Munich Re’s cutting-edge telematics solution

Innovate and improve your book of business with a proven, fully customizable or white-label app solution and our comprehensive consulting services

properties.trackTitle

properties.trackSubtitle

We offer hands-on support throughout the entire product development and technical implementation process. Our experienced team of motor experts is at your side from business case to product ideation, to market launch and beyond.

You benefit from in-depth strategy consulting, strong insurance and technological expertise, and vast project management experience.

Our aim is to improve your profitability and portfolio quality, boost your competitiveness, and increase your customer-centricity with our innovative, tailored and technologically advanced telematics product.

We offer you access to state-of-the-art technology and superior risk scoring services and ensure that you can take full advantage of the product, implement it successfully, and achieve your goals.

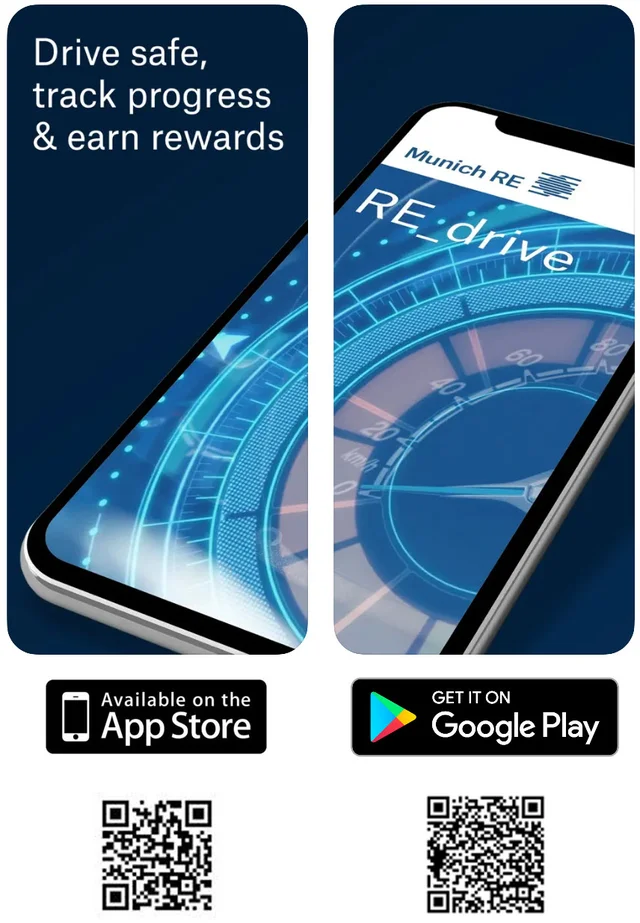

Our telematics product can be implemented as a plug-and-play white-label telematics app or as a fully flexible Software Development Kit. The latter implements our full Telematics functionality within clients’ existing insurance app and therefore allows a fully customizable user interface and experience.

Why Usage-Based Insurance (UBI)?

UBI is nothing new, so why is it a strategic topic?

UBI has been around for more than a decade, but only in the past few years have technological advances, improved connectivity and wider customer acceptance fostered its quality and adoption.

Today, telemetry, user behaviour data and mobility monitoring can enhance the entire insurance value chain, fuel new product developments, and enable new business models.

The macroeconomic developments over the past few years have greatly increased the volatility of end customers’ behaviour, which makes it more important than ever to adequately monitor your portfolio, to engage with your customers, and to develop pricing based on customer behaviour and real-time insights. In this respect, UBI holds substantial innovative potential and offers a range of benefits for insurers:

Risk Assessment

Retention

Claims

Our tried and proven consulting approach in a nutshell

We have established a long-term strategic partnership with The Floow as a leading telematics & analytics service provider

The Floow - From detect and repair to predict and prevent / Making mobility safer, smarter and cheaper for all

The Floow, part of NASDAQ-listed Otonomo Technologies, is our trusted partner since several years. The Floow follows the clear vision to make vehicles safer, smarter and cheaper for all.

The Floow has developed superior risk scoring techniques, a crash detection algorithm, and sophisticated software solutions. From day 1, The Floow has been driven strongly by scientific research, particularly computer, data and social sciences. They deliver the highest quality telematics technology and services in a uniquely, customer-focused manner, which not only benefits clients, but also delivers great value to drivers and other road users.

The hybrid project approach of Munich Re and The Floow allows us to focus on our core expertise and, together with our clients, to generate synergies that produce best-in-class solutions adjustable to the clients’ needs.

Download our Use Cases

Meet RE_drive

Would you like to know more?

Get in touch with our experts right away