© TODCHAMP / Getty Images

Public-Private Partnership Solutions

Risk management through public-private partnerships

Supporting public entities to strengthen their resilience

properties.trackTitle

properties.trackSubtitle

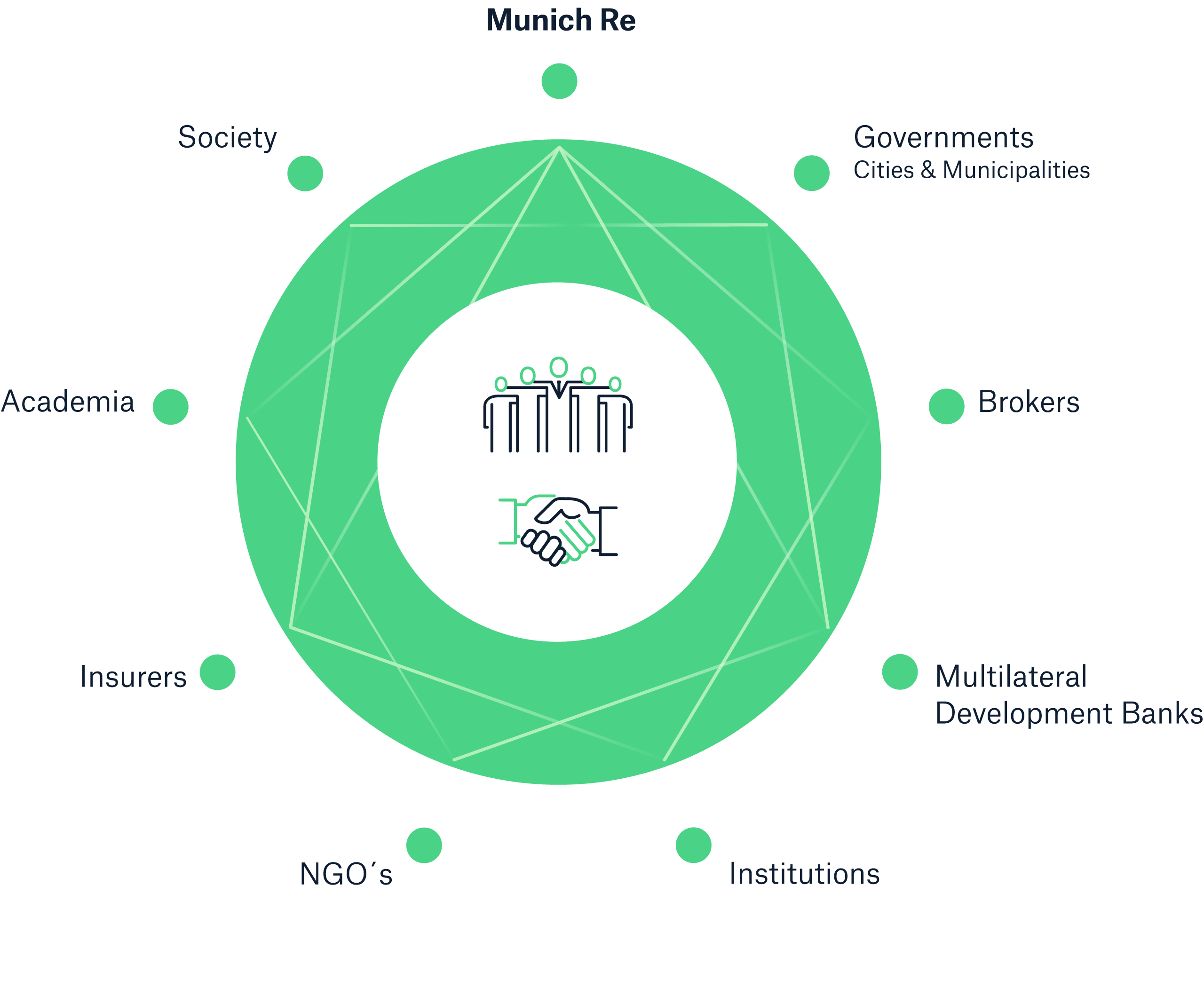

Climate change, natural disasters, pandemics, cyber risks: Global threats present public entities with growing challenges. To tackle their impact, Munich Re is committed to supporting the public sector with a proactive risk management. Our objective: A close cooperation between the public and the private sector.

"The UN's 2030 Agenda for sustainable development urgently calls for action and solid partnerships. We at Munich Re help bring together all relevant stakeholders: Governments, development banks and leaders of all industries."

Stefan Schüssele

Strategy & Partnership

Risk management solutions for public entities:

What's in it for you?

Blended finance

Innovative structures making use of development finance to mobilise private capital towards sustainable development

Global Challenges

Hybrid solutions of insurance and capital markets instruments for new and emerging risks

Strategic cooperation

Partnership to bridge the gap between the public and private sector, whereby stakeholders of the industry, governments and development banks are brought together

Holistic approach

Support in

- understanding and preparing for risks

- mitigating

- insuring

- recovering from disasters, and

- building back better.

- understanding and preparing for risks

- mitigating

- insuring

- recovering from disasters, and

- building back better.

Together, we engage to support the UN resolution aiming to build a better and more sustainable future for all human beings worldwide

The 2030 Agenda finds its footing on four pillars. These form an interdependent framework which guides global and national development schemes in collaborative partnerships.

Florian Gruson, Head of Public-Private Partnership Solutions, shares his views on the urgency for cooperation and the role of the insurance industry to best plan resilience and enhance communities' preparedness in the face of critical events.

Successful collaborations and partnership for increased resilience worldwide

Latin America and the Caribbean

North America

Southeast Asia

Belize blue bond

Californian hospitals

MSME in developing Asia

World’s first parametric disaster insurance integrated in a sovereign bond issuance

Non-damage business interruption risk cover

Innovative risk solutions for the underinsured and underbanked

So as to boost the resilience of governments and hence of communities to climate risks, Willis Towers Watson and Munich Re successfully collaborated. The latter provided the risk capacity to support a parametric catastrophe wrapper around Belize’s debt for marine conservation.

Insuring healthcare providers, at the frontline of the local fight against pandemics, enables them to sustainably offer quality care across demographics. Parametric triggers, indemnity settlement as well as a business continuity plan contribute to the improvement of the overall resilience against pandemics and epidemics.

By empowering and partnering with key economic, digital players, Munich Re co-develops and offers embedded financial solutions for Asia’s emerging micro-, small- and medium enterprises (MSME). The protection gap for vulnerable populations and businesses is hence reduced and payouts are ensured in a targeted and swift manner.

Contact:

Michael Roth

Senior Manager Origination

Capital Partners

Email:

MRoth@munichre.com

Contact:

Gunther Kraut

Global Head of Epidemic Risk Solutions

Munich Re Markets

Email:

GKraut@munichre.com

Contact:

Weihao Choo

Head of Global Consulting

Japan, India, Korea and Southeast Asia

Email:

WChoo@munichre.com

"Partnering with the public sector in achieving the Sustainable Development Goals is our priority. Join us on this journey!"

Ralf Weiß

Business Development & Consulting

Purpose-built risk management solutions for the public sector

We are members of

Would you like to know more?

Get in touch with our experts right away.

3

Contact our public sector experts

Florian Gruson

Global Head of Public-Private Partnership Solutions

Stefan Schüssele

Strategy & Partnership

Ralf Weiß

Business Development & Consulting