How agricultural insurance works for agribusiness

Agricultural risks affect the entire supply chain

properties.trackTitle

properties.trackSubtitle

A comprehensive approach to climate risks in agriculture

Agricultural production depends on the weather more than any other economic sector. The industry faces greater agricultural risks than ever before as a result of the already noticeable effects of climate change.

No matter whether you’re a producer, an input supplier, an agricultural machinery manufacturer, grain trader, or a player in the food industry, agricultural risks affect the entire supply chain.

Agricultural insurance solutions that fit

Weather index insurance

Weather index solutions allow you to manage or "hedge" weather-related risk exposures.

Importantly, weather index insurance functions as a parametric insurance that pays out as soon as it is triggered by a specified weather event. It offers the further advantages of being easy-to-understand, transparent, and customizable.

The solution absorbs a precisely agreed portion of exposure, leaving a residual risk, also known as basis risk.

Yield index insurance

The parameter of yield is what defines the crop shortfall risk. Yield can be aggregated on a regional level, on a farm or field level. So, where consistent historical data is available, yield index covers are the solution of choice.

Yield index covers automatically pay out if the actual yield falls below an agreed percentage of the yield guarantee.

We have the right mechanisms in place to price the crop shortfall risk and to assess the actual yield. These include the use of digital tools such as crop yield modelling, remote sensing, data analytics and artificial intelligence.

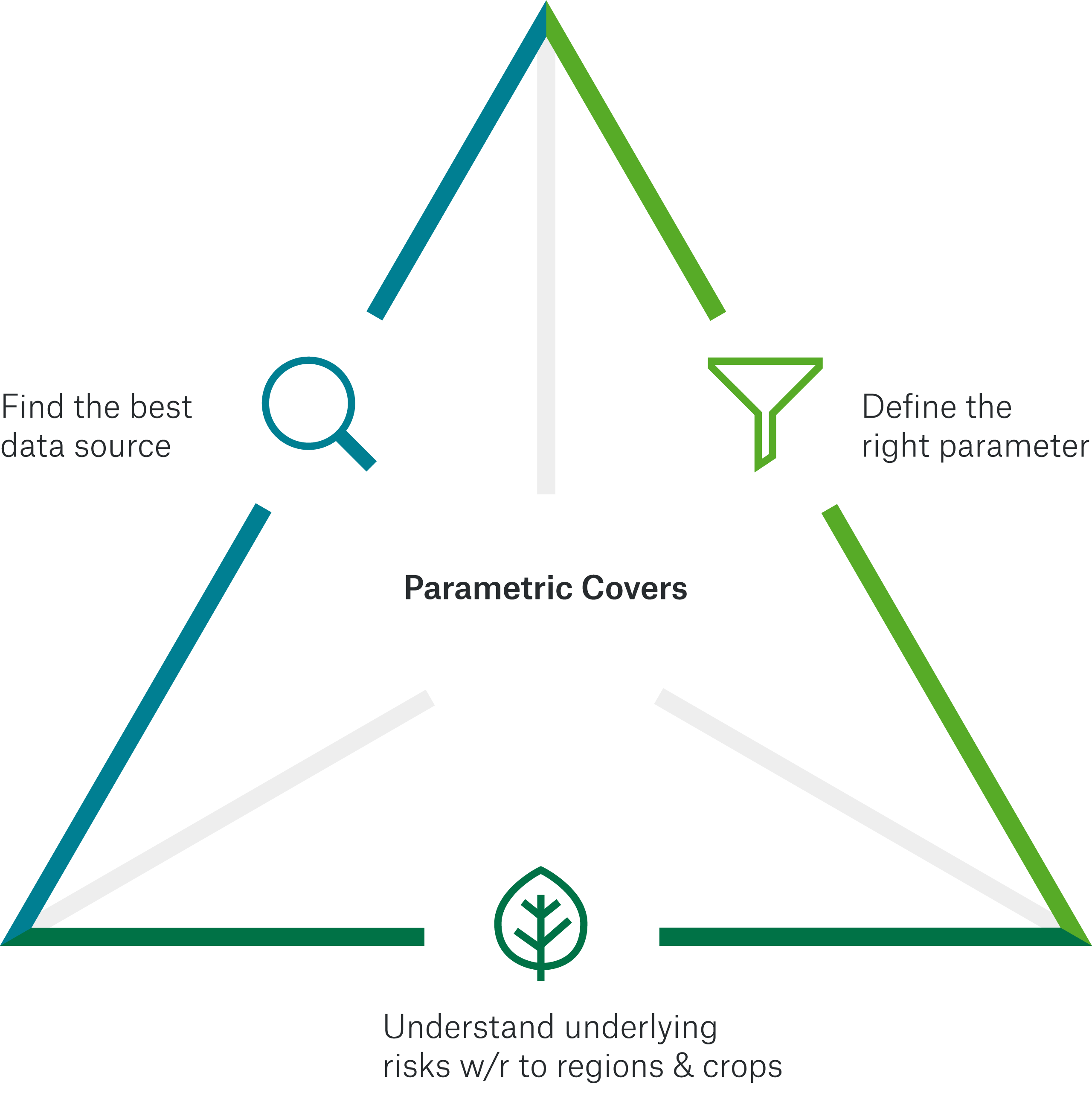

Further parametric insurance solutions

In addition to weather data, parameters derived from satellite sensors can function as an index. For example, the biomass of crops can be estimated by way of parameters such as remotely sensed vegetation index, i.e. NDVI (normalized difference vegetation index) or EVI (enhanced vegetation index). It serves as an index for agricultural risks.

It is possible to obtain additional relevant data for parametric solutions from smart farming and the use of ICT (information and communication technologies) in agriculture.

Index insurance solutions for small scale farming

International donors such as development banks, the InsuResilience Fund, and programs by the World Bank are increasingly coming to rely on agricultural insurance. A key feature, among others, is the co-financing of the insurance premiums.

We offer experience in business models that bring relevant stakeholders together to tackle climate risk. This is not only made possible due to digitalization in agriculture, big data, and increasing computing power.

Facts impacting agricultural climate risks