your investments out of high-risk areas into a balanced, optimised portfolio

- … you can identify not only possible VARs (values at risk), but also opportunities, enabling you to review your investment or exit strategies and adjust them if necessary

Recommended solutions: Climate Change Edition in combination with Natural Hazards Edition

As a Manager of Infrastructure Projects/Investor…

- … you can already evaluate the climatic impact on your infrastructure projects as part of the due-diligence process, enabling you to take substantiated decisions

- … you will be in a position to identify not only possible VARs (values at risk), but also opportunities, enabling you to review your investment or exit strategies and adjust them if necessary

Recommended solutions: Climate Change Edition in combination with Natural Hazards Edition

Munich Re’s

Data Risk Intelligence Platform

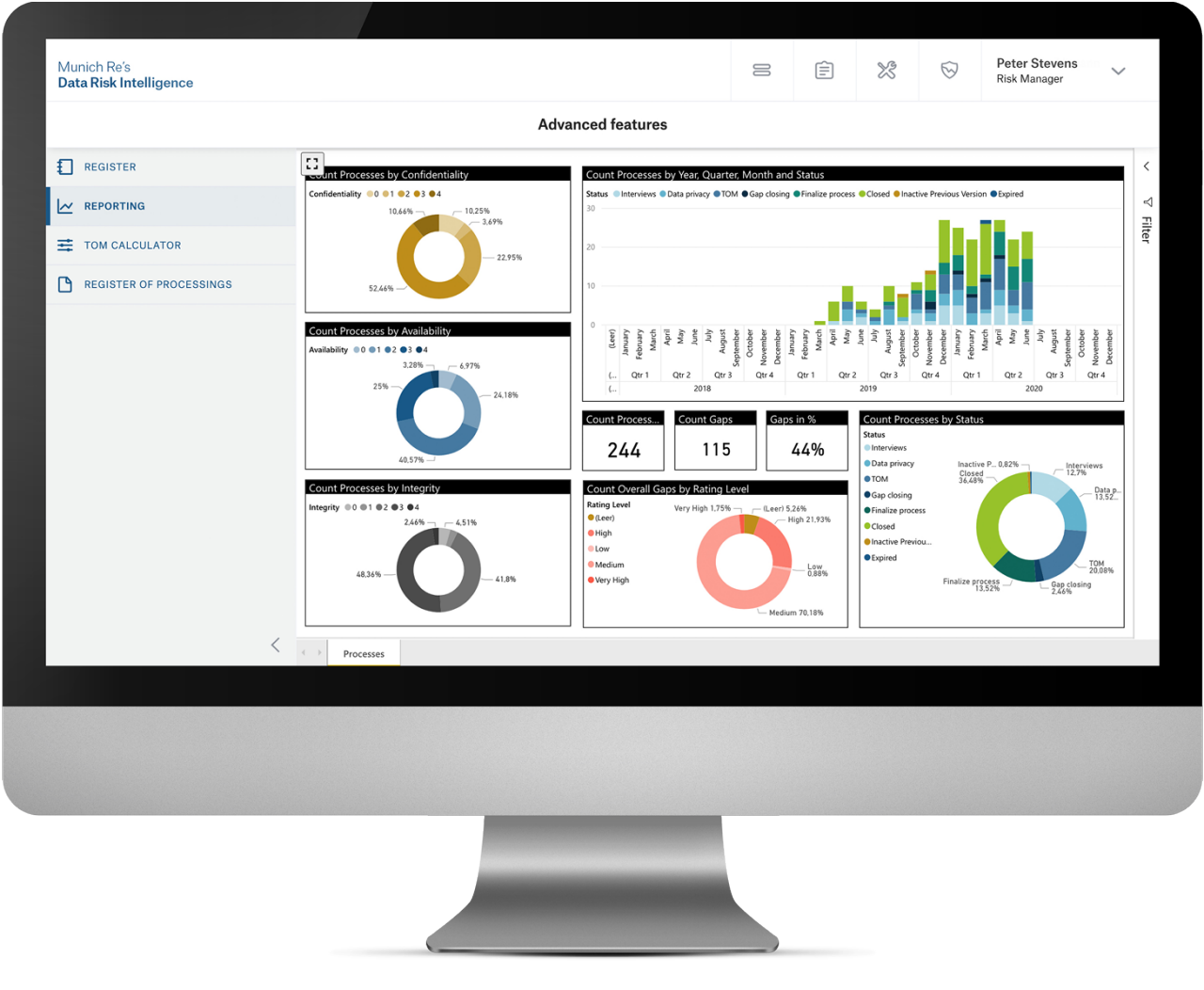

It is a comprehensive and at the same time modular SaaS solution for risk-based data protection and IT security management, including third-party risk assessment.

This solution considerably simplifies and accelerates the process of data and information protection and gives organisations a comprehensive overview of the current status of their data and information protection and their IT risk management.

How you benefit from Munich Re’s Data Risk Intelligence Platform.

As a Data Protection Officer …

- … the solution enables you to ensure a comprehensive and structured approach to auditing data protection, IT compliance and IT security processes, together with reliable, GDPR-compliant documentation

- … you can replace the error-prone, tedious, manual recording of vulnerabilities and in so doing decisively simplify and accelerate your processes in data and information protection as well as in IT risk management

- … you gain in-depth insights into your own IT landscape, while identifying potential vulnerabilities at an early stage creates a solid factual basis for your decisions regarding the most suitable technical and organisational measures

As a Chief Information Security Officer …

- … you obtain a comprehensive overview of all the critical processes and IT applications relating to data and information protection in your company, which enables you to initiate suitable technical and organisational measures based firmly on the facts

- … the evaluation of the IT risk potential inherent in your system enables you to implement a comprehensive risk assessment, including identification of any vulnerabilities

As a CEO …

- … by applying this solution you will not just improve the associated processes, you will also effectively enhance your reputation with customers, competitors and the regulatory authorities

- … based on the comprehensive processes and their GDPR-compliant documentation you substantially reduce the risk of data and information security breaches, and therefore maximise your protection against the corresponding financial penalties

- … you save considerable implementation and administrative costs by providing an out-of-the-box solution

- … thanks to its multilingual and holistic global approach you can deploy the solution worldwide and therefore across corporate groups.

Trust is good, certificates are even better

/Schmitzberger-Nicole.jpg/_jcr_content/renditions/cropped.square.jpg.image_file.320.320.file/cropped.square.jpg)

We believe you can never have too many good partners. Are you a value-added reseller, managed service provider or system integrator and would like to include our solutions in your portfolio? Then simply apply for our Risk Suite Partner Programme.