Our Strategy –

Munich Re Group Ambition 2030

Outpeak • Outpace • Outperform

properties.trackTitle

properties.trackSubtitle

We want to reach even higher peaks in every respect in order to outpace and outperform our peers by 2030. To do so, we will profitably expand our business in all segments. Our shareholders will enjoy an even greater share of our earnings. Thanks to our solid financial footing, we will be a steadfast partner for our customers, through varying market cycles. At the same time, we will reduce complexity and combine our market-leading know-how with artificial intelligence to boost our speed. Accordingly, our employees and society as a whole will benefit in a number of ways from a global, modern and innovative company.

Our commitment to Outperform

> 18.0%

RoE 2030

(Ambition 2025 target: 14–16%)

> 8.0%

Average earnings per share growth per year

(Ambition 2025 target: ≥5%)

> 80%

Total payout ratio* per year

(average actual value 2020–2024: approx. 75%)

> 200%

Solvency ratio

(Ambition 2025 target: 175–220%)

Munich Re’s unique business model builds on the synergies of four strong pillars – ERGO, P&C reinsurance, L&H reinsurance and Global Specialty Insurance – combined with an investment portfolio which generates high returns.

Munich Re has set itself a profit target of €6.3bn for 2026. Group insurance revenue is expected to rise to €64bn in 2026, while return on investment is projected to improve to above 3.5%.

ERGO

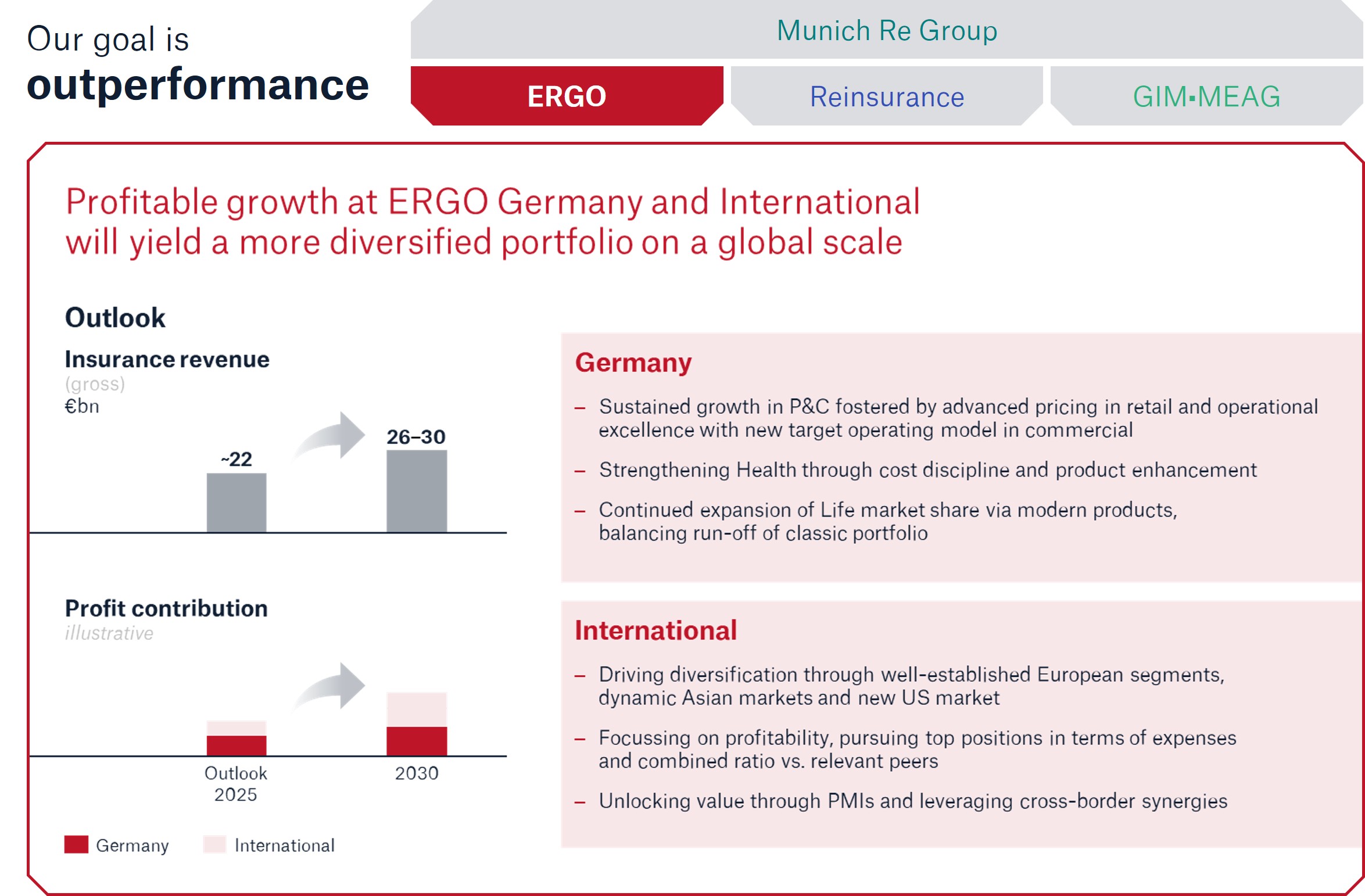

ERGO will continue to drive profitable growth and maintain its focus on technical excellence, the systematic digitalisation of the business and strict cost discipline. ERGO will contribute an RoE of more than 18% to the Ambition 2030 financial targets by 2030. Insurance revenue is expected to reach €26–30bn by 2030.

In the ERGO Germany segment, we aim to achieve sustainable profitable growth and thus strengthen our competitive position. In L&H, we will improve the product range and strengthen our broker sales channels. In P&C, the focus will be on new pricing models and strengthening operational excellence. We will drive forward the roll-out of digital technologies, especially the systematic use of AI along the entire value chain. Cost discipline will remain an essential lever for boosting profitability. The segment’s insurance revenue is expected to amount to €17–19bn by 2030. This corresponds to a compound annual growth rate (CAGR) of 3–5% compared to 2025. The high profitability in the German P&C business is to be further improved with a combined ratio of 87–89% by 2030 (2025 target: 89%).

In the ERGO International segment, the market position in Europe and Asia will be further strengthened. Moreover, with NEXT Insurance, ERGO is establishing itself in the US, the world’s largest insurance market, with the focus on small and mediumsized businesses (SMB). Both cross-border initiatives, such as in underwriting, pricing, and digitalisation, and local measures to expand business and increase efficiency will contribute to the increase in earnings. The segment’s insurance revenue is expected to reach €9–11bn by 2030. This corresponds to a CAGR of 6–10% compared to 2025. The segment’s combined ratio is to improve to 86–88% by 2030 (2025 target: 90%). Thus, the contribution of ERGO International to ERGO’s overall result will grow substantially and exceed that of ERGO Germany, reflecting the growing internationalisation of the ERGO field of business.

Reinsurance

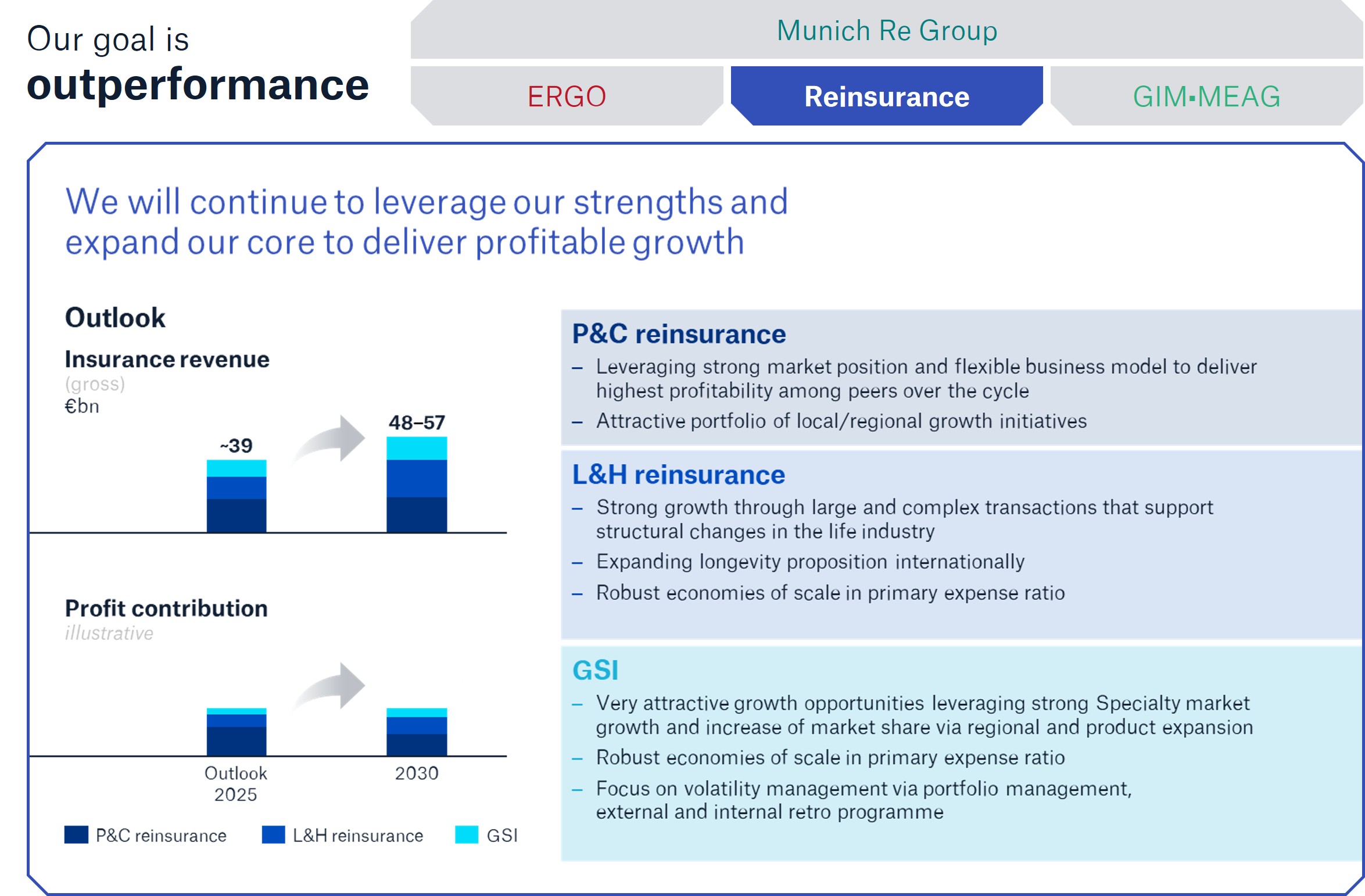

Munich Re will sustain its profitable growth in reinsurance. The field of business will contribute an RoE of more than 18% to the Ambition 2030 financial targets by 2030. Insurance revenue is expected to reach €48–57bn by 2030.

In P&C reinsurance, Munich Re is well prepared for a more competitive environment and is aiming for the highest profitability over the market cycle compared to its competitors. This is supported by our strong market position with sustained high demand for reinsurance cover, particularly in the area of natural catastrophes, a portfolio that is less price-sensitive and more balanced than those of our competitors, and the correspondingly high degree of flexibility and effectiveness in cycle management. The segment’s insurance revenue is expected to reach €18–21bn by 2030. This corresponds to a CAGR of 0–3% compared to 2025. The high profitability is to be maintained with a combined ratio of 79–83% by 2030 (original 2025 target: 79%).

In L&H reinsurance, Munich Re plans to increase the new business CSM and the total technical result each year. This will be done in part by strengthening established earnings drivers, such as the assumption of biometric risks and reinsurance solutions for financing and capital relief for our customers, and also by expanding the longevity annuity business internationally and further developing the business with major life portfolio transactions, for example by expanding partnerships with specialised asset managers. The segment’s insurance revenue is expected to reach €18–22bn by 2030. This corresponds to a CAGR of 8–12% compared to 2025. The total technical result is expected to rise from €1.7bn (2025 target) to €2.4–2.7bn by 2030.

In the Global Specialty Insurance segment, Munich Re aims to achieve continuous revenue and earnings growth. To this end, we are entering new markets in continental Europe and Asia, expanding our product range, and tapping potential by gaining market share in attractive submarkets in which we currently have little presence (e.g. in the Excess & Surplus business in North America). The segment’s insurance revenue is expected to amount to €12–14bn by 2030. This corresponds to a CAGR of 5–9% compared to 2025. The combined ratio is to be reduced to 87–90% by 2030 (original 2025 target: 90%).

Group Investment Management

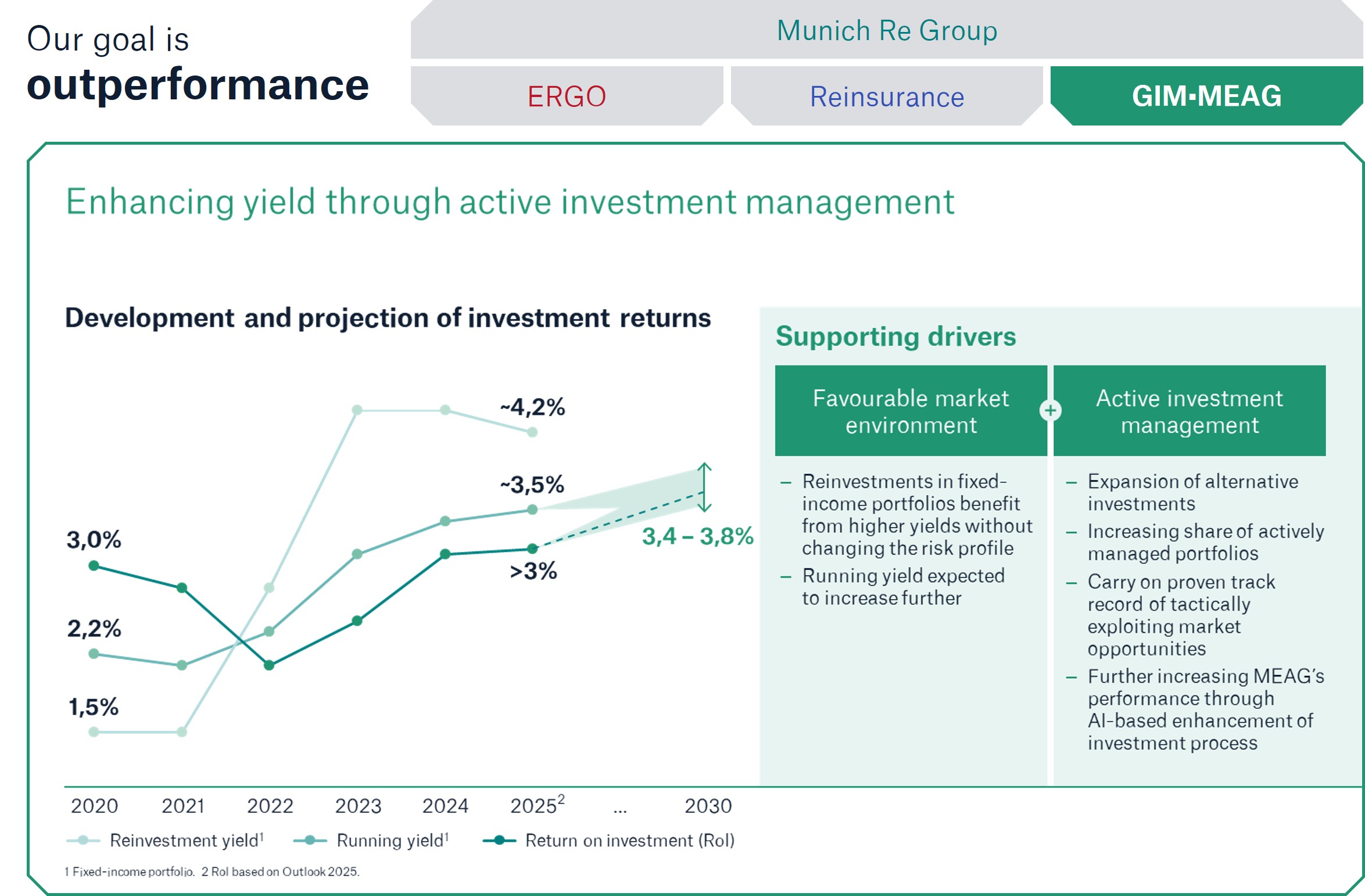

In the investment business, the tailwind from the rise in interest rates is to be strengthened through active investment management, thereby increasing the return on investment to 3.4–3.8% by 2030 (2025 target: >3.0%).

One key lever for this will be the gradual expansion of investments in alternative assets through the provision of additional risk capital. Other levers include more active management along the entire investment value chain, based on an optimised organisational structure, and the creation of integrated steering for the Group’s own asset manager MEAG and external asset managers.

MEAG strives to sustainably outperform its peers in all asset classes, for example by improving the investment process through AI. In addition, a more targeted sales strategy is intended to boost growth in third-party business.

Non-financial targets: Climate and DEI ambitions

Munich Re remains committed to its long-term aim of reducing greenhouse gas emissions in its entire (re)insurance and investment portfolio to net zero by 2050, thereby helping to achieve the goals of the Paris Agreement.

As part of Ambition 2030, our current climate targets will be renewed or stepped up for the period to the end of 2030 and new targets will be introduced. With regard to investments, for example, the original plan to phase out thermal coal by 2040 is to be brought forward significantly and achieved by 2030. On the (re)insurance side, a new target for reducing emission intensity in the Facultative & Corporate Global divisional unit will be introduced, among other things. A complete overview and definition of all climate targets can be found here. Further information on the new Climate Ambition 2030 can be found in the explanatory notes.

Munich Re continues to see DEI as a business imperative. Globally, we strive to build balanced teams across all aspects of difference. Our commitment in this area is supported by new, local targets that optimally take into account the requirements of and circumstances in individual countries and markets.