Agriculture reinsurance solutions for insurers

Sharpen your competitive edge with a diverse range of agricultural reinsurance solutions that go far beyond the traditional

properties.trackTitle

properties.trackSubtitle

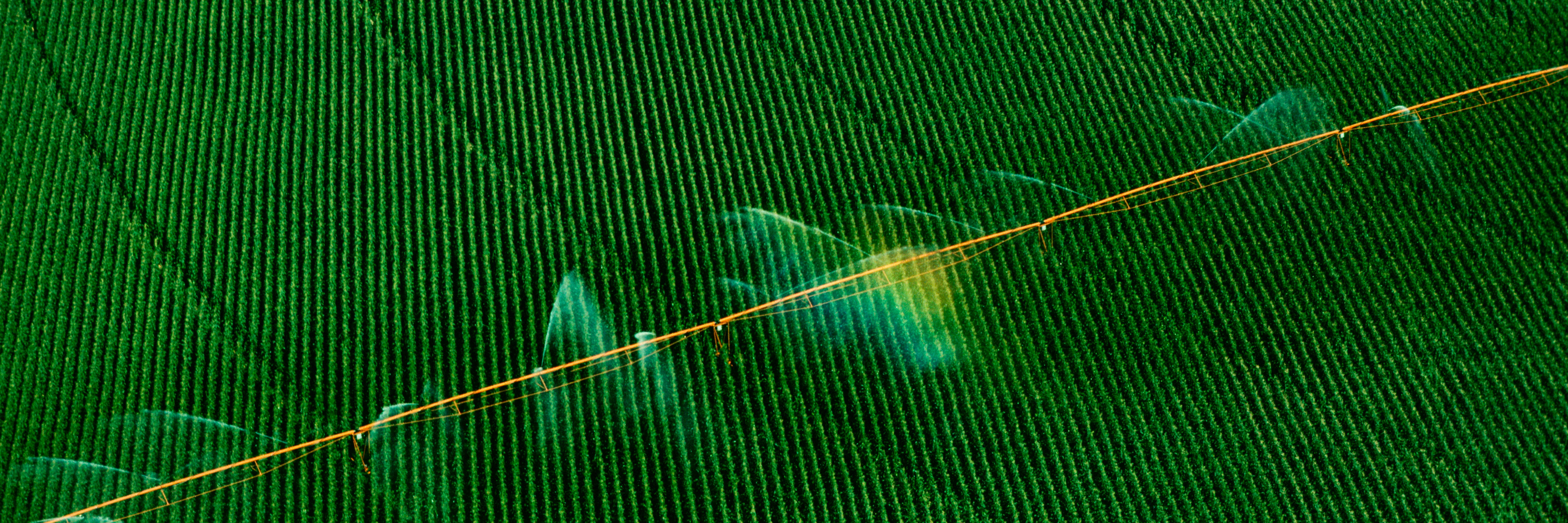

Agricultural reinsurance solutions for insurance companies worldwide

Working with us enables you to benefit from our financial strength, our expertise and our global experience in supporting insurers of agricultural risks.

As a leading agricultural reinsurer, we offer our clients around the world tailored agricultural solutions that include capital relief transactions and go well beyond the standard approach to reinsurance.

Our range of agricultural reinsurance solutions

Risk capacity

Portfolio management

Product design that puts insurers in front

As an agricultural insurance provider, you’re under constant pressure to maintain your competitive edge. Having a strong partner in reinsurance certainly helps. Wherever you are in the world, we can assist you in factoring in the possible impacts of climate change, such as increasing rainfall, heatwaves, droughts, unseasonable frosts, and windstorms. These conditions present serious challenges to your business as an insurer of agricultural risks. And our agricultural insurance experts stand ready to assist you with individual, needs-based reinsurance solutions, as well as advice on product design for the following lines:

- Crop hail insurance: Coverage of hail on standing crops

- Multi-peril crop insurance: Coverage of all-natural perils (drought, excessive rainfall, frost, windstorm, etc.)

- Revenue insurance: Coverage of natural perils (drought, excessive rainfall, frost, windstorm, etc.) linked to commodity price fluctuations

- Livestock insurance: Coverage includes animal accident and life insurance, transport and quarantine, business interruption due to epidemics, diseases, technical malfunction

- Greenhouse insurance: Coverage of the failure of technical facilities (e.g. heating, irrigation systems) and natural hazards (hail, wind, etc.)

- Insurance of forestry plantations: Coverage of forestry plantations, risk management of planted trees

- Aquaculture insurance: Coverage of aquaculture stock and equipment

Public-private partnerships

Today, farmers find it more and more difficult to rely on stable crop yields. To counteract this trend, particularly in poorer countries, initiatives from the World Bank and other multilateral institutions, non-government organizations and donors increasingly turn to agricultural insurance. This also has application in industrialized countries where, for example, they make widespread multi-peril crop insurance possible.

Governments and the insurance industry want to ensure that farmers can make long-term investments without incurring substantial risks. Public-private partnerships (PPPs) are part of an intelligent solution at national level in which farmers, governments and the insurance industry work together. Our role is to connect the different players and develop optimum solutions, based on our expertise and global business connections. There are already multiple successful PPP models worldwide, which Munich Re builds on when assisting you in the design of a new solution.

Capital market solutions

What makes Munich Re unique as an agricultural reinsurer?

The year Munich Re began to reinsure agricultural risks