Insurance covers for energy storage systems

Enabling sustainable growth – safe and sound

properties.trackTitle

properties.trackSubtitle

Renewable energy calls for reliable energy storage

Renewables like wind and solar energy are intermittent by nature. To successfully master the energy transition, reliable energy storage systems are a must to provide the necessary supply stability. This opens up attractive growth opportunities for solution providers – but also requires huge investments, whose profitability depends on the long-term performance of assets.

Green Tech Solutions pools expert resources and know-how in the field of renewable energies. Our warranty insurance solutions help to secure your sustainable business in the long run.

Know the risks

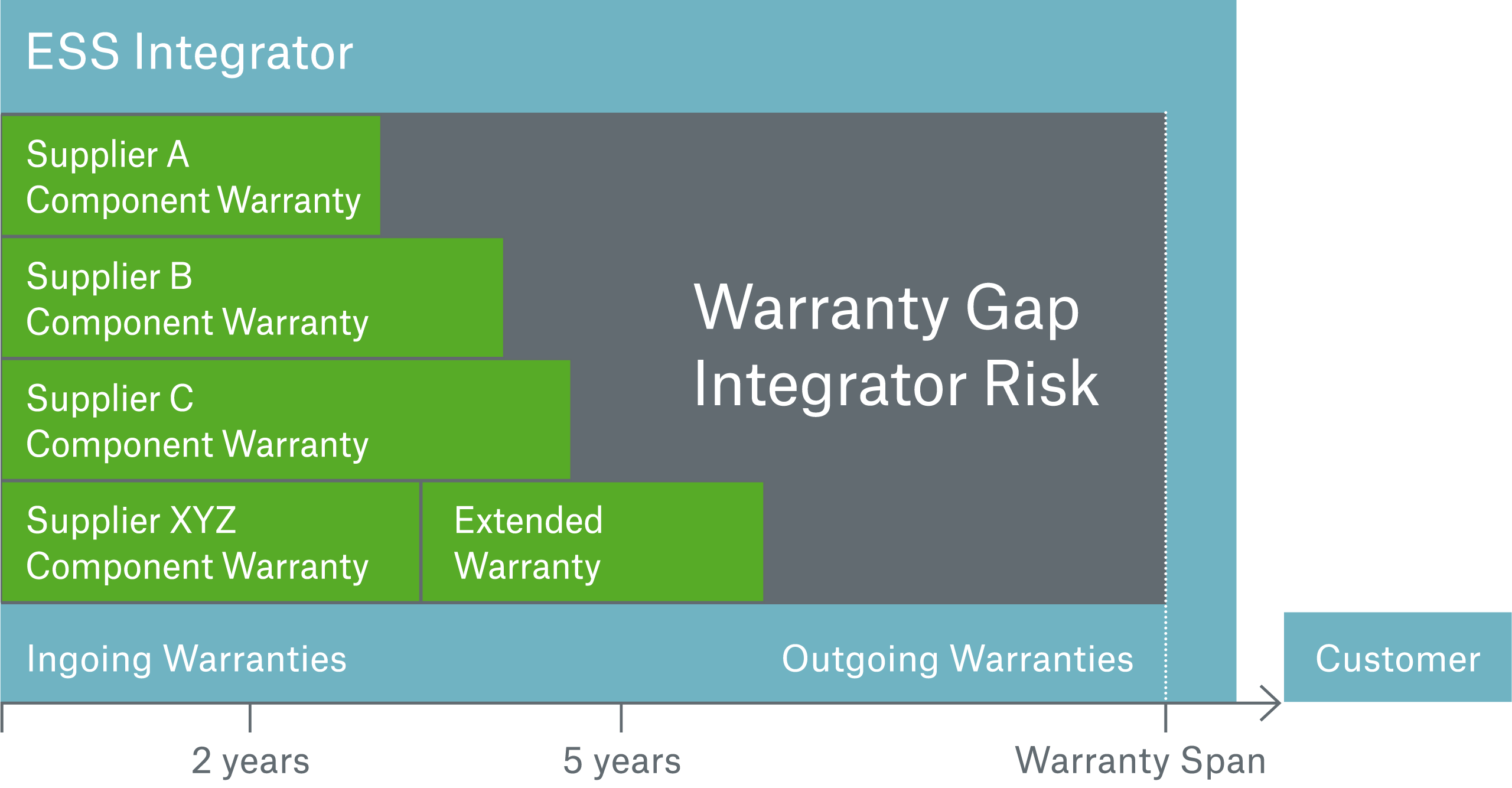

Energy storage systems often involve the complex integration of multiple high-tech components. These are all prone to failure and malfunction, particularly over long periods of ten years and more.

As a manufacturer and system integrator you have to provide your customers with warranties. However, excessive warranty claims or a gap of warranties can negatively affect your financial stability.

Play it safe

- With a partner like Munich Re’s Green Tech Solutions at your side, you can fulfil your investors’ demands for long-term security and bankable solutions in a rapidly consolidating market.

PROTECTION

The product and performance warranty of your system is protected for the entirety of the warranty period.

- Quality and reliability check

A technical due diligence by our industry experts provides your clients confidence in your product’s reliability - Additional Services Green Tech Solutions offers specific sales trainings with regard to the risk transfer solutions for your team and joint marketing activities.

Depending on your protection needs and growth ambitions we have different, tailored solutions for your specific business model. Contact us for further information: