How Risk Management Partners can help companies adapt to climate change

properties.trackTitle

properties.trackSubtitle

The EU Taxonomy is a tool designed to help investors, companies, insurers, and banks evaluate and disclose how environmentally friendly their investments into a wide range of economic activities are. Companies, large and small, as well as banks and investors can potentially benefit from “green financing” opportunities enabled by the shared standard for sustainable economic activities it has introduced.

Jump directly to the bigger picture

…disclose the results and details (e.g., coverage) of the assessment, and the actions taken in response.”

The motivation behind the EU Taxonomy

Currently, there are many different disclosure forms that companies must complete to apply for sustainable investment assistance. And each form has its own criteria and definitions of “sustainable,” which can be both time-consuming and confusing. The aim of the EU Taxonomy is to create a unified standard.

Of particular relevance in this article are any investments required to adapt buildings and infrastructure to cope with increased physical climate risks. Because companies need to identify all criteria that align these investments with the Taxonomy and, as such, define them as “green.”

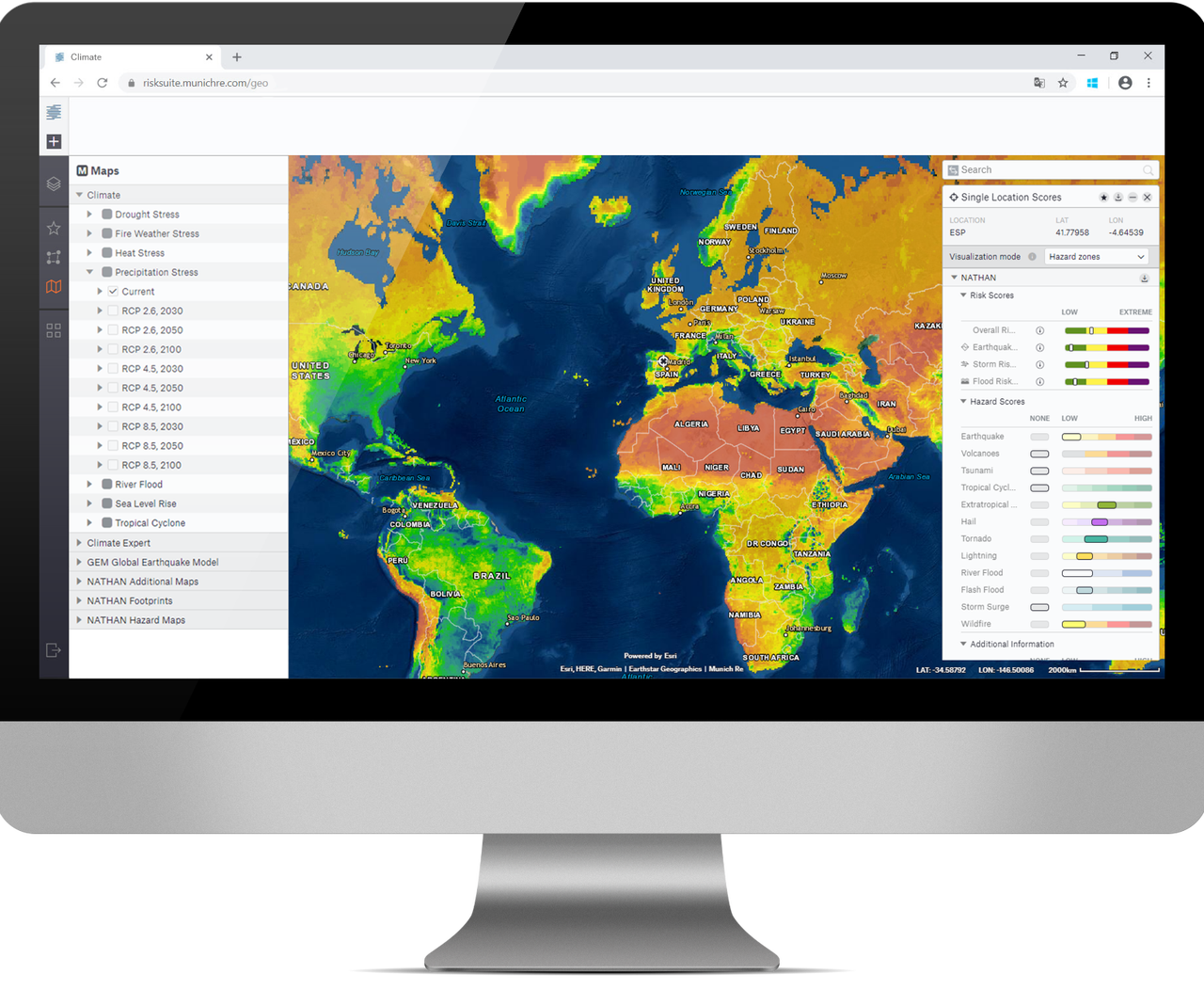

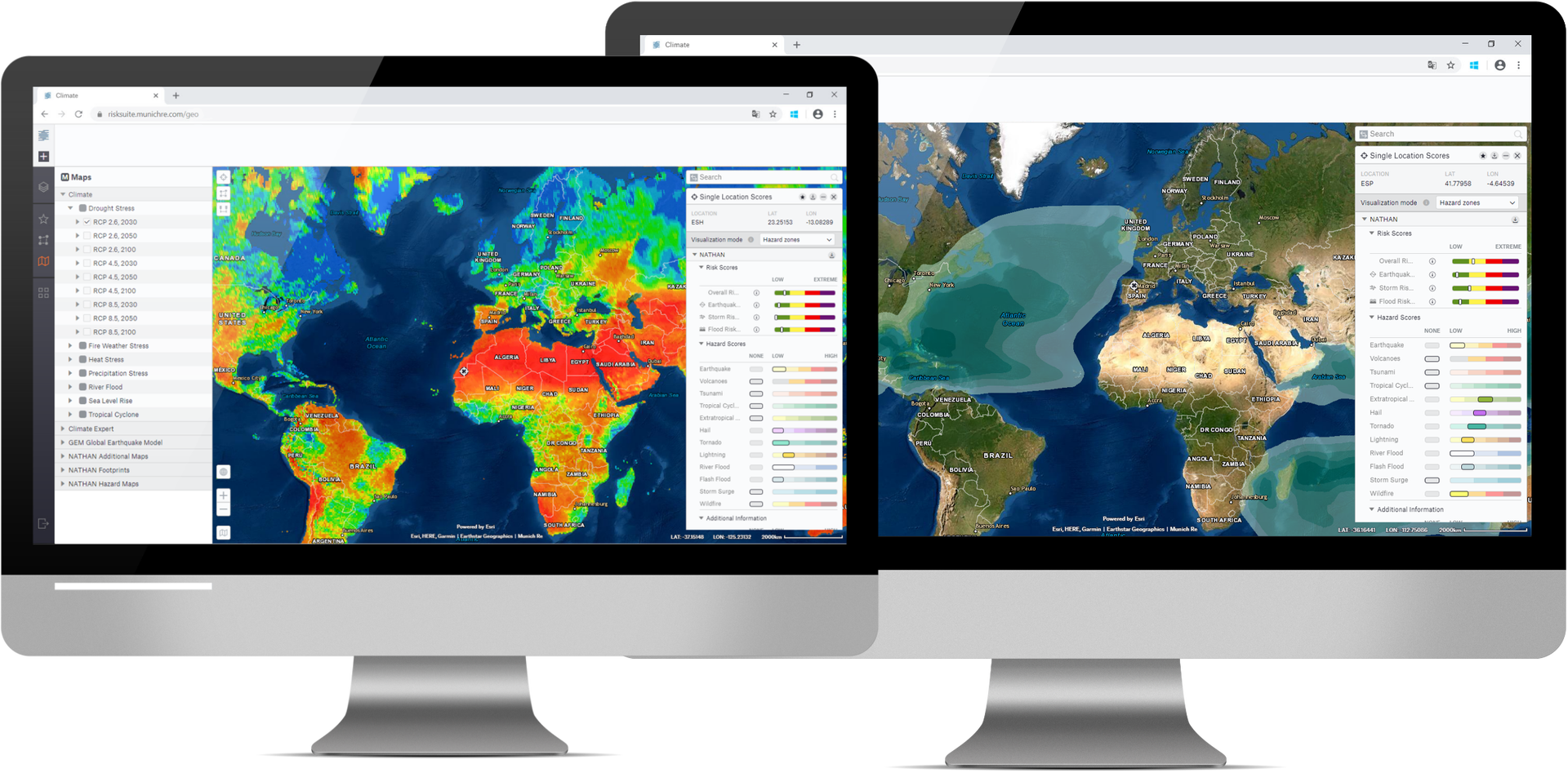

The good news for organisations wishing to address this challenge is that Risk Management Partners (RMP) offer a Location Risk Intelligence (LRI) Platform that includes relevant scores for most risks included in the Taxonomy. This makes it possible for companies to assess physical risks related to EU Taxonomy disclosures on demand.

Physical risks included in the EU Taxonomy

| Temperature-related | Wind-related | Water-related | Solid mass-related | |

|---|---|---|---|---|

| Chronic | Changing temperature (air¹, freshwater, marine water) | Changing wind patterns | Changing precipitation⁴ and types (rain, hail, snow/ice) | Coastal erosion |

| Heat stress¹ | Precipitation⁴ and/or hydrological variability | Soil degradation | ||

| Temperature variability⁴ | Ocean acidification⁴ | Soil erosion | ||

| Permafrost thawing¹ | Saline Intrusion | Solifluction | ||

| Sea level rise³ | ||||

| Water stress² | ||||

| Acute | Heat wave¹ | Cyclone, hurricane, typhoon¹ | Drought³ ⁵ | Avalanche⁴ |

| Cold wave/Frost¹ | Storm² (including blizzards, dust and sandstorms) | Heavy precipitation and types (rain¹, hail², snow/ice) | Landslide² | |

| Wildfire¹ | Tornado² | Flood (coastal² ⁵, fluvial¹, pluvial², groundwater) | Subsidence⁴ | |

| Glacial lake outburst |

1Risk predictions for present day, 2050 and 2100 available

2RMP's Location Risk Intelligence provides relevant scores for the present

3RMP's Location Risk Intelligence provides relevant scores for the future

4 Coming 2023

5 Additional time horizons are coming 2023

Advantages of putting the LRI Platform to work for your business

In addition to helping your organisation qualify for green financial assistance, the LRI platform can identify the most relevant perils your company faces and save it significant amounts over the long term. Because the platform enables it to ensure specific insurances are in place to cover the most likely hazards, as well as to invest in adaptation measures to protect against the ever-increasing risk of natural catastrophe. Further, it will ensure you avoid investing in the mitigation of perils your organisation is unlikely to be affected by.

The report on the EU Taxonomy includes a use case which highlights the utility of RMP’s risk assessment solution in securing “green financing”. It illustrates the points made above by discussing how to evaluate and adapt to increased physical risks on company buildings. The full case is in the white paper available via the link below.