Solutions by

Realytix

User Centricity

Designing innovation from idea to market

Benefits at a glance

- Much reduced time to market

- Customizable, flexibly implementable platform

- Digital distribution

- Increased (process) efficiency, cost and time savings

Solutions by

Infrastructure Risk Profiler

User Centricity

Holistic risk assessment for infrastructure investments

Benefits at a glance

- Holistic, objective and transparent overall perspective

- Solid basis for an informed investment decision to better secure the return on their investments

- Thorough analysis within up to 4 weeks

- Comparability of different infrastructure projects that match their individual appetite

Solutions by

NatCatSERVICE

User Centricity

Complex risk modelling with regard to natural perils

Benefits at a glance

- Flexible, easy to use and fast

- Reliable data on natural catastrophes back to year 1980

- Hazard-specific analyses (e.g. tropical cyclones, hurricanes/typhoons, earthquakes)

- Charts can be shared directly (social media channels/download)

Solutions by

Risk Suite: Location Risk Assessment

User Centricity

Comparing risk assessments on a global scale

Benefits at a glance

- Comprehensive Geo Coder

- Hazard Score rating on a worldwide base

- Risk evaluation on a global scale

- Munich Re risk insights included

- Climate change impact evaluation

Solutions by

Risk Suite: Claims

User Centricity

Comprehensive business insight on one platform

Benefits at a glance

- Huge amounts of information on losses, assets and other information processed and enriched with Munich Re data

- Claims data analysis

- Portfolio visualization and analysis

- Accumulation analysis

- Reporting via customized dash boarding

Solutions by

Risk Suite: Compliance

User Centricity

Implementing the requirements of GDPR

Benefits at a glance

- Easy-to-use dashboard for data protection professionals

- User friendly, fast and secure for all involved stakeholders

- Automatic generation of required documents legally required by GDPR

Solutions by

IMPROVEX

Connected World

Portfolio management with dynamic data exchange

Benefits at a glance

- Strengthens participants’ competitive position and opens up new possibilities to identify attractive business potential

- Interactive heat map helps to identify “white spots” and allows to challenge the underwriting and growth strategy

- Next-level empirical pricing parameters make it possible to optimize excess pricing and attachment point strategy

Solutions by

Cyber Solutions

Connected World

A new kind of cyber insurance – beyond traditional reinsurance

Co-operation and underwriting services include

- Legal advice and wording analyses

- Workshops, training and client seminars

- Technical risk assessment support

- White-label concept design for cyber products

- Threat intelligence sharing and cyber-claims information exchange

- Innovative cyber products and co-creation in the cyber network

Solutions by

IoT Solutions

Connected World

Integrating tech, risk management & financing

Benefits at a glance

- Cutting edge technology (hardware, software and retrofitting)

- Use-case development

- Risk management services

- Ecosystem partners

- Tailored financial solutions

Solutions by

MIRA Digital Suite

Artificial Intelligence

Accelerating life insurer’s underwriting and claims handling

Benefits at a glance

- Faster process time in underwriting and claims handling

- Innovative, flexible and customized products

- More efficient processes inside the company

- Improved risk results

- Access to the newest, continuously updated insurance solutions

Solutions by

FIVE

Artificial Intelligence

Rules-based investment strategies

Benefits at a glance

- Access to a selection of quantitative investment strategies

- Better risk transfer by sourcing complete investment solutions directly from Munich Re

- Attractive payouts with guarantees and insurance covers

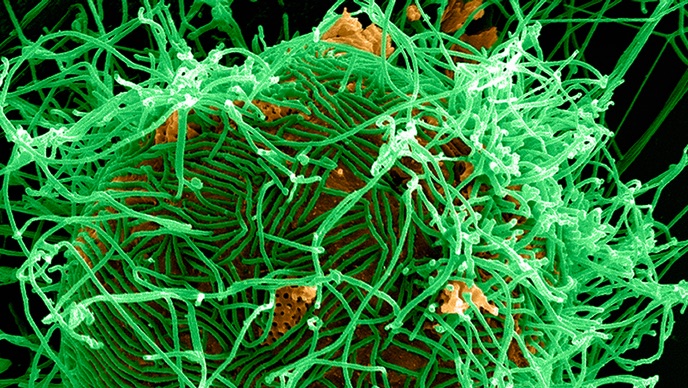

Solutions by

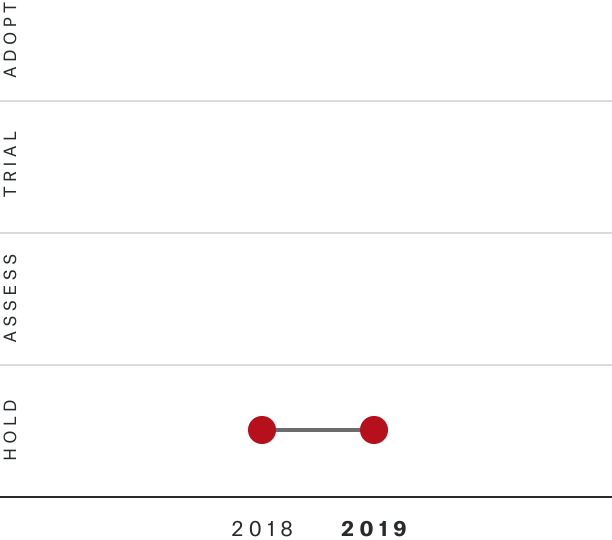

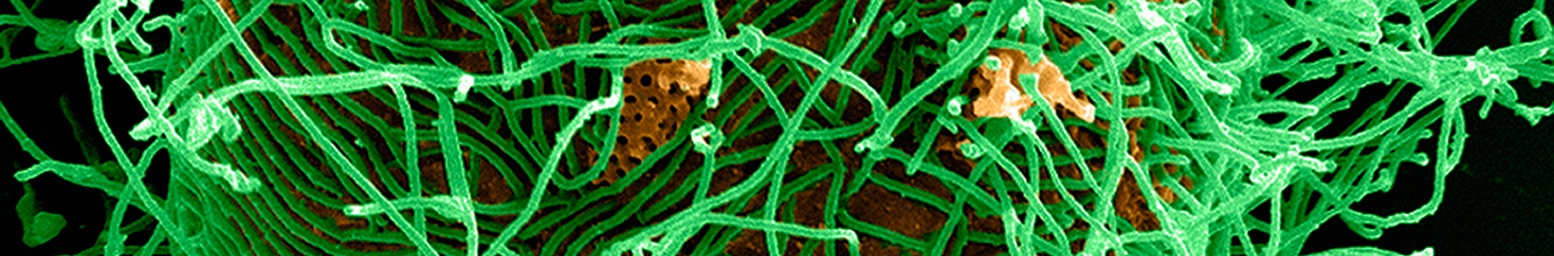

Epidemic Risk Solutions

Artificial Intelligence

Holistic solutions saving lives, protecting economies

Benefits at a glance

- Revenue stability

- Balance sheet protection

- Indemnification of lost revenues or profits

Solutions by

Remote Claims Adjusting

Disruptive Technologies

Algorithm-based, automated claims processing for natural catastrophes

Benefits at a glance

- Lower claims handling costs

- Improve reaction times

- Enhance fraud detection possibilities

Solutions by

One Cat Parametric Solutions

Disruptive Technologies

Comprehensive and rapid response to natural catastrophes

Benefits at a glance

- Parametric triggers ensure rapid recovery

- Covers previously uninsurable risks from natural catastrophes

- Unprecedented level of transparency

- No deductibles

- Reduced claims-related expenses

© iStock

© iStock

© Munich Re

© Munich Re

© Plainpicture/Westend61/Martin Rietze

© Plainpicture/Westend61/Martin Rietze

© Munich Re

© Munich Re

© Shuoshu / Getty Images

© Shuoshu / Getty Images

© Wavebreak Media ltd / Alamy Stock Photo

© Wavebreak Media ltd / Alamy Stock Photo

© Bestbrk / iStock / Getty Images

© Bestbrk / iStock / Getty Images

© Munich Re

© Munich Re

© Munich Re

© Munich Re

© Munich Re/Daniel Grizelj

© Munich Re/Daniel Grizelj

© Munich Re

© Munich Re

© Callista Images / Getty Images/Cultura RF

© Callista Images / Getty Images/Cultura RF

© Mark Downey / Radius Images

© Mark Downey / Radius Images

© Millionhope / Getty Images

© Millionhope / Getty Images